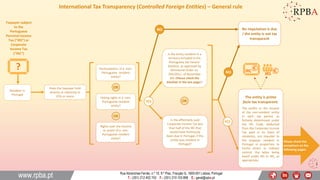

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities) - Updated 14.01.2021

•

0 gostou•109 visualizações

The Portuguese rules on international tax transparency (usually known as CFC rules, the abbreviation for Controlled Foreign Companies) are complex. RPBA has prepared an infographic to help understand this subject and conclude on the transparent or opaque nature of non-Portuguese resident entities, with consequences at the level of the Portuguese Corporate Income Tax (“IRC”) or Personal Income Tax (“IRS”).

Denunciar

Compartilhar

Denunciar

Compartilhar

Baixar para ler offline

Recomendados

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) di...

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) di...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions, in particular under the OECD Model Tax Convention on Income and on Capital (OECD-MC) and the Portuguese Non-habitual tax resident (NHR) regime, is a complex topic, namely due to the diversity of legal and tax status among IFs. RPBA’s Infographic provides a step-by-step questionnaire for an accurate and full analysis of the matter. RPBA Infographic: Updated investment types and requirements to obtain a Portu...

RPBA Infographic: Updated investment types and requirements to obtain a Portu...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Golden Visa provides free travel within the European Schengen area and the possibility to reside in Portugal. The beneficiaries of this Visa can also ensure that their family members obtain a fully valid residence permit in Portugal. Please take a look at RPBA’s infographic on the types of investment and requirements to obtain a Golden Visa in Portugal.Special Tax Regime for non-habitual residents in Portugal

Portugal created a special regime for new residents (also applicable to Portuguese out bounds living abroad for many years) designed to promote the transfer of residence of skillful professionals, entrepreneurs and investors, by offering attractive tax opportunities at the individual level.

This summary provides a brief overview and explains the main guidelines and potential implications of this new regime for foreigners and for Portuguese individuals settling in Portugal after an extended period of living abroad.

Guide To Business In Spain

This document provides an overview of establishing and doing business in Spain. It discusses the main types of legal entities for forming a business (corporations and limited liability companies), the process for incorporation which takes 6-8 weeks, and the Spanish financial, tax, labor and commercial legal systems. It also outlines various investment incentives available in Spain such as tax benefits, regional incentives, and incentives for specific industries, SMEs and foreign investment.

NHR case-studies Infographics 31.10.2019

NHR case-studies Infographics 31.10.2019Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese non-habitual tax resident regime is granted to individuals who become resident for tax purposes in Portugal. This regime may grant an exemption on certain foreign source income as well as a 20% tax rate on employment and self-employment income deriving from high value added activities during 10 years. It targets non-resident individuals who are likely to establish residence in Portugal. View a few standard case studies on this RPBA’s infographic.NHR regime update

Recently, there have been some developments in Portugal’s non-habitual resident tax regime.

Among others, an amendment to the list of High Value-Added Activities was published and a General Ruling changed the procedure to acknowledge the activities regarded as High Value-Added.

In this newsletter we highlight these changes and share our insights.

Contact us should you require personalised advice on these matters.

RPBA - Real Estate Tax Planning in Portugal - Update 11-04-2019

RPBA - Real Estate Tax Planning in Portugal - Update 11-04-2019Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Real estate, as an immovable factor, tends to be overtaxed in most countries and Portugal is no exception. Tax structuring and optimizing is crucial to minimize total acquisition costs and maximize investment returns.

RPBA’s updated presentation deals with this challenging topic incorporating the latest developments, including tax incentives on rehabilitation, the OECD Multilateral Instrument rules on “real estate rich” companies and also the brand new SIGI company (the Portuguese equivalent of the REIT – Real Estate Investment Trust).RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Golden Visa is a special residence permit for investors which enables non-EU individuals to become resident in Portugal and move freely within the Schengen Zone. Please take a look at RPBA's detailed and updated presentation.Recomendados

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) di...

Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) di...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Personal Income Taxation of Non-Portuguese Investment Fund (IF) distributions, in particular under the OECD Model Tax Convention on Income and on Capital (OECD-MC) and the Portuguese Non-habitual tax resident (NHR) regime, is a complex topic, namely due to the diversity of legal and tax status among IFs. RPBA’s Infographic provides a step-by-step questionnaire for an accurate and full analysis of the matter. RPBA Infographic: Updated investment types and requirements to obtain a Portu...

RPBA Infographic: Updated investment types and requirements to obtain a Portu...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Golden Visa provides free travel within the European Schengen area and the possibility to reside in Portugal. The beneficiaries of this Visa can also ensure that their family members obtain a fully valid residence permit in Portugal. Please take a look at RPBA’s infographic on the types of investment and requirements to obtain a Golden Visa in Portugal.Special Tax Regime for non-habitual residents in Portugal

Portugal created a special regime for new residents (also applicable to Portuguese out bounds living abroad for many years) designed to promote the transfer of residence of skillful professionals, entrepreneurs and investors, by offering attractive tax opportunities at the individual level.

This summary provides a brief overview and explains the main guidelines and potential implications of this new regime for foreigners and for Portuguese individuals settling in Portugal after an extended period of living abroad.

Guide To Business In Spain

This document provides an overview of establishing and doing business in Spain. It discusses the main types of legal entities for forming a business (corporations and limited liability companies), the process for incorporation which takes 6-8 weeks, and the Spanish financial, tax, labor and commercial legal systems. It also outlines various investment incentives available in Spain such as tax benefits, regional incentives, and incentives for specific industries, SMEs and foreign investment.

NHR case-studies Infographics 31.10.2019

NHR case-studies Infographics 31.10.2019Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese non-habitual tax resident regime is granted to individuals who become resident for tax purposes in Portugal. This regime may grant an exemption on certain foreign source income as well as a 20% tax rate on employment and self-employment income deriving from high value added activities during 10 years. It targets non-resident individuals who are likely to establish residence in Portugal. View a few standard case studies on this RPBA’s infographic.NHR regime update

Recently, there have been some developments in Portugal’s non-habitual resident tax regime.

Among others, an amendment to the list of High Value-Added Activities was published and a General Ruling changed the procedure to acknowledge the activities regarded as High Value-Added.

In this newsletter we highlight these changes and share our insights.

Contact us should you require personalised advice on these matters.

RPBA - Real Estate Tax Planning in Portugal - Update 11-04-2019

RPBA - Real Estate Tax Planning in Portugal - Update 11-04-2019Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Real estate, as an immovable factor, tends to be overtaxed in most countries and Portugal is no exception. Tax structuring and optimizing is crucial to minimize total acquisition costs and maximize investment returns.

RPBA’s updated presentation deals with this challenging topic incorporating the latest developments, including tax incentives on rehabilitation, the OECD Multilateral Instrument rules on “real estate rich” companies and also the brand new SIGI company (the Portuguese equivalent of the REIT – Real Estate Investment Trust).RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Presentation - The Portuguese Golden Visa Regime - Updated: 24.03.2021Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Golden Visa is a special residence permit for investors which enables non-EU individuals to become resident in Portugal and move freely within the Schengen Zone. Please take a look at RPBA's detailed and updated presentation.RPBA Newsletter - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Newsletter - The Portuguese Golden Visa Regime - Updated: 24.03.2021Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Golden Visa Regime provides a pathway to Portuguese citizenship for non-EU investors. It was established in 2012 and grants residency permits and access to the Schengen Area in exchange for investments in Portugal. Recent changes have increased investment minimums to €1.5 million and restricted real estate purchases to certain regions. The program aims to attract foreign investment and tax revenue while providing benefits like EU travel and residency. Proper legal advice is recommended when applying for a Golden Visa.Non habitual residents tax regime en 03.2017

The document discusses Portugal's non-habitual residents tax regime. The regime aims to attract qualified professionals, high net worth individuals, and foreign pensioners by providing them with favorable taxation rates during a 10-year period if they become tax residents in Portugal. Key benefits include a 20% tax rate on employment and self-employment income obtained in Portugal, and exemption from taxation on income obtained abroad.

Portuguese non habitual tax regime

Status of non-habitual tax resident both for EU/EEA non-residents who plan

on establishing permanent residency in Portugal, and for temporary residents.

Advent Uk Permanent Residency In Malta 2009

This document provides information on obtaining permanent residency in Malta, including an overview of the tax advantages and eligibility requirements. Some key benefits include a flat 15% income tax rate on any income remitted to Malta, no tax on worldwide income not remitted to Malta, and Malta's membership in the EU. Applicants need a minimum net worth of around 349,000 Euros or annual income of 23,000 Euros, along with good character references. Once approved, permit holders must purchase or rent a property in Malta, but are not required to live there for any set time period. The application process takes around 12 weeks.

NON-REGULAR TAX REGIME FOR NON-REGULAR RESIDENTS Program - E&V Presentation

Portugal offers a favorable tax regime for non-regular residents to attract qualified professionals and individuals with high net worth. This regime applies a 20% tax rate to certain incomes and exempts foreign source income. To qualify, individuals must be tax residents in Portugal for 183 days or more in a year and not have been residents in the prior 5 years. The regime exempts income from foreign sources and certain high-value Portuguese sources from taxation and applies for 10 years to those who meet residency requirements annually. It aims to attract non-residents to Portugal permanently or temporarily, such as independent professionals, pensioners, and those on international assignments.

Portugal Golden Residence Permit Program by Henley & Partners Portugal

The Portuguese Golden Residence Permit Program, which we refer to at Henley&Partners as PRIP–thePortugalResidence- by-Investment Program, is a five year investment-based residence process for non EU nationals. The residence permit allows free circulation in the Schengen Zone of 26 states and only requires an average of seven days per year stay in Portugal over this period, which can also count towards citizenship eligibility after six years.

Portugal Residence by Investment Program Presentation for UBS 20130912

Overview

1. Henley & Partners Portugal

2. Portugal Residence by Investment Program (PRIP)

3. The PRIP Proposition

4. Requirements & Formalities

4.1 Key Qualifying Documents

4.2 Key Considerations

4.3 Costs & Fees

4.4 Tax Considerations

4.5 Residence to Citizenship

5. Key Advantages

6. Why Portugal?

US Tax Consultants Modelo 720

This document provides information about Form 720 filing requirements in Spain. Form 720 must be filed by Spanish tax residents to report assets held abroad if the value of bank accounts, investments, or real estate exceeds 50,000 euros. It outlines what assets must be reported, including bank accounts, stocks, insurance policies, and real estate. Failure to file or filing incomplete or inaccurate information can result in fines of up to 150% of unreported asset values. The deadline to file Form 720 is March 31, 2014.

Albertina Silva- Curriculum vitae (english and portuguese) - junho 2016 .

This curriculum vitae is for Albertina Quissanga Castelo David e Silva Adão, an Angolan national born in 1986 in Luanda. She has a Master's degree in Tax Law from Agostinho Neto University and a degree in Business and Financial Management from the Catholic University of Angola. Her work experience includes positions at Cobalt International Energy as a Reporting Analyst since 2014 and at Pricewaterhousecoopers from 2010 to 2013 as a Senior Financial and Tax Consultant. She is proficient in Portuguese and English.

Invertir en españa 2015 (ENG)

This document summarizes key information for foreign investors looking to invest in Spain in 2015. It outlines the regulated sectors for foreign investment, classifications of tax residents and non-residents, and considerations for establishing a branch or subsidiary. It also provides an overview of corporate and individual taxation, real estate investments, VAT rules, and advantages of the Canary Islands Special Zone for reduced corporate tax rates. Finally, it summarizes Spain's "Golden Visa" program which provides residence permits for foreign investors making certain minimum investments in Spain.

Canary Islands Hub tax system by Deloitte

The Canary Islands Hub have an Economic and Tax System (REF) of their own, fully approved by the EU, which applies double taxation conventions and fiscal transparency.

Guide for a successful establishment in Spain from China

This document provides a summary of the key steps and considerations for establishing a business in Spain from China, including:

- The most common corporate structures are public and private limited companies, which have minimum capital requirements of €60,000 and €3,000 respectively.

- The process to establish a subsidiary involves requesting a company name, drafting statutes, obtaining tax IDs, signing documents before a notary, and registering with commercial and tax authorities.

- Spain has a favorable tax regime and double taxation agreements with China and Hong Kong to avoid double taxation. Main taxes are corporate tax of 15-30% and VAT of 21%.

- Requirements for a residence permit include proof of funds, health insurance,

New amendments to Cyprus Tax Legislation

-Land Resgistry Fees

-Capital Gains Tax

-Special Defense Contribution

-Non - domiciled persons

-Notional interest deduction on new equity

-Upcoming expected changes in Cyprus tax legislation

ACM NTK seminar Fiscal obligations 2016

This document discusses the key fiscal obligations of U.S. citizens residing in Spain. It notes that Americans living abroad have increased to over 7.6 million in 2014 and over 8.7 million in 2015. It then summarizes the main forms and reports required, including the Form 1040 tax return, Foreign Bank Account Report (FBAR), Spanish tax return (Modelo 100), and the Spanish asset reporting form (Modelo 720). The document provides brief descriptions of when each form is due and what types of income and accounts must be disclosed.

Portugal as a platform of investiment

Portugal offers several tax incentives and programs to attract foreign investment, including the Non-Habitual Resident tax regime, Golden Visa program, and Madeira's International Business Center. The Non-Habitual Resident tax regime exempts foreign-source income for ten years. The Golden Visa program provides residency and citizenship for investments over €500,000 in real estate. Madeira's center offers a 5% corporate tax rate for companies creating jobs and investing in the region. Overall, Portugal aims to be a competitive location for international investors through these programs and a simplified corporate tax system.

Webinar Slides Romania Withholding Tax

The document discusses Romania's withholding tax on revenues earned by non-residents, including what incomes are subject to the tax, exemptions, conditions for applying double taxation treaties to lower rates, requirements for registering contracts with non-residents, and taxation of permanent establishments in Romania.

Overview of french business law

The document provides an overview of key aspects of French business law, including:

1) France has a civil law system based on the Napoleonic Code where written submissions are more important than oral arguments and there are no juries.

2) Common courts for resolving disputes include commercial courts, courts of appeal, and the supreme court. Litigation follows an inquisitorial process rather than an adversarial one.

3) French employment law has rigid protections for employees, requiring written contracts and restricting dismissal except for specific reasons.

Pis e cofins - Guia Prático

PIS/PASEP e COFINS Guia Prático - Imposto e Situação tributaria. Veja detalhes dos cálculos, situações e alíquota a serem utilizados

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Real estate, as an immovable factor, tends to be overtaxed in most countries and Portugal is no exception. Tax structuring and optimizing is crucial to minimize total acquisition costs and maximize investment returns.

RPBA’s updated presentation deals with this challenging topic incorporating the latest developments, including tax incentives on rehabilitation, the OECD Multilateral Instrument rules on “real estate rich” companies and also the brand new SIGI company (the Portuguese equivalent of the REIT – Real Estate Investment Trust).Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...

Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Non Habitual Resident (“NHR”) and Madeira Free Zone (“MFZ”) regimes offer ample opportunities for those who wish to live in Portugal or manage their investments through Portugal. This presentation is designed with Dutch clients in mind and exemplifies some of the many possibilities that the said regimes enable to conduct life or business in a tax efficient manner.

RPBA has in-depth knowledge and experience with both regimes and can advise you on the best solutions to take full advantage of them.

Please do not hesitate to contact us if you consider moving your personal residence to Portugal or taking advantage of the MFZ to structure your business.

A. From residence to Portuguese nationality 12.04.2024

A. From residence to Portuguese nationality 12.04.2024Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

It is important to note that the Portuguese “Golden Visa” is a residence by investment program and not a nationality by investment program.

In this sense, to obtain the nationality based on the Golden Visa it is important to fulfill two requirements:

1. Have at least five years of legal residence;

2. Have a Portuguese language knowledge test (level A2).

Please take a look at RPBA’s infographic on the topic.Doing Business / Investing in Portugal (A quick guide)

Created by: ESPANHA E ASSOCIADOS

Portugal is a unique European country to live or invest, evidencing, among other things, a pleasant all year climate, friendly people, passionate food, safety and a beautiful Atlantic coast-line with endless landscape views. Being part of EU since 1986, Portugal has seen significant growth since then, being now an indisputable modern western country, well-served in terms of network connections, business friendly laws, competitive and qualified professionals and, at the same time, a cost of living well below the EU average, which represents a clear advantage when you are thinking about investing or living abroad.

Mais conteúdo relacionado

Mais procurados

RPBA Newsletter - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Newsletter - The Portuguese Golden Visa Regime - Updated: 24.03.2021Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese Golden Visa Regime provides a pathway to Portuguese citizenship for non-EU investors. It was established in 2012 and grants residency permits and access to the Schengen Area in exchange for investments in Portugal. Recent changes have increased investment minimums to €1.5 million and restricted real estate purchases to certain regions. The program aims to attract foreign investment and tax revenue while providing benefits like EU travel and residency. Proper legal advice is recommended when applying for a Golden Visa.Non habitual residents tax regime en 03.2017

The document discusses Portugal's non-habitual residents tax regime. The regime aims to attract qualified professionals, high net worth individuals, and foreign pensioners by providing them with favorable taxation rates during a 10-year period if they become tax residents in Portugal. Key benefits include a 20% tax rate on employment and self-employment income obtained in Portugal, and exemption from taxation on income obtained abroad.

Portuguese non habitual tax regime

Status of non-habitual tax resident both for EU/EEA non-residents who plan

on establishing permanent residency in Portugal, and for temporary residents.

Advent Uk Permanent Residency In Malta 2009

This document provides information on obtaining permanent residency in Malta, including an overview of the tax advantages and eligibility requirements. Some key benefits include a flat 15% income tax rate on any income remitted to Malta, no tax on worldwide income not remitted to Malta, and Malta's membership in the EU. Applicants need a minimum net worth of around 349,000 Euros or annual income of 23,000 Euros, along with good character references. Once approved, permit holders must purchase or rent a property in Malta, but are not required to live there for any set time period. The application process takes around 12 weeks.

NON-REGULAR TAX REGIME FOR NON-REGULAR RESIDENTS Program - E&V Presentation

Portugal offers a favorable tax regime for non-regular residents to attract qualified professionals and individuals with high net worth. This regime applies a 20% tax rate to certain incomes and exempts foreign source income. To qualify, individuals must be tax residents in Portugal for 183 days or more in a year and not have been residents in the prior 5 years. The regime exempts income from foreign sources and certain high-value Portuguese sources from taxation and applies for 10 years to those who meet residency requirements annually. It aims to attract non-residents to Portugal permanently or temporarily, such as independent professionals, pensioners, and those on international assignments.

Portugal Golden Residence Permit Program by Henley & Partners Portugal

The Portuguese Golden Residence Permit Program, which we refer to at Henley&Partners as PRIP–thePortugalResidence- by-Investment Program, is a five year investment-based residence process for non EU nationals. The residence permit allows free circulation in the Schengen Zone of 26 states and only requires an average of seven days per year stay in Portugal over this period, which can also count towards citizenship eligibility after six years.

Portugal Residence by Investment Program Presentation for UBS 20130912

Overview

1. Henley & Partners Portugal

2. Portugal Residence by Investment Program (PRIP)

3. The PRIP Proposition

4. Requirements & Formalities

4.1 Key Qualifying Documents

4.2 Key Considerations

4.3 Costs & Fees

4.4 Tax Considerations

4.5 Residence to Citizenship

5. Key Advantages

6. Why Portugal?

US Tax Consultants Modelo 720

This document provides information about Form 720 filing requirements in Spain. Form 720 must be filed by Spanish tax residents to report assets held abroad if the value of bank accounts, investments, or real estate exceeds 50,000 euros. It outlines what assets must be reported, including bank accounts, stocks, insurance policies, and real estate. Failure to file or filing incomplete or inaccurate information can result in fines of up to 150% of unreported asset values. The deadline to file Form 720 is March 31, 2014.

Albertina Silva- Curriculum vitae (english and portuguese) - junho 2016 .

This curriculum vitae is for Albertina Quissanga Castelo David e Silva Adão, an Angolan national born in 1986 in Luanda. She has a Master's degree in Tax Law from Agostinho Neto University and a degree in Business and Financial Management from the Catholic University of Angola. Her work experience includes positions at Cobalt International Energy as a Reporting Analyst since 2014 and at Pricewaterhousecoopers from 2010 to 2013 as a Senior Financial and Tax Consultant. She is proficient in Portuguese and English.

Invertir en españa 2015 (ENG)

This document summarizes key information for foreign investors looking to invest in Spain in 2015. It outlines the regulated sectors for foreign investment, classifications of tax residents and non-residents, and considerations for establishing a branch or subsidiary. It also provides an overview of corporate and individual taxation, real estate investments, VAT rules, and advantages of the Canary Islands Special Zone for reduced corporate tax rates. Finally, it summarizes Spain's "Golden Visa" program which provides residence permits for foreign investors making certain minimum investments in Spain.

Canary Islands Hub tax system by Deloitte

The Canary Islands Hub have an Economic and Tax System (REF) of their own, fully approved by the EU, which applies double taxation conventions and fiscal transparency.

Guide for a successful establishment in Spain from China

This document provides a summary of the key steps and considerations for establishing a business in Spain from China, including:

- The most common corporate structures are public and private limited companies, which have minimum capital requirements of €60,000 and €3,000 respectively.

- The process to establish a subsidiary involves requesting a company name, drafting statutes, obtaining tax IDs, signing documents before a notary, and registering with commercial and tax authorities.

- Spain has a favorable tax regime and double taxation agreements with China and Hong Kong to avoid double taxation. Main taxes are corporate tax of 15-30% and VAT of 21%.

- Requirements for a residence permit include proof of funds, health insurance,

New amendments to Cyprus Tax Legislation

-Land Resgistry Fees

-Capital Gains Tax

-Special Defense Contribution

-Non - domiciled persons

-Notional interest deduction on new equity

-Upcoming expected changes in Cyprus tax legislation

ACM NTK seminar Fiscal obligations 2016

This document discusses the key fiscal obligations of U.S. citizens residing in Spain. It notes that Americans living abroad have increased to over 7.6 million in 2014 and over 8.7 million in 2015. It then summarizes the main forms and reports required, including the Form 1040 tax return, Foreign Bank Account Report (FBAR), Spanish tax return (Modelo 100), and the Spanish asset reporting form (Modelo 720). The document provides brief descriptions of when each form is due and what types of income and accounts must be disclosed.

Portugal as a platform of investiment

Portugal offers several tax incentives and programs to attract foreign investment, including the Non-Habitual Resident tax regime, Golden Visa program, and Madeira's International Business Center. The Non-Habitual Resident tax regime exempts foreign-source income for ten years. The Golden Visa program provides residency and citizenship for investments over €500,000 in real estate. Madeira's center offers a 5% corporate tax rate for companies creating jobs and investing in the region. Overall, Portugal aims to be a competitive location for international investors through these programs and a simplified corporate tax system.

Webinar Slides Romania Withholding Tax

The document discusses Romania's withholding tax on revenues earned by non-residents, including what incomes are subject to the tax, exemptions, conditions for applying double taxation treaties to lower rates, requirements for registering contracts with non-residents, and taxation of permanent establishments in Romania.

Overview of french business law

The document provides an overview of key aspects of French business law, including:

1) France has a civil law system based on the Napoleonic Code where written submissions are more important than oral arguments and there are no juries.

2) Common courts for resolving disputes include commercial courts, courts of appeal, and the supreme court. Litigation follows an inquisitorial process rather than an adversarial one.

3) French employment law has rigid protections for employees, requiring written contracts and restricting dismissal except for specific reasons.

Pis e cofins - Guia Prático

PIS/PASEP e COFINS Guia Prático - Imposto e Situação tributaria. Veja detalhes dos cálculos, situações e alíquota a serem utilizados

Mais procurados (18)

RPBA Newsletter - The Portuguese Golden Visa Regime - Updated: 24.03.2021

RPBA Newsletter - The Portuguese Golden Visa Regime - Updated: 24.03.2021

NON-REGULAR TAX REGIME FOR NON-REGULAR RESIDENTS Program - E&V Presentation

NON-REGULAR TAX REGIME FOR NON-REGULAR RESIDENTS Program - E&V Presentation

Portugal Golden Residence Permit Program by Henley & Partners Portugal

Portugal Golden Residence Permit Program by Henley & Partners Portugal

Portugal Residence by Investment Program Presentation for UBS 20130912

Portugal Residence by Investment Program Presentation for UBS 20130912

Albertina Silva- Curriculum vitae (english and portuguese) - junho 2016 .

Albertina Silva- Curriculum vitae (english and portuguese) - junho 2016 .

Guide for a successful establishment in Spain from China

Guide for a successful establishment in Spain from China

Semelhante a RPBA Infographic: International Tax Transparency (Controlled Foreign Entities) - Updated 14.01.2021

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

Real estate, as an immovable factor, tends to be overtaxed in most countries and Portugal is no exception. Tax structuring and optimizing is crucial to minimize total acquisition costs and maximize investment returns.

RPBA’s updated presentation deals with this challenging topic incorporating the latest developments, including tax incentives on rehabilitation, the OECD Multilateral Instrument rules on “real estate rich” companies and also the brand new SIGI company (the Portuguese equivalent of the REIT – Real Estate Investment Trust).Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...

Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Non Habitual Resident (“NHR”) and Madeira Free Zone (“MFZ”) regimes offer ample opportunities for those who wish to live in Portugal or manage their investments through Portugal. This presentation is designed with Dutch clients in mind and exemplifies some of the many possibilities that the said regimes enable to conduct life or business in a tax efficient manner.

RPBA has in-depth knowledge and experience with both regimes and can advise you on the best solutions to take full advantage of them.

Please do not hesitate to contact us if you consider moving your personal residence to Portugal or taking advantage of the MFZ to structure your business.

A. From residence to Portuguese nationality 12.04.2024

A. From residence to Portuguese nationality 12.04.2024Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

It is important to note that the Portuguese “Golden Visa” is a residence by investment program and not a nationality by investment program.

In this sense, to obtain the nationality based on the Golden Visa it is important to fulfill two requirements:

1. Have at least five years of legal residence;

2. Have a Portuguese language knowledge test (level A2).

Please take a look at RPBA’s infographic on the topic.Doing Business / Investing in Portugal (A quick guide)

Created by: ESPANHA E ASSOCIADOS

Portugal is a unique European country to live or invest, evidencing, among other things, a pleasant all year climate, friendly people, passionate food, safety and a beautiful Atlantic coast-line with endless landscape views. Being part of EU since 1986, Portugal has seen significant growth since then, being now an indisputable modern western country, well-served in terms of network connections, business friendly laws, competitive and qualified professionals and, at the same time, a cost of living well below the EU average, which represents a clear advantage when you are thinking about investing or living abroad.

Portugal D2 Visa Processing Mechanism For Individuals.pdf

The document outlines the 16 step process for obtaining a Portugal D-2 visa for business entrepreneurs, freelancers, and independent professionals. It involves establishing a company or branch in Portugal, obtaining necessary licenses and permits, opening a business bank account, hiring local employees, paying taxes, submitting a solid business plan and investment budget, applying for the visa, undergoing an interview, and receiving a decision from immigration authorities. If approved, the visa is stamped in the passport and applicants must report for biometrics collection before receiving a two-year residence card, with the option to later apply for family reunification.

Doing business Portugal 2019

Portugal offers many benefits for doing business including a highly skilled workforce, low operating costs, and a growing tech sector. There are simple processes for starting a business either online or in-person. Common business structures provide limited liability and Portugal has attractive corporate tax rates along with several exemptions. Personal income tax also has favorable regimes for residents and non-habitants. VAT applies to goods and services at standard or reduced rates.

Canary Islands Hub tax incentives by Price Waterhouse Cooper

As an EU outermost region, the Canary Islands have an Economic and Tax System (REF) of their own, fully approved by the EU, which applies double taxation conventions and fiscal transparency (Canary Islands Hub)

Tax evasion

This document discusses tax evasion in the Philippines. It defines tax evasion as the criminal act of deliberately failing to pay tax liability. People who commit tax evasion face criminal charges and penalties such as jail time and fines. The document then discusses various tax revenues in the Philippines including income tax, excise tax, franchise taxes, and import duties. It provides examples of high-profile tax evasion cases in the country. Finally, it discusses what counts as tax evasion and common types of tax evasion such as tax fraud, abusive tax schemes, and employment tax fraud.

Tax evasion

The document discusses tax evasion in the Philippines. It defines tax evasion as a criminal act of deliberately failing to pay tax liability. People who commit tax evasion face criminal charges and penalties such as jail time and fines. The document then discusses various tax revenues in the Philippines including income tax, excise tax, franchise taxes, and import duties. It provides examples of high-profile tax evasion cases in the country such as those against Dunkin Donuts, Rappler, former Supreme Court Chief Justice Renato Corona, and boxer Manny Pacquiao.

Newsletter Machado Associados

The Brazilian tax authority introduced changes to the list of tax havens and privileged tax regimes. Costa Rica, Madeira Island and Singapore were removed from the list of tax havens, while some of their zones and regimes were added to the list of privileged tax regimes. The tax authority also changed documentation requirements for taxes paid abroad. Companies can now provide an apostille instead of legalization for foreign tax documents, as long as the apostille is attached to the original tax document translated to Portuguese.

Golden Visa Program - E&V Presentation

The Golden Residence Permit Program in Portugal allows foreign nationals to obtain residency by transferring capital, creating jobs, or acquiring real estate worth at least 500,000 euros over 5 years. Applicants must apply within 90 days of entry and prove they meet investment thresholds. If approved, they receive a one year temporary permit renewable for two years as long as conditions are met. After 5 years, applicants can apply for permanent residency or citizenship. Real estate investments are subject to transfer taxes of 6.5% and annual property taxes between 0.3-0.5%, while applicants may qualify for tax benefits under the non-habitual residents regime.

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese tax regime for non-habitual residents is motivating high net worth individuals, pensioners and high value added professionals to relocate to Portugal, either on a permanent or on a temporary and expatriate basis. The regime is granted to individuals who become resident for tax purposes in Portugal without having been so in the five preceding years. Non-habitual resident individuals may enjoy such status for a ten-year period, after which they will be taxed under the standard regime. This regime may grant an exemption or reduced rate on foreign source income as well as a limited taxation on Portuguese domestic source income deriving from high value added activities. Our presentation does not contemplate changes envisaged by the proposed Budget Law for 2023 (an update will be made when such Law is approved).Pendulum of VAT on imported services - Nigeria

The Federal High Court, Lagos ("FHC") has revoked the decision of the Tax Appeal Tribunal ("TAT") in Gazprom Oil and Gas Nigeria Limited (Gazprom) v. Federal Inland Revenue Service (FIRS) relating to services which Gazprom received from a non-resident company. In Nigeria, the interpretation of destination and source principles of international taxation keeps swinging. Will there ever be an end?

RPBA Infographic: NHR case-studies - Updated: 09.11.2022

RPBA Infographic: NHR case-studies - Updated: 09.11.2022Ricardo da Palma Borges & Associados - Sociedade de Advogados, S.P., R.L.

The Portuguese non-habitual tax resident (NHR) regime is granted to individuals who become resident for tax purposes in Portugal. This regime may grant an exemption on certain foreign source income as well as a 20% tax rate on employment and self-employment income deriving from high value-added activities during 10 years. Entrants into the NHR regime that became Portuguese tax residents after April 1st 2020 are subject to a flat tax rate of 10% on foreign-sourced pensions (instead of the previous exemption), as well as on other payments, such as pre-retirement benefits and "lump-sum" payments from pension funds and similar retirement schemes. It targets non-resident individuals who are likely to establish residence in Portugal. View a few standard case studies on this RPBA’s infographic.Portuguese Golden Visa Regime

The document discusses Portugal's Golden Visa program (ARI), which grants residence permits to foreign investors. It provides statistics on total investments through the program (over 1 billion euros), types of investments made, and top countries of origin. It also summarizes the eligibility requirements, investment options, application process and documentation needed, as well as renewal procedures. Benefits of the program include the ability to live and work in Portugal and travel within Schengen, with the potential to gain citizenship after 6 years. Family members may also apply for residency under the program.

Singapore Tax Haven

Singapore is one of the destination country for tax haven. This presentation will give you insights why Singapore is widely chosen.

Rationale up to Flow of Research

1. The document discusses Value-Added Tax (VAT) in the Philippines, including what it is, who pays it, tax rates, and invoicing/receipt requirements for VAT-registered businesses.

2. VAT is imposed on the sale, barter, exchange or lease of goods/properties and services in the Philippines at 12% of the gross selling price or gross receipts. It is also imposed on imports.

3. Businesses whose gross sales/receipts exceed 1.9 million pesos per year must register for VAT and charge VAT on sales, issue VAT invoices/receipts, and file monthly VAT returns.

Brochure for e-mail 2016

Bulgaria offers many tax benefits for companies and individuals, including a 10% flat corporate profit tax and personal income tax rate. Setting up a company in Bulgaria is quick and easy, taking only a few days. Bulgaria has signed double taxation treaties with over 70 countries. Bulgaria provides opportunities for tax optimization, low costs, and a business-friendly environment within the European Union.

Lecture1

This document provides information about different tax systems. It discusses direct and indirect taxes, and provides examples of different types of taxes like income tax, value added tax, customs duty, and inheritance tax. It also provides examples of tax rates and calculations in countries like Canada, Libya, and the UK. Key taxes discussed include income tax, sales tax, value added tax, corporation tax, inheritance tax, and capital gains tax.

29 investments and trade in spain

INVERSIONES Y NEGOCIOS EN ESPAÑA

ESCURA tiene una larga tradición en la prestación de servicios a empresas extranjeras en España, apoyándolas en la defensa de sus asuntos, así como en la creación de filiales y sucursales.

En este sentido tenemos constituidos varios Desk, es decir, departamentos especializados por países.

Muchos clientes nos hacen llegar sus necesidades de servicios, habiendo detectado que muchas empresas necesitan un acompañamiento inicial para su implantación en España.

Conscientes de esta necesidad, hemos creado el International Service Hub (ISH).

El ISH agrupa un conjunto de servicios que requieren las empresas muy especialmente en su fase inicial de implantación. Servicios que van de disponer de unas oficinas y un domicilio, hasta recibir servicios de asesoramientoen todas las áreas que sean requeridas.

La guía "Investments & Trade in Spain" introduce el conocimiento a los inversores sobre las particularidades jurídicas, fiscales y laborales, de España y por extensión de Cataluña, siendo ésta la mejor región para invertir al sur de Europa, con un contenido focalizado en:

- Información General del País.

- Sistema Legal.

- Sistema Fiscal.

- Regulación Laboral.

- Sistema de procedimientos civiles.

- Legislación Contable.

Semelhante a RPBA Infographic: International Tax Transparency (Controlled Foreign Entities) - Updated 14.01.2021 (20)

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022

RPBA - Real Estate Tax Planning in Portugal - The Basics - Updated: 25.03.2022

Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...

Portugal: Non Habitual Resident and Madeira Free Zone Regimes – Opportunities...

A. From residence to Portuguese nationality 12.04.2024

A. From residence to Portuguese nationality 12.04.2024

Doing Business / Investing in Portugal (A quick guide)

Doing Business / Investing in Portugal (A quick guide)

Portugal D2 Visa Processing Mechanism For Individuals.pdf

Portugal D2 Visa Processing Mechanism For Individuals.pdf

Canary Islands Hub tax incentives by Price Waterhouse Cooper

Canary Islands Hub tax incentives by Price Waterhouse Cooper

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...

RPBA - The Portuguese Non-Habitual Tax Resident Regime - A detailed guide on ...

RPBA Infographic: NHR case-studies - Updated: 09.11.2022

RPBA Infographic: NHR case-studies - Updated: 09.11.2022

Último

THE CONCEPT OF RIGHT TO DEFAULT BAIL.pptx

The presentation deals with the concept of Right to Default Bail laid down under Section 167 of the Code of Criminal Procedure 1973 and Section 187 of Bharatiya Nagarik Suraksha Sanhita 2023.

A Critical Study of ICC Prosecutor's Move on GAZA War

ICC Prosecutor Karim Khan's proposal to its judges seeking permission to prosecute Israeli leaders and Hamas commanders for crimes against the law of war has serious ramifications and calls deep scrutiny.

一比一原版朴次茅斯大学毕业证(uop毕业证)如何办理

原版一模一样【微信:741003700 】【朴次茅斯大学毕业证(uop毕业证)成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理朴次茅斯大学毕业证(uop毕业证)【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理朴次茅斯大学毕业证(uop毕业证)【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理朴次茅斯大学毕业证(uop毕业证)【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理朴次茅斯大学毕业证(uop毕业证)【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版加拿大多伦多大学毕业证(uoft毕业证书)如何办理

原版一模一样【微信:741003700 】【加拿大多伦多大学毕业证(uoft毕业证书)成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理加拿大多伦多大学毕业证(uoft毕业证书)【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理加拿大多伦多大学毕业证(uoft毕业证书)【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理加拿大多伦多大学毕业证(uoft毕业证书)【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理加拿大多伦多大学毕业证(uoft毕业证书)【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版(trent毕业证书)加拿大特伦特大学毕业证如何办理

原版一模一样【微信:741003700 】【(trent毕业证书)加拿大特伦特大学毕业证成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理(trent毕业证书)加拿大特伦特大学毕业证【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理(trent毕业证书)加拿大特伦特大学毕业证【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理(trent毕业证书)加拿大特伦特大学毕业证【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理(trent毕业证书)加拿大特伦特大学毕业证【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版(liverpool毕业证书)利物浦大学毕业证如何办理

原版一模一样【微信:741003700 】【(liverpool毕业证书)利物浦大学毕业证成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理(liverpool毕业证书)利物浦大学毕业证【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理(liverpool毕业证书)利物浦大学毕业证【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理(liverpool毕业证书)利物浦大学毕业证【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理(liverpool毕业证书)利物浦大学毕业证【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版(ua毕业证书)加拿大阿尔伯塔大学毕业证如何办理

原版一模一样【微信:741003700 】【(ua毕业证书)加拿大阿尔伯塔大学毕业证成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理(ua毕业证书)加拿大阿尔伯塔大学毕业证【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理(ua毕业证书)加拿大阿尔伯塔大学毕业证【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理(ua毕业证书)加拿大阿尔伯塔大学毕业证【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理(ua毕业证书)加拿大阿尔伯塔大学毕业证【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版英国桑德兰大学毕业证(uos学位证)如何办理

原件一模一样【微信:WP101A】【英国桑德兰大学毕业证(uos学位证)成绩单】【微信:WP101A】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信:WP101A】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信:WP101A】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份【微信:WP101A】

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

办理英国桑德兰大学毕业证(uos学位证)学位证【微信:WP101A 】外观非常精致,由特殊纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理英国桑德兰大学毕业证(uos学位证)学位证【微信:WP101A 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理英国桑德兰大学毕业证(uos学位证)学位证【微信:WP101A 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理英国桑德兰大学毕业证(uos学位证)学位证【微信:WP101A 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版(uwlc毕业证书)美国威斯康星大学拉克罗斯分校毕业证如何办理

原版一模一样【微信:741003700 】【(uwlc毕业证书)美国威斯康星大学拉克罗斯分校毕业证成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理(uwlc毕业证书)美国威斯康星大学拉克罗斯分校毕业证【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理(uwlc毕业证书)美国威斯康星大学拉克罗斯分校毕业证【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理(uwlc毕业证书)美国威斯康星大学拉克罗斯分校毕业证【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理(uwlc毕业证书)美国威斯康星大学拉克罗斯分校毕业证【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版新加坡国立大学毕业证(本硕)nus学位证书如何办理

原版一模一样【微信:741003700 】【新加坡国立大学毕业证(本硕)nus学位证书成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理新加坡国立大学毕业证(本硕)nus学位证书【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理新加坡国立大学毕业证(本硕)nus学位证书【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理新加坡国立大学毕业证(本硕)nus学位证书【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理新加坡国立大学毕业证(本硕)nus学位证书【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版加拿大达尔豪斯大学毕业证(dalhousie毕业证书)如何办理

原版一模一样【微信:741003700 】【加拿大达尔豪斯大学毕业证(dalhousie毕业证书)成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理加拿大达尔豪斯大学毕业证(dalhousie毕业证书)【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理加拿大达尔豪斯大学毕业证(dalhousie毕业证书)【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理加拿大达尔豪斯大学毕业证(dalhousie毕业证书)【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理加拿大达尔豪斯大学毕业证(dalhousie毕业证书)【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版多伦多都会大学毕业证(TMU毕业证书)学历如何办理

原版办【微信号:95270640】【多伦多都会大学毕业证(TMU毕业证书)】【微信号:95270640】《成绩单、外壳、雅思、offer、真实留信官方学历认证(永久存档/真实可查)》采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【我们承诺采用的是学校原版纸张(纸质、底色、纹路)我们拥有全套进口原装设备,特殊工艺都是采用不同机器制作,仿真度基本可以达到100%,所有工艺效果都可提前给客户展示,不满意可以根据客户要求进行调整,直到满意为止!】

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信号95270640】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信号95270640】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

留信网服务项目:

1、留学生专业人才库服务(留信分析)

2、国(境)学习人员提供就业推荐信服务

3、留学人员区块链存储服务

【关于价格问题(保证一手价格)】

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:客户在留信官方认证查询网站查询到认证通过结果后付款,不成功不收费!

一比一原版新加坡南洋理工大学毕业证(本硕)ntu学位证书如何办理

原版一模一样【微信:741003700 】【新加坡南洋理工大学毕业证(本硕)ntu学位证书成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理新加坡南洋理工大学毕业证(本硕)ntu学位证书【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理新加坡南洋理工大学毕业证(本硕)ntu学位证书【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理新加坡南洋理工大学毕业证(本硕)ntu学位证书【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理新加坡南洋理工大学毕业证(本硕)ntu学位证书【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

一比一原版(ual毕业证书)伦敦艺术大学毕业证如何办理

原版一模一样【微信:741003700 】【(ual毕业证书)伦敦艺术大学毕业证成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理(ual毕业证书)伦敦艺术大学毕业证【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理(ual毕业证书)伦敦艺术大学毕业证【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理(ual毕业证书)伦敦艺术大学毕业证【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理(ual毕业证书)伦敦艺术大学毕业证【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

Capital Punishment by Saif Javed (LLM)ppt.pptx

This PowerPoint presentation, titled "Capital Punishment in India: Constitutionality and Rarest of Rare Principle," is a comprehensive exploration of the death penalty within the Indian criminal justice system. Authored by Saif Javed, an LL.M student specializing in Criminal Law and Criminology at Kazi Nazrul University, the presentation delves into the constitutional aspects and ethical debates surrounding capital punishment. It examines key legal provisions, significant case laws, and the specific categories of offenders excluded from the death penalty. The presentation also discusses recent recommendations by the Law Commission of India regarding the gradual abolishment of capital punishment, except for terrorism-related offenses. This detailed analysis aims to foster informed discussions on the future of the death penalty in India.

Último (20)

production-orders-under-article-18-of-the-budapest-convention-on-cybercrime-a...

production-orders-under-article-18-of-the-budapest-convention-on-cybercrime-a...

A Critical Study of ICC Prosecutor's Move on GAZA War

A Critical Study of ICC Prosecutor's Move on GAZA War

RPBA Infographic: International Tax Transparency (Controlled Foreign Entities) - Updated 14.01.2021

- 1. International Tax Transparency (Controlled Foreign Entities) – General rule Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt No imputation is due / the entity is not tax transparent Is the entity resident in a territory included in the Portuguese tax havens’ blacklist, as approved by Ministerial Order no. 292/2011, of November 8th (Please check the blacklist in the last page)? Participations in a non- Portuguese resident entity? Taxpayer subject to the Portuguese Personal Income Tax (“IRS”) or Corporate Income Tax (“IRC”) NO Is the effectively paid Corporate Income Tax less than half of the IRC that would have fictitiously been due in Portugal, if the entity was resident in Portugal? OR YES NO Voting rights in a non- Portuguese resident entity? Rights over the income or assets of a non- Portuguese resident entity? OR ORDoes the taxpayer hold directly or indirectly in 25% or more: Please check the exceptions on the following pages: Resident in Portugal YES 1 The entity is prima facie tax transparent: The profits or the income of the non-resident entity in each tax period, as fictively determined under the IRC Code, deducted from the Corporate Income Tax paid in its State of residence, are imputed to the taxpayer resident in Portugal in proportion to his/its direct or indirect control, the latter being taxed under IRS or IRC, as appropriate.

- 2. Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt Are the incorporation and holding of the non-resident entity based on valid economic reasons? YES Is the entity resident or established in another Member State of the European Union or of the European Economic Area? NO Does the non-resident entity develop an agricultural, commercial, industrial or service rendering activity? YES NO NO The entity is secunda facie tax transparent: The profits or the income of the non-resident entity in each tax period, as fictively determined under the IRC Code, deducted from the Corporate Income Tax paid in its State of residence, are imputed to the taxpayer resident in Portugal in proportion to his/its direct or indirect control, the latter being taxed under IRS or IRC, as appropriate. The entity is not tax transparent Please check the remaining exceptions on the next page: International Tax Transparency (Controlled Foreign Entities) – Exception according to residence 2 YES NO YES Is this activity supported by staff, equipment, assets and premises?

- 3. Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt The entity is not tax transparent The entity is tax transparent: The profits or the income of the non-resident entity in each tax period, as fictively determined under the IRC Code, deducted from the Corporate Income Tax paid in its State of residence, are imputed to the taxpayer resident in Portugal in proportion to his/its direct or indirect control, the latter being taxed under IRS or IRC, as appropriate. YES NO DISCLAIMER: This infographic is updated until January 14th, 2021. Although great care has been taken when drafting this infographic, Ricardo da Palma Borges & Associados (RPBA) - Sociedade de Advogados, S.P., R.L. does not accept any responsibility whatsoever for any consequences arising from the use of the information contained herein. The information is provided solely for general purposes, cannot be regarded as legal or other advice. It is strongly recommended to take professional legal advice appropriate for your case before making any decisions. Is the income of the non-resident entity derived in more than 25% from one or more of the following categories of income ? Interest or any other capital income? Royalties or any other income derived from intellectual property, image rights or rights of similar nature? Dividends and income derived from the disposal of shares of capital? Income derived from financial leasing? Income derived from transactions proper of the banking business even if not carried on by credit institutions, relating to insurance, business or from other financial activities entered into with entities in special relations for the purposes of the Portuguese transfer pricing provision? Income from invoicing companies that earn commercial and services income derived from goods and services purchased from and sold to related entities, for the purposes of the Portuguese transfer pricing provision and that add no or little economic value? International Tax Transparency (Controlled Foreign Entities) – Exception according to activities 3 OrAnd OrAnd OrAnd OrAnd OrAnd

- 4. Rua Abranches Ferrão, n.º 10, 9.º Piso, Fracção G, 1600-001 Lisboa, Portugal T.: (351) 212 402 743 F.: (351) 210 103 898 E.: geral@rpba.pt Portuguese Tax Havens’ Blacklist, as approved by Ministerial Order no. 292/2011, of November 8th Anguilla Guyana Puerto Rico Antigua and Barbuda Honduras Qatar The Netherlands Antilles Hong Kong The Solomon Islands Aruba Jamaica American Samoa Ascension Jordan Samoa The Bahamas The Queshm Island St. Helena Bahrain Kiribati St. Lucia Barbados Kuwait St. Kitts-Nevis Belize Labuan San Marino Bermuda Lebanon St. Pierre and Miguelon Bolivia Liberia St. Vincent and the Grenadines Brunei Liechtenstein The Seychelles The Channel Islands (Alderney, Guernsey, Jersey, Great Sark, Herm, Little Sark, Brechou, Jethou and Lihou) The Maldives Swaziland The Isle of Man Svalbard Islands (Spitsbergen archipelago and the Bjornoya island)The Northern Marianas Islands The Cayman Islands The Marshall Islands Tokelau The Cocos o Keeling Islands Mauritius Tonga The Cook Islands Monaco Trinidad and Tobago Costa Rica Montserrat Tristão da Cunha Island Djibouti Nauru Turks and Caicos Islands Dominica Natal Tuvalu United Arab Emirates Niue Uruguay The Falkland Islands Norfolk Island Vanuatu Fiji Oman The British Virgin Islands Gambia Palau The U.S. Virgin Islands Grenada Panama Yemen Gibraltar Pitcairn Island “Other Pacific Islands not specifically mentioned” Guam French Polynesia 4