The Singularly Confident Figures 1 6

•Transferir como PPT, PDF•

1 gostou•656 visualizações

Denunciar

Compartilhar

Denunciar

Compartilhar

Recomendados

💉💊+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768

+971581248768 Mtp-Kit (500MG) Prices » Dubai [(+971581248768**)] Abortion Pills For Sale In Dubai, UAE, Mifepristone and Misoprostol Tablets Available In Dubai, UAE CONTACT DR.Maya Whatsapp +971581248768 We Have Abortion Pills / Cytotec Tablets /Mifegest Kit Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujairah, Ras Al Khaimah, Umm Al Quwain, UAE, Buy cytotec in Dubai +971581248768''''Abortion Pills near me DUBAI | ABU DHABI|UAE. Price of Misoprostol, Cytotec” +971581248768' Dr.DEEM ''BUY ABORTION PILLS MIFEGEST KIT, MISOPROTONE, CYTOTEC PILLS IN DUBAI, ABU DHABI,UAE'' Contact me now via What's App…… abortion Pills Cytotec also available Oman Qatar Doha Saudi Arabia Bahrain Above all, Cytotec Abortion Pills are Available In Dubai / UAE, you will be very happy to do abortion in Dubai we are providing cytotec 200mg abortion pill in Dubai, UAE. Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. We only offer abortion pills from 1 week-6 Months. We then advise you to use surgery if its beyond 6 months. Our Abu Dhabi, Ajman, Al Ain, Dubai, Fujairah, Ras Al Khaimah (RAK), Sharjah, Umm Al Quwain (UAQ) United Arab Emirates Abortion Clinic provides the safest and most advanced techniques for providing non-surgical, medical and surgical abortion methods for early through late second trimester, including the Abortion By Pill Procedure (RU 486, Mifeprex, Mifepristone, early options French Abortion Pill), Tamoxifen, Methotrexate and Cytotec (Misoprostol). The Abu Dhabi, United Arab Emirates Abortion Clinic performs Same Day Abortion Procedure using medications that are taken on the first day of the office visit and will cause the abortion to occur generally within 4 to 6 hours (as early as 30 minutes) for patients who are 3 to 12 weeks pregnant. When Mifepristone and Misoprostol are used, 50% of patients complete in 4 to 6 hours; 75% to 80% in 12 hours; and 90% in 24 hours. We use a regimen that allows for completion without the need for surgery 99% of the time. All advanced second trimester and late term pregnancies at our Tampa clinic (17 to 24 weeks or greater) can be completed within 24 hours or less 99% of the time without the need surgery. The procedure is completed with minimal to no complications. Our Women's Health Center located in Abu Dhabi, United Arab Emirates, uses the latest medications for medical abortions (RU-486, Mifeprex, Mifegyne, Mifepristone, early options French abortion pill), Methotrexate and Cytotec (Misoprostol). The safety standards of our Abu Dhabi, United Arab Emirates Abortion Doctors remain unparalleled. They consistently maintain the lowest complication rates throughout the nation. Our Physicians and staff are always available to answer questions and care for women in one of the most difficult times in their lives. The decision to have an abortion at the Abortion Cl+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...?#DUbAI#??##{{(☎️+971_581248768%)**%*]'#abortion pills for sale in dubai@

Mais conteúdo relacionado

Último

💉💊+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768

+971581248768 Mtp-Kit (500MG) Prices » Dubai [(+971581248768**)] Abortion Pills For Sale In Dubai, UAE, Mifepristone and Misoprostol Tablets Available In Dubai, UAE CONTACT DR.Maya Whatsapp +971581248768 We Have Abortion Pills / Cytotec Tablets /Mifegest Kit Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujairah, Ras Al Khaimah, Umm Al Quwain, UAE, Buy cytotec in Dubai +971581248768''''Abortion Pills near me DUBAI | ABU DHABI|UAE. Price of Misoprostol, Cytotec” +971581248768' Dr.DEEM ''BUY ABORTION PILLS MIFEGEST KIT, MISOPROTONE, CYTOTEC PILLS IN DUBAI, ABU DHABI,UAE'' Contact me now via What's App…… abortion Pills Cytotec also available Oman Qatar Doha Saudi Arabia Bahrain Above all, Cytotec Abortion Pills are Available In Dubai / UAE, you will be very happy to do abortion in Dubai we are providing cytotec 200mg abortion pill in Dubai, UAE. Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. We only offer abortion pills from 1 week-6 Months. We then advise you to use surgery if its beyond 6 months. Our Abu Dhabi, Ajman, Al Ain, Dubai, Fujairah, Ras Al Khaimah (RAK), Sharjah, Umm Al Quwain (UAQ) United Arab Emirates Abortion Clinic provides the safest and most advanced techniques for providing non-surgical, medical and surgical abortion methods for early through late second trimester, including the Abortion By Pill Procedure (RU 486, Mifeprex, Mifepristone, early options French Abortion Pill), Tamoxifen, Methotrexate and Cytotec (Misoprostol). The Abu Dhabi, United Arab Emirates Abortion Clinic performs Same Day Abortion Procedure using medications that are taken on the first day of the office visit and will cause the abortion to occur generally within 4 to 6 hours (as early as 30 minutes) for patients who are 3 to 12 weeks pregnant. When Mifepristone and Misoprostol are used, 50% of patients complete in 4 to 6 hours; 75% to 80% in 12 hours; and 90% in 24 hours. We use a regimen that allows for completion without the need for surgery 99% of the time. All advanced second trimester and late term pregnancies at our Tampa clinic (17 to 24 weeks or greater) can be completed within 24 hours or less 99% of the time without the need surgery. The procedure is completed with minimal to no complications. Our Women's Health Center located in Abu Dhabi, United Arab Emirates, uses the latest medications for medical abortions (RU-486, Mifeprex, Mifegyne, Mifepristone, early options French abortion pill), Methotrexate and Cytotec (Misoprostol). The safety standards of our Abu Dhabi, United Arab Emirates Abortion Doctors remain unparalleled. They consistently maintain the lowest complication rates throughout the nation. Our Physicians and staff are always available to answer questions and care for women in one of the most difficult times in their lives. The decision to have an abortion at the Abortion Cl+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...?#DUbAI#??##{{(☎️+971_581248768%)**%*]'#abortion pills for sale in dubai@

Último (20)

ICT role in 21st century education and its challenges

ICT role in 21st century education and its challenges

Polkadot JAM Slides - Token2049 - By Dr. Gavin Wood

Polkadot JAM Slides - Token2049 - By Dr. Gavin Wood

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHA...

Why Teams call analytics are critical to your entire business

Why Teams call analytics are critical to your entire business

Vector Search -An Introduction in Oracle Database 23ai.pptx

Vector Search -An Introduction in Oracle Database 23ai.pptx

"I see eyes in my soup": How Delivery Hero implemented the safety system for ...

"I see eyes in my soup": How Delivery Hero implemented the safety system for ...

Apidays New York 2024 - APIs in 2030: The Risk of Technological Sleepwalk by ...

Apidays New York 2024 - APIs in 2030: The Risk of Technological Sleepwalk by ...

Rising Above_ Dubai Floods and the Fortitude of Dubai International Airport.pdf

Rising Above_ Dubai Floods and the Fortitude of Dubai International Airport.pdf

Navigating the Deluge_ Dubai Floods and the Resilience of Dubai International...

Navigating the Deluge_ Dubai Floods and the Resilience of Dubai International...

CNIC Information System with Pakdata Cf In Pakistan

CNIC Information System with Pakdata Cf In Pakistan

WSO2's API Vision: Unifying Control, Empowering Developers

WSO2's API Vision: Unifying Control, Empowering Developers

Web Form Automation for Bonterra Impact Management (fka Social Solutions Apri...

Web Form Automation for Bonterra Impact Management (fka Social Solutions Apri...

Introduction to Multilingual Retrieval Augmented Generation (RAG)

Introduction to Multilingual Retrieval Augmented Generation (RAG)

Apidays New York 2024 - The value of a flexible API Management solution for O...

Apidays New York 2024 - The value of a flexible API Management solution for O...

Six Myths about Ontologies: The Basics of Formal Ontology

Six Myths about Ontologies: The Basics of Formal Ontology

Destaque

Destaque (20)

Product Design Trends in 2024 | Teenage Engineerings

Product Design Trends in 2024 | Teenage Engineerings

How Race, Age and Gender Shape Attitudes Towards Mental Health

How Race, Age and Gender Shape Attitudes Towards Mental Health

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

The Singularly Confident Figures 1 6

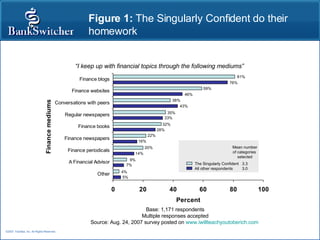

- 1. Figure 1: The Singularly Confident do their homework Base: 1,171 respondents Multiple responses accepted Source: Aug. 24, 2007 survey posted on www.iwillteachyoutoberich.com “ I keep up with financial topics through the following mediums” 81% 76% 59% 46% 38% 43% 35% 33% 32% 28% 22% 16% 20% 14% 9% 7% 4% 5% The Singularly Confident All other respondents Mean number of categories selected 3.3 3.0

- 2. Figure 2: The Singularly Confident have retirement planning under control Base: 1,171 respondents Multiple responses accepted Source: Aug. 24, 2007 survey posted on www.iwillteachyoutoberich.com “ What are your financial priorities?” 83% 73% 40% 40% 38% 36% 22% 19% 20% 26% 20% 22% 17% 23% 14% 16% 11% 11% The Singularly Confident All other respondents Confident with current level of retirement planning* 66% 39% *Responses of “Very True” and “True” to Q17: ” I feel confident in my current level of retirement planning”

- 3. Figure 3: The Singularly Confident will count on 401Ks and investments when they retire Base: 1,171 respondents Multiple responses accepted Source: Aug. 24, 2007 survey posted on www.iwillteachyoutoberich.com “ I am relying on the following for my retirement:” 82% 75% 73% 52% 32% 41% 23% 26% 20% 14% 17% 12% 16% 13% 2% 4% The Singularly Confident All other respondents

- 4. Figure 4: The Singularly Confident push to earn more Base: 1,158 respondents Source: Aug. 24, 2007 survey posted on www.iwillteachyoutoberich.com “ I negotiate my salary.” The Singularly Confident All other respondents Sometimes Never Always

- 5. Figure 5: The Singularly Confident are less likely to have car loans and consumer debt Base: 1,171 respondents Multiple responses accepted Source: Aug. 24, 2007 survey posted on www.iwillteachyoutoberich.com “ I have the following types of debt:” 39% 30% 39% 42% 25% 30% 24% 30% 23% 27% 4% 9% 4% 7% The Singularly Confident All other respondents

- 6. Figure 6: The Singularly Confident are more interested in investment topics Base: 1,171 respondents Multiple responses accepted Source: Aug. 24, 2007 survey posted on www.iwillteachyoutoberich.com “ I prefer the following personal finance topics:” 85% 74% 70% 74% 57% 59% 51% 45% 47% 56% 43% 45% 25% 20% 22% 19% 11% 16% The Singularly Confident All other respondents