Rich dad

- 1. ocrediCog She Saot nws h t o f Mo n ey Save Yo u Rich D rself from th ad's Tr e Crisis uth Ab out Mo ! ney 1 Go to school 2 Get a job 3 Work hard 4 Save Money 5 Livebelow your means 6 Your home is an asset 7 Get out of debt 8 Invest for the long term in a retirement plan filled with stocks, bonds and mutual funds TM 1 knowledge: the new money ™

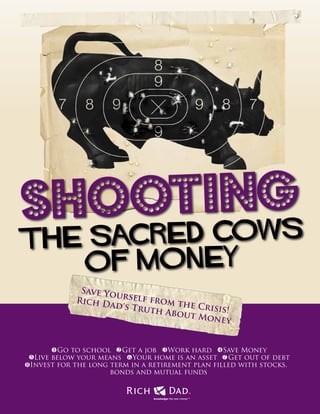

- 2. Shooting the Sacred Cows of Money Putting a bullet in the head of bad financial advice A Quick Note from Robert Throughout history, cultures have tightly grasped their “sacred cows” (dearly held beliefs so commonly accepted, so religiously observed, that to question them is sacrilege). Our culture is no different. Our beliefs are no less sacred. Especially when it comes to money. A year or so ago, Kim and I did something we’d never done before. We assembled all the Rich Dad advisors in one room to talk about the common myths our culture holds about money. These myths include: • Go to school • Get a job • Work hard • Save money • Your house is an asset • Get out of debt • Live below your means • Invest for the long term in a well-diversified portfolio The conversations were candid, funny, and dead-on. We filmed these conversations and placed them on a website, www.shootingthesacredcows.com. The goal was to create short, free, easy-to-watch, and easy-to-share videos to introduce those new to the Rich Dad message and to help the Rich Dad community educate their family, friends, and co-workers about Rich Dad principles. Rich Dad’s vision has always been to provide comprehensive financial education with quality, free resources when possible to as many people as we can. The mission of Sacred Cows is to take you from the established mindset about money to the enlightened mindset, to put a bullet to the head of bad financial advice, and to help you take charge of your financial future. The videos are available for free online at www.shootingthesacredcows.com. But we thought it would be a great idea to take the content from the videos and condense it all into a free eBook that is easy to share. So, that’s what we’ve done. 2

- 3. The following eBook is an edited version of the video transcript. I hope you enjoy it. Please share it with your friends, family, and co-workers—anyone you know who could benefit from the collective knowledge of the Rich Dad team. Comprehensive financial education is still the surest way to financial freedom, both personally and as a society. Together we can make a difference. Rich Dad Team Robert T. Kiyosaki Robert is the founder of The Rich Dad Company, a recognized brand worldwide and a global leader in financial education, empowering people to escape the Rat Race and find financial freedom. A successful entrepreneur and investor, Robert is the author of 19 books, including Rich Dad Poor Dad—the #1 personal finance book of all time. He’s regularly featured on shows such as Larry King Live, Oprah, and Your World with Neil Cavuto. Robert’s bestseller, Conspiracy of the Rich: The 8 New Rules of Money, pioneered online book publishing as a free online interactive book with contributions from over a million readers in over 167 countries. Frequent updates appear on www.conspiracyoftherich.com 3

- 4. His latest release, Unfair Advantage, addresses what schools will never teach you about money and incorporates both audio and video into Rich Dad’s first enhanced eBook. A true advocate of effective financial education, Robert isn’t afraid to challenge the status quo. He offers financial advice that exposes the absurdity of conventional attitudes about money and debunks the so-called financial experts. Kim Kiyosaki As an internationally renowned speaker, author, entrepreneur, and real estate investor, Kim knows what it takes to succeed and be a financially independent woman. She’s a sought-after speaker, television and radio talk-show guest, the host of a PBS Rich Woman show, and a columnist for www.WomenEntrepreneur.com. Through her international brand, Rich Woman, Kim draws on a lifetime of experience in business and investing to be an advocate for women in the marketplace. A self-made millionaire, Kim is a happily married (but fiercely independent) woman and often travels and speaks with her husband, Robert Kiyosaki. Her first book, Rich Woman, was a Business Week bestseller and is one of the top 50 best-selling personal-finance books of all time. Ken McElroy Ken is a founding partner of MC Companies, a real estate investment company that specializes in management, investment, development, and construction with a portfolio across the southwestern United States of over 10,000 apartment units valued in the hundreds of millions of dollars. 4

- 5. As a Rich Dad Advisor, Ken brings 20 years of real estate experience to the team and speaks to thousands of people across the globe each year. He is the author of the Rich Dad Advisor books The ABCs of Real Estate Investing, The Advanced Guide to Real Estate Investing, and The ABCs of Property Management. He is also a contributing author to Robert’s The Real Book of Real Estate and the author of The Sleeping Giant: The Awakening of the Self-Employed Entrepreneur. Find out more at www.KenMcElroy.com, www.mccompanies.com, and www.thesleepinggiant.com. Andy Tanner Andy is a renowned paper-assets expert and successful business owner and investor known for his ability to teach key techniques for stock-options investing. In 2008, Andy was key in helping develop and launch Rich Dad’s Stock Success System which teaches investors advanced technical trading techniques to profit from bull and bear markets. He serves as a coach to Rich Dad’s Stock Success System trainers and as the Rich Dad Advisor for paper assets. He is currently authoring an upcoming Rich Dad Advisor book on paper-asset investing. Anita Rodriguez Anita homeschooled her four children before becoming a teacher and counselor in the poorest high schools of Denver’s inner city. Later, she was a high school administrator for Douglas County in Colorado, one of the wealthiest counties in the nation. Having spent most of her life in education and seen first-hand the lack of sound financial education in the U.S. school system, she joined The Rich Dad Company in 2006 as an Education Advisor. She brings her vast experience to Rich Dad to help develop world-class financial-education curriculums that change lives. 5

- 6. Blair Singer Blair is a top-rated and internationally known speaker and sales communications trainer. Since 1987 he’s worked with tens of thousands of individuals and organizations such as IBM and JPMorgan to help them achieve extraordinary levels of sales, performance, productivity, and cash flow. As a speaker and Rich Dad Advisor, Blair has presented in over 20 countries across 5 continents on life-changing sales success, and is the author of the Rich Dad Advisor books Sales Dogs and The ABCs of Building a Business Team that Wins. Find out more at www.salesdogs.com and www.blairsinger.com. Tom Wheelwright Tom is the founder and principal for ProVision Wealth Strategies. For more than 25 years, Tom has devised innovative tax, business, and wealth strategies for sophisticated investors and business owners. Tom is an international speaker and an adjunct professor in the Masters of Tax program at Arizona State University. He serves as the Rich Dad Advisor for Tax and Wealth Strategy and is the author of an upcoming Rich Dad Advisor book on building wealth through tax strategies. Find out more at www.provisionwealth.com. 6

- 7. Garrett Sutton Garret is a founder and partner with Sutton Law Center, P.C., a law firm with offices in Nevada, Wyoming, and California. He has over 20 years experience assisting and advising entrepreneurs, families, and businesses in selecting the appropriate corporate structures to limit their liability, protect their assets, and advance their personal financial goals. As a Rich Dad Advisor, Garrett speaks frequently at Rich Dad events on the topic of corporate formation and asset protection. He is the author of the Rich Dad Advisor books The ABCs of Writing Winning Business Plans, The ABCs of Getting Out of Debt, Own Your Own Corporation, and How to Buy and Sell a Business. Find out more at www.garrettsutton.com and www.sutlaw.com. Mike Maloney Mike is the owner and founder of www.goldsilver.com, an online precious-metals dealership that specializes in the delivery of gold and silver and secured storage. Additionally, www.goldsilver.com provides research and commentary for its clients, assisting them in their wealth-building endeavors. Mike has spoken to audiences throughout the world on the benefits of precious-metals investing. A student of economics, Mike is regarded as an expert on economic cycles and capitalizing on the opportunities they afford. He is the author of the Rich Dad Advisor book, Guide to Investing in Gold and Silver. Find out more at www.goldsilver.com. 7

- 8. Kathy Heasley Kathy is the founder and principal of Heasley & Partners, Inc., a branding and marketing firm, which pioneered and champions Heart & Mind™ Branding. A successful author, entrepreneur, business coach, and public speaker, Kathy serves as the Rich Dad Advisor for marketing and branding. She has over 20 years of experience helping to shape brands like Cold Stone Creamery and Massage Envy and is an international speaker on branding, marketing, and communications. Find out more at www.heasleyandpartners.com. Trina White Maduro Trina is a businesswoman, investor, and social entrepreneur. She grew up in the midst of violence, drugs, and gangs on the south side of Chicago and was raised in a single-parent home with 14 other siblings and family members. Trina excelled in sports and initially viewed professional basketball as her destiny and vehicle to success. She later chose to pursue a career in social work and ministry through non-profit organizations and churches, which she’s done for the last 21 years. Today, she is a social entrepreneur who understands how to use money to create opportunities and better the lives of herself and those she serves. 8

- 9. Rodney Anderson Rodney is the Executive Director and Senior Managing Partner for Rodney Anderson with Supreme Lending. He is the leading home-loan specialist in Texas, and has arranged financing for over 20,000 families over the last 18 years. He is the #1 producer of mortgage origination in the state of Texas and was named the #1 FHA/VA lender by Mortgage Originator magazine. Rodney brings his 25 years of experience to the table as the Rich Dad Advisor on lending. Visit www.RodneyAnderson.com for more information. Marco Antonio Regil Marco is a successful entertainment entrepreneur and investor. He’s Mexico’s number-one TV host and has devoted 25 years of his life to radio and television. He’s a spokesperson for such companies as McDonald’s, Pepsi, and Nestle and for non-profit organizations like the American Red Cross and the Mexican Telethon. He’s helped raise more than $40 million every year for these charities. 9

- 10. Introduction: Robert and Kim’s Story In Shooting the Sacred Cows, Kim and I share our story about how we met, were dirt-poor, and built our wealth together as a team. We also share why we felt compelled to start The Rich Dad Company and why we feel financial education is so important. Robert Hello I’m Robert Kiyosaki, and I’m probably best-known for my book Rich Dad Poor Dad. Kim And I’m Kim Kiyosaki. Robert Kim and I met in Hawaii in 1984 when I was kind of between businesses. Kim I should say something. We met in 1984 and fell in love, and 1985 was probably the worst year of our lives. We were broke and building a business, but we were homeless for a period of time, we struggled financially, and it was a really tough time to go through. Robert So, in 1986 I asked Kim to marry me because I figured if she had put up with me with no money, she’d put up with me any time. I asked her dad and his first question was... Kim My dad’s first question was, “Does he have a job?” Robert The answer was, of course, no! But anyway, by 1994 Kim and I were financially free, and we did it without a job, without a retirement plan, and without government support. Kim Yes, and I think one of the most beautiful things about being financially free was that it was the first time we were able to ask, “What do we want to do with the rest of our lives?” Because, up until that point, we were so busy working day to day and paying the bills that we never had that luxury. And that’s when we started The Rich Dad Company. Robert And in 1996, we created the CASHFLOW board game to give people the same financial education my rich dad gave me. 10

- 11. Kim Prior to meeting Robert, I had very-little-to-no financial education. And what Robert’s rich dad taught him and what we learned on our journey to becoming financially free was not what we heard from financial advisers and planners. In fact, it was almost the opposite. We found that lots of people were asking us how we achieved financial freedom, so we created the CASHFLOW game to teach people just what we did, which was quite the opposite of what many people are taught. Robert Today we’re in a financial crisis. Kim and I saw this crisis coming, and that was the reason back in 1996 that we created The Rich Dad Company—to provide financial education so people can learn to take care of themselves. I was always taught the importance of teaching people to fish instead of giving people fish. Unfortunately, what our governments do today is give people fish rather than teach them to fish. And the more you give people fish, the more poor people you create. The Rich Dad Company was formed to teach people what my rich dad taught me, but more importantly, to teach them how to fish. Kim Like Robert said, there’s a huge financial crisis going on right now. If something isn’t working for you financially today, then maybe you need to look for new answers. And we’re always looking for new answers. That’s what Shooting the Sacred Cows is about—getting financially educated, taking charge of your life, and not depending on the government or other financial experts. Robert Our answer to the financial crisis is to get financially educated. Instead of starting out with learning how to fish, financial education begins by shooting the sacred cows of money. Money does not start in your hands. Money actually starts in your head. People hold to sacred cows, age-old Industrial-Age beliefs, such as, “Go to school.” Everybody says, “Well, you have to go to school.” Unfortunately, you don’t learn anything about money in school. In Shooting the Sacred Cows of Money, we’re going to say some things that will challenge you. You might even say, “That’s not fair!” Well, we’re not trying to be fair. There is no fairness when it comes to money. Either you’re a winner, or you’re a loser. We say hard things because they are the truth, but also because we care about your financial future. The lies of the sacred cows of money actually hurt people. A sacred cow is something that everyone accepts as truth—and it’s taboo to say anything bad about it or to the contrary. There are many sacred cows regarding money. They are serious, and they hurt people. 11

- 12. Today’s world is different than it used to be. The way things always have been done financially isn’t working, and it’s time that somebody stands up and shoots a few sacred cows so that people stop suffering. A good analogy is the people who lived in New Orleans prior to Hurricane Katrina. They knew they lived below sea level. They knew that it was only a matter of when, not if, a disaster like Katrina hit. Yet, they chose to ignore the potential consequences. And they paid the price. Today, we’ve got a lot of financial storms. You need to be prepared. We have a solution—a very strong solution. By shooting the sacred cows of money, we hope to wake you up to start thinking differently. So, lock and load. Time Out: The 5 Elements of Financial Education You need to know the five elements of financial education. Element number one is history. There are many interesting dates, but one important one is 1913 when the Federal Reserve Bank was created. Also of importance, in 1913 the Internal Revenue Service (IRS) was created so that they could tax us. They had to tax us if they were going to print money. In 1971, President Richard Nixon took the U.S. off the gold standard. After 1971, money stopped being money. It became a currency backed by debt. One of the reasons we’re in this massive financial crisis today is because, after 1971, the Federal Reserve Bank could print as much money as it wanted. In 1974, the rules of retirement changed with the Employee Retirement Income Security Act (ERISA), which paved the way for the 401(k). And that’s why today so many people of my generation are afraid of running out of money during retirement. Element number two is taxes. As you know, taxes are not fair. There are many reasons why the rich pay much less in taxes than people who work for the rich. Element number three is financial vocabulary. In other words, understanding the language of money. For example, what’s the difference between an asset and a liability, capital gains versus cash flow, or fundamentals versus technicals? That’s all part of a financial vocabulary. Number four is wealth protection. As we all know, people out there are trying to steal your money. But there are also people whom you trust who are taking your money. Because of this, financial education is not only how much money you make, but how much money you keep. And element number five is that there are two sides to every coin. When you put your money in the bank, the bank gives it to somebody else. When you put your money in your retirement plan, the bank gives it to somebody else. 12

- 13. Sacred Cow #1: Go to School An important part of financial education is having a financial statement, which includes an income statement and a balance sheet. When you go to your banker, your banker always asks for your financial statement, not your report card, because your financial statement is your report card once you leave school. Your financial statement will tell you whether or not you’re smart with money. The financial statement is the report card of your financial intelligence. One of the biggest sacred cows of all is go to school. Many people think I’m anti-school. That is not true. I’m anti- ignorance. So, I’m very pro-education. I’m just not pro of being stupid about money. Anita Education is more important now than it’s ever been. Robert That’s right. Anita So the problem is that the schools focus just on two kinds of education. There’s the academic, which is really important…Reading, writing, arithmetic. You need to have it, that’s basic. The second type of education they give is the professional kind of education. If you want to be a lawyer or an accountant or a teacher, then you need to go to school and get those certifications. But the one kind of education that’s lacking severely in the school system is financial education. Rodney I put on my Facebook one day that we need to teach our children financial education, and I received a comment back from a teacher that said, “Who’s going to pay for it?” We’re all going to pay for it if we don’t start educating our children about finances in school. Robert This is a very hot subject. Our schools are training people to be employees, to work for the rich. The second thing I don’t like about school is how they label a kid as smart or stupid at an early age. The reason I’m sensitive about that is because I was labeled stupid right from the start! And it wasn’t that I was stupid. I was bored and not interested, and we studied subjects I wasn’t interested in. Nobody could tell me how I was going use calculus. Were they training me to be an employee or street smart? My poor dad was school smart. My rich dad was street smart. I’d rather be street smart today. Tom Well, there’s a total lack of practical education. That’s really what you’re talking about, and I found that to be true. I’m an accountant. I have a master’s degree. 13

- 14. Robert And you’re an “A” student, right? Tom Yes, I’m an “A” student. Robert: We’ll forgive you. Tom Thank you. But when I went to school, the only financial education I got was specific to my profession. There was no general financial education. I could have gotten a master’s degree and a PhD in my field without any specific financial education at all about how to handle myself once I got out of school. Robert Right. And people say to me, “Well, I learned economics in school. Economics is financial education, right?” Not really. It’s not about investing. It’s not about the law. It’s not about taxes, not about history. Garrett Robert, as a lawyer, I see all sorts of people walk through the door. Some are highly educated, and some have no education at all, but like you said, they’re street smart. And the first time I saw this type of client, I thought, “Wow! He’s doing pretty well. He didn’t go to college, but he’s got all this real estate.” And then there’s a pattern that develops where you see a lot of people who never went to college but are street smart and have done very well. Kim I was talking to a woman the other day. She’s a highly successful medical doctor. She’s very smart in many ways, but when we were talking, she finally looked at me and said, “Oh my gosh. I have not a clue about my money.” She’s 45 years old, and she has not a clue. Many times you think that, because people are successful, they know something about money. But they really don’t because they never had the education. Andy School creates a culture of dependence. We depend on three things. We depend on a corporation to take care of us. We depend on government to take care of us. And, the scary one I think is, we depend on institutions—you know, the people who run our 401(k)s— to take care of us. We rob ourselves of the independence to think freely as entrepreneurs or investors, and we become dependent on those three entities. It’s brutal. Robert Mr. Maloney, you never finished school, did you? Mike No, no. I failed school, but more than that, school failed me. I was dyslexic. 14

- 15. They didn’t know what dyslexia was back then, but basically I was just like you, Robert. I was bored stiff. I got put in all the remedial classes. Basically, I was in with the dumb kids. They weren’t teaching me anything I wanted to learn or anything that I would ever use in my lifetime. Robert And the reason I’m bringing up Michael is that most people will agree he’s probably the smartest guy on this team. And the problem for Michael was that there are three kinds of education. There’s academic: reading, writing and arithmetic. There’s professional: become a doctor or a lawyer or, in my case, a pilot. And there’s financial. But Michael was put back because of academics, because you can’t read, right? Mike Right. Robert So, how did you learn to read? Mike Apple came out with OSX at the beginning of the last decade, and you can just select text, hit a button, and the computer reads to you. Most people don’t know it’s built into the operating system. I developed a passion for global finance and economics and monetary history especially. And passion drives you. Robert Now we can’t shut him up, and I’m going to blame Apple for that one! Andy School is so low gain. I didn’t do well in school. I did very well in sports, and in sports you learn to compete. You learn to deal with pressure. Goals in school are individually focused. You’re competing against everybody, and teamwork is called cheating in school. Some of us cheated better than others. Robert: And I’ll just say the last thing about school that really upsets me. In America, schools are based on real estate tax. In other words, if you come from a rich neighborhood, the real estate tax pays for better schools. If you are from a poor neighborhood, you get less money. So, any time somebody tells me schooling is about being fair, when I look at the number side of it, it isn’t. If you’re poor, you’re getting the worst possible education. To me, that is cruelty. So how does a person learn about money? How does a person increase their financial intelligence? A diagram called the Cone of Learning provides some interesting clues. 15

- 16. Cone of Learning After 2 weeks we Nature of Involvement tend to remember Doing the Real Thing 90% of what we say Simulating the and do Real Experience Doing a Active Dramatic Presentation Giving a Talk 70% of what we say Participating in a Discussion Seeing it Done on Location Watching a Demonstration 50% of what we hear and see Looking at an Exhibit Watching a Demonstration Passive Watching a Movie 30% of what we see Looking at Pictures 20% of what we hear Hearing Words 10% of what we read Reading Source: Cone of Learning adapted from Dale, (1969) The Cone of Learning was created by an educational researcher named Edgar Dale in 1969. What he found is that the worst way to learn is by reading or listening to a lecture. And the best way to learn is at the top of the cone, which is simulations through games, and then doing the real thing. The interesting thing is that my poor dad who was good at school thought that reading and lecture were the best way to learn. My rich dad taught me to be a rich man by using methods at the top of the cone. He taught me using the game of Monopoly™—you know, four green houses, one red hotel, four green houses, one red hotel—and then we went out and did the real thing. So, one of the ways, if you want to learn without much risk, is by simulations, playing games. The reason my wife and I created the CASHFLOW game was so that you could play and make a lot of mistakes with play money. How many people in this room have made financial mistakes? 16

- 17. Kathy Yes, the only thing we were ever taught in school was maybe how to balance a checkbook, how to have a savings account, those basics. Robert Financial education is like learning another language. Marco I say this all the time in Mexico. If you learn English, you can do business with the whole world. Robert When you learn to speak the language of money, it opens up a whole new world. And unfortunately in our school systems, we don’t teach the language of money. We teach people the language of becoming a doctor, lawyer, or an employee. Sacred Cow #2: Get a Job The next sacred cow is get a job. Now the problem with getting a job is: Who do you think pays the most taxes—the owner of the business or the worker? For that, I’ll turn to my accountant here, Tom. Tom Well, it’s clearly the employee who’s paying the most taxes. I started as an employee right out of school, and I was paying high taxes. Even though my job is to reduce taxes, I was paying high taxes. And then about 15 years ago, I started my own business—my own CPA firm—and I was now self-employed and paying more taxes. So, it wasn’t until I started acting like a bigger business, and was really a significant-sized business, that I started paying less in taxes. It’s because the business owners, the entrepreneurs, and the investors—the active investors—really pay the least amount of taxes. Time Out: The CASHFLOW Quadrant In this eBook, you’ll hear a lot about E, S, B & I, also known as the CASHFLOW Quadrant. E stands for employee; employees have a job. S stands for self-employed, small business, or specialist like a doctor or a lawyer. These people own a job. B stands for big business, 500 employees or more, and these people have other people working for them. And I stands for investor, and investors have their money work for them. Now my poor dad always said to me, “Go to school and get a job.” He wanted me to become an employee or a specialist like a doctor or a lawyer. My rich dad said, “If you want to be rich, you have to be a business owner on the B-I side.” And that’s the difference between my rich dad and my poor dad. Robert If you look at the CASHFLOW Quadrant, you have the E, S, B, & I quadrants. The people who go to school are on the E and S side. The S stands for specialist like a doctor or a lawyer, and the E’s are employees. But doctors and lawyers pay the highest taxes, right? 17

- 18. Tom Oh, by far. It’s the self-employed people because, not only are they paying the highest income taxes, they also get the privilege of paying Social Security taxes and Medicare taxes on everything they earn. So, they’re paying extra taxes just to be in that S quadrant. Robert Right. My mother wanted me to be a doctor. If I had followed that advice, I’d be paying the highest tax possible. They make a lot of money, but they pay the highest percentage in taxes. So that’s why this relates back to “go to school.” Tom That’s right. And they actually have the fewest options to reduce their taxes. But the tax laws are really geared towards those people who are creating jobs, the entrepreneurs—those who are creating housing, real estate investors—because the government understands that’s what we need. They want the private sector to do that, and so they reward them for doing so. And that’s really all the tax law is. It’s a system of rewards for people doing what the government wants you to do. Blair The other part of it is this whole idea of getting a job. There’s some kind of a myth out there that goes with “get the job, get a safe, secure job.” And so that by getting a job somehow you’re going to be taken care of for the rest of your life. All you have to do is pick up any paper to see how many tens of thousands of people are losing their jobs. There are no safe, secure jobs, and now we’re competing with India and Asia for jobs that were sacred to America at one point in time. So, this whole idea of having a job and being secure is just not true. It’s probably the most insecure thing you could be doing right now. Robert The idea of a secure job is an Industrial-Age idea. Blair Exactly. Kim The only option put into your head is to go get a job, and I wasn’t around… Robert That’s brainwashing. Kim Yes. I didn’t grow up around entrepreneurs. I wasn’t around business owners. I was around employees. Kathy When I first started my company 15 years ago, I went back to my class reunion, which is always an interesting thing to do, and I remember saying to them, “Yeah, you know, I started a company about five years ago.” They looked at me like, “You’re so brave.” And I’m thinking, “I’ve had this company for five years now. That’s the longest I have ever worked anywhere.” 18

- 19. Robert See, without financial education you have to get a job. What’s tragic today with so many people losing their jobs is that they’re going back to school to get another job, but they’re now competing with their kids. That’s insanity. So, we’re not saying jobs are bad. We’re just saying as entrepreneurs that our job is to create jobs. The government doesn’t really create jobs. They need more entrepreneurs. Kim I didn’t even know there was another option growing up. I thought all you could do was get a job. So again, it’s not right or wrong to be an employee, but I’d like to know what my options are. Anita When you were in school, did they say, “Go to school, get your diploma, and become an entrepreneur?” No. I mean you’ll never hear that in the school system. Kim No, they said, “Work your way up the ladder, get the bigger paycheck, get a better job, and higher pay.” Anita But you’re right. Get a job is the only option that you’ll hear in school as a rule. Robert And job stands for Just Over Broke, you know. Tom To me, the real issue with a job is that it’s the highest-risk profession you can have because you only have one client. When I started my business 15 years ago, it was after being fired from a job. What I recognized was that I had no control over my life because I had one client, my employer, whereas now I have thousands of clients. Now, if one client fires me, it’s not the end of the world. Now my risk has gone down considerably, almost to nothing. When you have a job, it’s just a high-risk play. Ken Well, the other thing is, you’re in complete control. That’s the piece that I like. Robert You’re an entrepreneur because nobody would hire you! (Group laughter.) Ken But it’s nice. If you’re going to lose some business, or you do lose some business, you can go out and do something. You can go out, generate business, and fill that gap. Robert Financial security is more important than job security. E’s and S’s get punished for making mistakes, or they lose their job. B’s and I’s get richer from their mistakes because they learn from their mistakes. 19

- 20. Sacred Cow #3: Work Hard The next sacred cow is work hard. My poor dad, a schoolteacher, a great guy with his PhD, always said, “I’m a good, hardworking man.” My rich dad had a different point of view. He had me read this book by Mark Twain. It was a story of how Tom Sawyer got the other kids to paint the fence for him. My rich dad said, “That’s working hard. You want other people to work hard for you, and you want your money to work hard for you.” That was his lesson. Robert A lot of people can’t wait until Friday because they hate their work so much. And they dread Sunday because they have to go back to work the next day. With us, I would say most of us are working 24/7, but we’re working differently. I love my work. It’s challenging, with problems and all that stuff, but I love it. So, we work hard, but we don’t work hard in the normal sense of working hard. The problem with working hard for money, because the rich don’t work for money, is that you pay more in what, Tom? Tom Taxes. Robert Taxes. The harder you work for money, the more you will pay in taxes, right? Tom Right. Instead of working hard for money, the rich work for assets and pay a lot less in taxes. The tax law is geared towards building assets because, when we build assets, we build the economy. Robert The big difference between E’s and S’s, and B’s and I’s, is that E’s and S’s focus on the income statement, and B’s and I’s focus on the asset column. Tom As we build assets, the economy grows. Employees benefit also because now we have more jobs for more employees. Robert But on Michael’s side, people are working so hard because the Feds are also working hard printing money, right? Mike I’ve got friends who just say, “I need to get more hours,” or “I need to get a second job,” or something like that. They’re working harder to make a few more dollars, but they don’t realize that over this entire past decade, the average income after inflation has fallen. So the harder people work, the less they’re making because the government and the Federal Reserve, the banking system, they’re basically stealing it from them. Robert Can we bring in the bags of coins right now? Thank you. 20

- 21. Kim I’m not going to hold that! Robert I’ll give you an example. In the year 2000, one gold coin cost $300. This huge bag I’m holding is $300 in U.S. quarters. Today, in 2010, that same gold coin costs thousands of dollars to buy. So the reason people have to work so hard to keep up is because the value of our dollars is going down. The insanity of getting another job, paying more taxes, and working harder when... How many dollars did the Fed print in 2009? Mike From August of 2008 through 2009, they created about 1.5 times more paper dollars than they printed in the previous 200 years. Robert So, that’s why people are working harder, because their money is worth less. Mike And it isn’t the coin that changed. People don’t understand that it isn’t the price going up. It’s the value of the dollar falling. It’s the currency that’s changing. The can of Campbell’s soup in the grocery store is the same can with the same contents from back in 1950 when it cost 15 cents. Today it’s $1.95 or whatever it is. What’s changed is the dollar’s value, not the can of soup. Robert So that’s why the rules have changed. In 1971 the U.S. dollar stopped being money and it... Mike It became a currency. It became debt. Robert It became an IOU from the federal government. And the thing is, they can print as much as they like. The more they print, the harder you have to work. It all takes place in your head. Take this glass here. In this case, the glass here is “context.” It holds the “content,” in this case, the water. E’s and S’s have a different context than B’s and I’s. Having a different context, E’s and S’s attract the sacred cows like “go to school,” “work hard,” and “live below your means.” B’s and I’s, having a different context entirely, attract a different type of content, a different type of information, and a different type of education. Money is created out of your head. If you’re a true B and I, you’re not concerned. It’s because, just like the Fed, we can print our own money. 21

- 22. Sacred Cow #4: Live Below Your Means Our next sacred cow is one of our favorite ones—live below your means. Do you like living below your means? It’s no fun. It kills people’s spirits. Why would you want to live below your means? But many people have to live below their means, unfortunately, because the Fed is printing so much money that taxes and inflation go up, which means people are forced to live below their means. Let’s talk about what keeps people living below their means and how you can rise above yours. Anita Well, if you’re on a paycheck, you have that one income coming in, and if you’re just one person, you’ve only got 24 hours in a day to work. So, there is a limit to how much you can work to get those paychecks coming in. This forces many to live below their means. Tom The key here is to raise your means. That’s the idea here. It’s not that we want to have terrible credit-card debt or something like that. Instead, let’s raise our means so that we can live the way we want to live instead of living at this poverty level. Kim So why is it that whenever some adviser looks at your finances that the first thing he looks at is how you can cut expenses? Tom Well, what does a financial planner tell you? The first thing that they ask you is, “What do you need to live on when you retire?” They never ask, “What do you want?” Kim Robert and I definitely do not believe in living below our means. Robert When we met in 1984, we had nothing, but every year we would get together at New Year’s and we would set our goals for health and assets. So, that’s why it took us only about 10 years from 1984 to 1994 to become financially free, because we kept adding assets every year. And we continue to do the same thing today because it’s fun and exciting. That’s one of the best-kept secrets—getting rich is fun! Kim It is fun! It’s a lot of fun. If Robert and I want to buy a luxury like a new car, we first acquire an asset. So we acquire the asset and the cash flow from the asset pays for the car payment. So it’s never living below your means. It’s expanding your means through acquiring assets that give you cash flow that gives us all those good things in life. 22

- 23. Robert The point here is this: There are assets and liabilities. The way you increase your means is to acquire more assets—not houses or cars—but assets. The reason so many people struggle financially is that they have no financial education. They may be a good doctor or lawyer or accountant or rock star, but if they don’t know the difference between assets and liabilities and they keep buying liabilities instead of assets, they have to keep living below their means. If you’re single or not, if you’re on a fixed income, if you’re an E and an S, your income is limited. There are four major expenses that keep E’s and S’s poor. Number one is tax, and taxes are going to go up because the Fed is printing so much money all over the world. Two is debt. People leave college with tons of debt, use credit-card debt to make ends meet, and then use debt to buy their house because they think it’s an asset. Three is inflation. Inflation goes up because, as taxes go up and prices go up, then inflation goes up. And fourth is retirement. You must put something away for the day when you stop working. Those are the four main reasons E’s and S’s, as a general rule, have to live below their means. But if you have financial education and live on the B-I side, you can increase your means by increasing cash-flowing assets. Andy I think a lot of people accept mediocrity, and in order to be able to grow in business, in order to make more money, you have to step out of that comfort zone and stop being mediocre. Robert Or hoping the government is going to save you. I think living below your means is one of the greatest spirit-killers there is. There’s a lot of people who like being poor. I’m not making it right or wrong, but that’s definitely not what I like to do. Kim and I definitely don’t live below our means. Kim No, I definitely do not like living below my means. I did it when I was in college, and that was exciting times and all, but I get inspired when I get put in a position where I need to create something new. I want to be bigger than I am, not less than I am, and I think people are being taught to contract and be less than they are instead of being inspired to expand and be more than they are. Tom That’s the issue with the idea of a budget, right? A budget is all about cutting. It’s all about slicing. It’s all about being less than you are. Instead, you should make a strategy and look at projections into the future. Ask “What can I do?” as opposed to “What can’t I do?” That’s the big distinction. Kathy A lot of it comes from fear, too. You know, I think people are afraid of their futures. They’re not sure where the future is going to lead them, and they think, “I’ll live below my means. I’ll save. I won’t allow myself to have this small luxury, that small luxury.” They of course fall off the wagon, and then they feel bad about it, and it creates guilt. 23

- 24. Robert The worst thing is that they cut back on their expenses and they save money. Right, Mike? That’s the worst thing they could do. Mike Right. They’re saving depreciating money. Anita It all goes back to the questions you ask. When you say, “I can’t afford it. I don’t have the money for that,” you put yourself in a box. A better question would be, “How could I afford that? How can I get the money for that?” That type of question expands your mind. Trina You know, in my community where I grew up, living below your means was pretty much a step up. I’m just being honest. We didn’t have any means, and we didn’t live and didn’t know how to live. It was basically survival. And some of the ways we created those means were, of course by legal definition, illegal. That was the way we survived, and that was the way we got by. Living below your means is completely opposite to abundant living, which is what I believe in my faith, abundant living. The opposite of that, to me, is not the way that God intended for us to live. Robert That’s why I think it’s absolutely criminal that our school system does not teach us much about money. And what they do teach us is to put your money in the bank which means you lose more money, and then talk to a financial planner who’ll put you into mutual funds. That is not financial education. That is educating people to give more money to the rich. Kim That will also cause you to have to live below your means. That’s what they’re training you to do. Create a budget. Mike And while you’re at it, you’re going to pay more and more in taxes because you get no tax benefit for living below your means. Robert And that’s a problem. You say to a child, “Go to school and get a job. Become a doctor or a lawyer.” That child will pay more than his or her fair share of taxes and then will have to live below his or her means. Marco If you’re playing defense instead of offense, you’re just hiding and trying to play it safe, saving money, and you never manifest. You cannot be who you’re supposed to be. Kim I say it’s time to get financially educated and take care of yourself. 24

- 25. Sacred Cow #5: Save Money The fifth sacred cow is save money. In 1971 President Nixon took the dollar off the gold standard, essentially taking the world off the gold standard, and money was no longer money. So people are no longer saving money. They’re saving debt. Robert As I’ve said in my books for years, the big reason that savers are losers is very simply because in 1971 the dollar stopped being money and became debt. Right, Mike? Mike Yes, the rules all changed in 1971. Before then, when someone became working age, they could expect to put away 10 percent a year, and by the time they got into their 60s, they could retire on their savings account and expect to live off that interest. In 1971, everything changed and they started creating currency on a massive scale. Robert Worldwide. Mike Worldwide. And that is what causes inflation and the loss of purchasing power. Back in the 1950s, if you had $100,000 in the bank, you could retire on that. Robert So for folks like my mom and dad, the World-War-II generation, the industrialized generation, it was very smart to save money. For our generation, the baby-boom generation, saving money could be the stupidest thing you can do because the system is stealing your wealth through the very thing you work for—money itself, which isn’t really money anymore. Mike Right. Real money is actually gold and silver. Money has to maintain its value over long periods of time. Currency doesn’t have to. For 5,000 years, gold has been the predominant currency. It became money when somebody minted it into coins in Lydia in about 680 BC, and each unit had the same buying power as the next one. They became interchangeable. Robert Let me ask you this. This printing of money out of just paper, this has been tried before, hasn’t it? Mike Many, many, many times, and there’s always one result. When they start creating a whole lot of currency, you get far higher prices for everything, but especially real money. Eventually gold and silver lie in wait. When the public senses the inflation of retail prices that is caused by the inflation of the amount of currency in circulation, they rush back toward gold and silver. They have for 5,000 years. Robert Name some governments that have attempted to print money. 25

- 26. Mike The Weimar Republic. Kim What about Zimbabwe? Mike Zimbabwe, yes. They are the most recent, having printed a $100 trillion note. This is the largest note ever printed. Robert And this was printed in 2000? Mike Yes. But when Zimbabwe was created as a country, when it went from Rhodesia to Zimbabwe, the Zimbabwean dollar was on parity with the U.S. dollar. One U.S. dollar was the same as the Zimbabwe dollar. But it doesn’t buy anything today. It doesn’t buy a cup of coffee. Robert Right. See, the Greeks did the same thing when they started clipping coins. The Romans tried it, the English tried it, the Germans tried it, the Chinese tried it, and now the U.S. is trying it. Mike Yep. Robert And so that’s why saving money is probably the biggest mistake you could make right now because today money is no longer money. It’s now debt. All currencies throughout the world are in trouble, the same way the Zimbabwe dollar is in trouble. That’s the problem with saving money. After 1971, it was no longer money. Mike And more than 70 percent of all the currency on the planet is U.S. dollars. Robert If the U.S. dollar goes, the world goes with it. Mike I’m preparing by getting fully diversified. I buy both gold and silver! 26

- 27. Sacred Cow #6: Your Home Is an Asset The next big sacred cow is your home is an asset. In 1997, I wrote in Rich Dad Poor Dad that your house is not an asset. At that point, every realtor stopped sending me Christmas cards. Your home is not your asset. It’s actually your bank’s asset if you read a financial statement. Robert Kenny, you own lots of real estate. Ken Yes. Robert Is your home an asset? Ken No, not my personal residence. Robert A lot of people are in trouble today with their house. Ken Yes, because it doesn’t produce any revenue. I pay the bank every month. It’s the bank’s asset. Robert Everybody used to tell me my house had appreciated in value. Again, that’s capital gains versus cash flow. And what people are finding out now that the real estate market has crashed and the value of homes has been sucked out… now people are upside down on their home, and they’re finding out it’s a liability because they still have to pay the bank on that mortgage. Rodney And I’ll tell you, I’m the largest originator of FHA and VA loans in the entire country. I rent. What does that tell you? Robert Well, as an accountant, is a house an asset? Tom Well, no. The bank will say it’s an asset, and the financial planners will say it’s an asset, but the reality is that it’s not an asset for you unless it’s putting money in your pocket. A house just drains money from your pocket. One of my little pet peeves is that people say, “Well, if you own a house, though, you get a deduction for the interest.” Yes, but it’s money out of your pocket and the best you can get is 40 cents on the dollar, okay? So you’re giving a dollar and you get 40 cents back. You’re still out 60 cents. It’s not difficult math. 27

- 28. Rodney Your home is shelter. It’s a place to raise a family, but it’s not an asset that you’re going to make money on. It’s not a financial asset. Robert Now, you might make money in an up-trending market, but today the market’s trending down. That’s why in 1997, what I said in Rich Dad Poor Dad, that your house is not an asset, was heresy because the market was up-trending. Now people are saying, “Oh my God, I should’ve listened to him.” I’m not saying don’t buy a house. I’m saying just don’t be financially ignorant and call your house an asset if it’s taking money out of your pocket. Kim and I own two houses, one in Arizona and one beautiful beach house in Hawaii, and they’re our biggest liabilities. Kim People did think, especially in the high times when the markets were high, that their house was an asset. Even if they had their mortgage paid off, people were borrowing against their house and putting it into the stock market or wherever they were putting it. So, not only were they getting crazy mortgages, but they were also taking money out against their house in second and third mortgages. Tom And they were doing it for things like vacations, boats, cars, and other things. And the reality is that the reason they were doing that is because they got to deduct the interest off their taxes and so they thought, “Well, this is okay because I get a deduction.” Just because you get a deduction doesn’t make it a good thing to do. Rodney One of the big mistakes people make is over-improving their house. They put in a $50,000 swimming pool, and it brings them $20,000 worth of value. The way I look at it is that you just bought a $30,000 babysitter. Garrett Fifty percent of the mortgages in Reno are under water, meaning that the mortgage is greater than the value of the property. And this affects the whole community because people aren’t able to sell their homes and move to a place where they can get a better job. The neighbors aren’t going to sell their houses because values are so far down, and so this has affected entire communities. We’ve heard people say that your home is an asset. Well, we’re talking here about financial education, and this is one of the biggest financial lessons that our country has had to learn in a very hard way. Your home is not an asset. Ken This has happened before and what will happen is new laws will come in, new credit will be loosened again years from now, prices will come up again, and people will do it again. Robert It’s about a 20-year cycle, as in anything. The point here is that this is the best time to buy real estate. If you are a first-time home-buyer, this is your best time. Just don’t call it an asset. This is the best time to get back in the market, and that’s why it takes financial education. The reason I’m in real estate is for one reason—debt—because one of the easiest assets to get debt on is real estate. But if you’re going to use debt, you’ve got to be highly financially intelligent. Otherwise, if you’re not intelligent, just keep calling your house an asset. 28

- 29. Time Out: The Four Asset Classes We’re talking a lot about assets, and there are four primary asset classes. One is business. As an entrepreneur you own a business. Number two is real estate, and we love rental properties that cash flow, real estate that puts money in our pocket every single month. Number three is paper assets: stocks, bonds, mutual funds, and savings. Most E’s and S’s are in paper assets today. And number four is commodities: gold, silver, other precious metals, oil, and gas. We’re in business, we’re in real estate, and we own hundreds of properties in real estate. We have paper assets, and we have commodities. So for us, when we talk about diversification, we’re in all four asset classes. Sacred Cow #7: Get Out of Debt Time to shoot one of the more evil of all the sacred cows, evil for most people—get out of debt. A lot of people are saying to cut up your credit cards. I think that’s really ridiculous because a credit card is not the problem. In fact, I love my credit cards. I don’t know how anybody could get along today without a credit card. The problem is a lack of financial education. Mike The entire currency supply, all of the dollars in existence, requires debt. You can’t have a dollar without debt. A dollar is just an IOU. It’s borrowed into existence either by the government creating a bond that promises to pay interest or by future taxes. Currency is also created by people taking out a loan at the bank through fractional-reserve lending. Every month there’s a payment due on those dollars that you created. Robert Right. And a credit card is a fast way of creating money because there’s really no money in the card. So let’s say I go to the store, and I charge $100. Like magic, $100 is created and it flows into the economy. That’s why debt is good. But when you abuse this, that’s when we get in trouble. Rodney, you see the horror stories of bad debt, don’t you? Rodney Yes. I see people walk into my office who make $150,000 a year, but they have $250,000 in credit-card debt. Let’s face it, we live in a credit society, and you do have to have credit. We have to learn how to survive and thrive in this credit economy. But people are walking into my office, and they have this bad debt. They’re asking, “What do we do with it?” Well, number one, you try to pay off the bad debt so that you can invest in good debt, which would be real estate. Robert And we love debt, don’t we? 29

- 30. Ken Yes, we have a lot of debt. Robert Our real estate that we own is all basically financed with our tenants, so that’s what I consider to be good debt. So when we get real estate, we get proper leverage, and it’s paid by all the residents who live in all of our projects. Tom And it’s not just real estate. Business is the same way, and we even have good debt in business as well. That’s how we grow. And it’s the cash flow from the business that’s able to pay the debt, and the debt creates more cash flow. Robert Many people are worried today or think investing is risky because they invest for capital gains. They’re hoping the stock price goes back up. They’re hoping their home value goes back up. A smart investor doesn’t really care. A smart investor wants both capital gains and cash flow. People say that I like real estate. But I don’t really like real estate. I just love debt because it’s so easy to get a loan on real estate, right? Ken I like the analogy that you use sometimes. You say that if you put $1 million of cash into a mutual fund, you get whatever you get paid. But if you put $1 million as a down payment on real estate, you actually buy a $5 million project. Robert Right. Ken So you’re actually getting a $5 million asset with $1 million, versus $1 million of mutual funds with $1 million. And by using the bank’s leverage, the value you’re creating on that real estate is on the $5 million, not the $1 million. Tom And the tax benefits that you get on the real estate isn’t on the $1 million either. It’s on the $5 million. So you not only increase leverage on your cash flow and on growth in your asset, but you also increase leverage on your taxes. Ken Here’s what we’re doing. We get these loans, and the tenants are paying them off. That’s the point. Robert And they’re paying it off with after-tax dollars. Ken They’re moving into our places, paying rent, and we’re taking that rent and paying our mortgages down to zero. 30

- 31. Kim Wait a minute! Ken is talking about these million-dollar deals. Let me tell you how I started. I’m somebody that knew absolutely nothing about money or financing or investing, and I began investing with a little two-bedroom, one-bath house, and this was back in 1989. The house cost me $45,000. I had to put down $5,000, which I didn’t have, and I had a mortgage—or good debt—of $40,000. The reason it was good debt is because every month I would collect the rent and pay the expenses, including my mortgage payment. At the end of the month I had a positive cash flow of $25. Now it wasn’t a lot, but it was a start, and from there I learned. I did my next investment and my next investment. So it was good debt because that debt put money in my pocket every single month. If only people understood that there is such a thing as good debt. I don’t know how many people I talk to who think “debt” is the dirtiest word in the world. That’s the four-letter word. Robert Because they’re not educated. That’s why. Kim No. And people are raised, and I was raised, to get out of debt. Robert Go to a bank and the banker will sell you mutual funds. But ask them if they will loan you money to buy those mutual funds, and the answer is no. But if we go in and say we want to buy real estate, they’ll ask us how much we want. Ken That’s because there’s collateral. Robert Yes! Ken They actually have something physical. That’s it. Robert They’ll sell you mutual funds, but they won’t lend you money on mutual funds. That should tell you something. And the other part about it is, that borrowed money for real estate—is that after-tax, pre-tax, or no tax? Tom It’s no tax. Anytime you’re borrowing money, there’s no tax on that money. You can use that cash tax-free. Robert So if somebody wants to save a million dollars versus borrow a million dollars, it’ll probably take them $2 million to save the million because taxes will take 50 percent of it. Tom Right. 31

- 32. Robert But I just go straight into a bank, and I can borrow a million dollars tax-free. It’s great money. I love my banker. I’m not saying bankers are bad. They’re fabulous because they give us the money. All they want is their interest. We keep all the appreciation, depreciation, and amortization. We keep all of it. They’re the best partners of all. So I’m not anti-bank, and I’m not anti-debt. I’m anti-lack of financial education because there’s good debt, and there’s bad debt. Kim Your rich dad was a tough mentor. But you know, I think some of the greatest mentors are tough because a really great mentor will push you to go beyond where you think you can go. Some of my best mentors, that’s what they’ve done for me. Robert Yes. And I didn’t always listen to my rich dad. I still remember when I did a real estate course, and I went running out and found this condo for $64,000 that didn’t cash flow. I went to see my rich dad, and I said, “But it’s going to go up in value,” in other words, capital gains. He said, “Never buy anything that goes up. It must cash flow.” And I said, “No, no, no. It’s going to go up.” And we argued and argued and argued. He finally said to me, “If you start investing for capital gains, someday you will lose big time.” So I let that condo go, and I didn’t pay $64,000. Today it’s probably worth $300,000, but I learned a lesson from my coach, my rich dad. If I had gotten into the habit of buying for capital gains due to the price of stocks going up or real estate going up, I might have been wiped out in this crisis. So that’s why a coach and a mentor keep you onto your plan. Kim And help you create and develop very good financial habits. Robert Right. Kim Because if you have poor financial habits in your personal life, you’re going to take those into your investment life. One of the most important things a coach will do is help you develop great financial habits. Robert Because when markets go up, greed sets in. And greed makes people stupid. 32

- 33. Sacred Cow #8: Invest for the Long Term in a Well-Diversified Portfolio Our last sacred cow is invest for the long term in a well-diversified portfolio of stock, bonds, and mutual funds. After 1974, the rules of retirement changed and suddenly forced E’s and S’s into the I quadrant with no financial education as they had to put their money into these retirement plans. A whole new industry was born called financial planners. Today it takes 30 days to become a financial planner. It still takes a year and a half to become a massage therapist. Robert Andy, what do you think of mutual funds? Andy I think they’re a great way to make money... if you sell them to other people. Honestly, I think they’re one of the worst places a person can put money. They make other people rich with hidden fees and expense ratios. And you talk about the law of compound interest. Well, there’s the law of compound expenses too. Robert Okay, so let me ask you this: If I say to invest for the long term, like 30 or 40 years, what do you think about that and paper assets? Andy You’ve lost control that quick. Liquidity is what paper assets are about—your ability to sell and buy without negotiation problems. Think of all the companies people have held for the long term: Enron, Worldcom, General Motors, United Airlines... you can just go on and on. But the moment you decide to hold stocks, what control do you have? Robert None. Andy In real estate, you can force the appreciation—paint it, carpet, etc. You can’t do that with paper assets. Your only control is to sell. If you hold it forever, you’re rolling the dice and saying, “I hope it works out.” Robert Right. There are a lot of people, like financial advisers, who say that stocks are the best way to go and not to get into real estate. Stocks are good for people who are not business people. You see, as entrepreneurs and real estate people, we’re personally responsible for income, expenses, assets, and liabilities. But as a stock investor, even in Microsoft, I have no control over income, expense, assets, and liabilities. Andy All you can do is sell or hedge. That’s all you can do. 33

- 34. Tom That’s right. And what makes it worse is that you take those paper assets that you don’t have control over because you invest long-term and then put them into a 401(k). Then you have even less control because, once they’re in that 401(k), you can’t take them out. Robert You’re penalized for early withdrawal. Tom You’re penalized for pulling them out. And then on top of that, you don’t even get the one tax benefit you get with paper assets—capital gains. By putting them into a 401(k), you’ve lost that benefit. Robert On top of that, when you pull them out, there are three types of taxes: ordinary earned income, portfolio income, and capital gains or passive income. And savings and mutual funds, what are they taxed at? Tom When you pull out earnings, when it’s coming through savings or a 401(k), they’re all taxed at the highest ordinary earned income rate. Robert It’s the worst thing you could possibly do if you plan on being rich. But if you plan to be poor, it’s a pretty good plan. Andy Robert, I’ve seen you take heat in the press when you say they’re risky. I’ll tell you where I think the risk is. When you sit down and they say, “We’re going to diversify you so that, if one company goes down, you’ve got all these other companies to buoy you up.” That’s fine for non-systemic-type things, but not a system-wide problem. It does not protect us if the system breaks down. And I think it’s… Robert That’s not diversification. Andy Right. It’s more fragile now than I think it ever has been before. And these people saying, “I’m well diversified,” they’re not well diversified. Robert, you’re diversified across asset classes, not just bunches of stocks. Robert So the problem with diversification in just one asset class like paper assets is that it doesn’t protect you from a crash. Andy Right. Robert Warren Buffet, the world’s greatest investor, reportedly says that diversification is protection from ignorance. 34

- 35. Andy Right. Robert But it’s ignorance from both the person selling you the plan as well as you who invest in the plan. But here is the biggest thing that really bugs me. When Kenny and I buy real estate, we always buy insurance, don’t we? Ken Yes. Robert And then when we drive a car, we have insurance, right? Ken Right. Robert Is there insurance for mutual funds? Andy Well, not for the average person. Robert Is there insurance on your 401(k) that what you put in will be there when you retire? Andy And which is more likely to burn down in the next five years, your home or your 401(k)? Robert And I’ll say it again. We all drive cars with insurance, hopefully. We all have houses with insurance. When we buy real estate, we have insurance. Our companies have insurance. But the 401(k), all these retirement plans, there’s no insurance on them. So if it crashes, you lose everything and the mutual fund companies walk away with the money. Andy And that’s a hard level of education because most people don’t know how to hedge that. Robert Nope. Andy They don’t know how. I mean it’s possible, but if you’re the average person, you don’t know. Robert That’s what we teach in our advanced courses. 35

- 36. Andy If you poll the average person and ask the difference—this is a very basic question—between a defined-benefit pension plan and a defined-contribution plan, most people do not know that difference. That is not a minor thing. That is a major deal. Time Out: Defined-Benefit Plans vs. Defined-Contribution Plans This is a very important point. In 1974, the rules of retirement changed. Prior to 1974, most people like my parents had a defined-benefit pension plan. What that meant was that they received a paycheck for life from their company after they retired. After 1974, the entire world started shifting onto defined-contribution pension plans. What you put in is all you get back. Many people are terrified of running out of money in retirement simply because, with a defined- contribution plan, you can lose everything in a market crash or you can run out of money before you die. Ken The cool part about this whole discussion is that those people putting their money in the plans and mutual funds, that’s the money I get to buy my real estate. Robert That’s right. Ken That’s the truth. Robert So the money flows from the E’s and S’s… Ken And then I make money on their money. Robert Kim and I just bought this huge property, five golf courses and a major resort, and most of the money came from retirement plans. So keep putting that money in that 401(k), you guys, because it has to go somewhere. Cash always flows, and it flows from the E’s and S’s to the B’s and I’s. And that’s why financial education is so crucial. Any time you have no control over your money, or the return of your money, you’re gambling. 36

- 37. Final Thoughts Robert In closing, I’d like to thank you for reading and paying attention to this. I’d also like to thank my friends who helped impart their wisdom because, as you’ve heard so many times, one of your greatest assets—or liabilities—is the people you hang around with. But there’s one more thing about friends. I just want to thank you guys for being givers. Tom What I would leave you with is to take control of your life. It’s not too late. And in fact, if you’re in a difficult situation, now’s a better time than ever to make a change. And you can make that change. We’ve all made this change. Every one of us has been there. We’ve all been in the dumps, and we’ve all hit at the top. We know that we can do it, and we know that you can do it. So take control. Kathy You can’t wait until you have 100 percent confidence because you’ll never have 100 percent confidence. Take the leap. Kim It’s not until you hit a point where things become so uncomfortable or so painful that you are willing to accept that things aren’t working right, the way that you think they’re supposed to work. And so for many people, when they get into a financial crisis, that’s their wake-up call, and that’s where the change starts. Robert Help your children today. Take control of their financial education because they may not receive it in school, but there are experts out there. Kim And I want to say specifically to the women, this is your time. Be strong. Get that financial education. As we said, knowledge is the new money, and for women I think this is really an opportunity for you to grow and get stronger. Take that next step. Ken And the objective is, like Robert says, to turn your mind into an asset instead of a liability. It takes more than one book. It takes more than watching one video. It’s a whole process. I mean there’s no professional, there’s no athlete, no expert in any area that has become a professional at something in one week or with one book or with one DVD or one workshop. Kim To further your financial education, The Rich Dad Company has advanced educational and mentorship programs **LINK** These programs are in the business entrepreneurial sector of real estate and paper assets. We also have Rich Dad coaching programs **LINK** in business, real estate, and paper. These programs are developed to get you from where you are today, to where you want to be. 37

- 38. It is imperative that you get role models in the form of coaches and trainers every step of the way. They will keep you on track. You’ve got to go through a minefield of failures to get over onto the side of success where you want to be. Robert Education’s a process. For example, I entered Navy Flight School in Pensacola, Florida. Two years later, I popped out as a Marine helicopter-gunship pilot on my way to Vietnam. That educational process transitioned me from a guy who couldn’t fly, to somebody who became one of the best pilots in the world. The same thing happens with education. When you go to school, the question is, “What do you come out as?” When you go through the process of education, do you come out an employee? Do you come out as a person who needs a paycheck? Do you come out as a person always looking for a job? A person working hard and paying excessive taxes? Most people go to school and they pop out as E’s and S’s. To come out as a B and I, you need financial education because financial education is also a process. Finally, one of the ways we learn best is by repetition. For example, I didn’t learn to fly by flying once. I kept flying and flying and got better and better. One of the reasons we created this eBook is so you can read it again and again. Wait a week, read it again, and you’ll absorb more and see new things. Wait another week, read it again, and more and more will make sense. That’s a great way to use this eBook, and that’s why I’m glad and I thank all of my friends for coming together to share their knowledge. As you can see, financial intelligence isn’t from one source. It’s from multiple sources, and that’s why friends are so important. I’ll end with some great words about quitting from a great man, one of the greatest leaders of all—Winston Churchill. In the darkest hour of England, he said, “Never, never, never, never give up.” 38