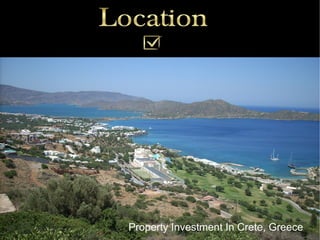

Location Location Location Invest In Crete Greece European Property

- 1. Property Investment In Crete, Greece

- 2. “GREECE’S WEALTH OF CUL TURE, MYTHOLOGY, GEOGRAPHIC DIVERSITY AND UNIQUE IDENTITY GIVES IT THE POTENTIAL TO BE ONE OF THE WORLD’S LEADING TOURISM DESTINATIONS” World Travel and Tourism Council 2008 In their 2008 presentation “Greece Travel and tourism navigating the path ahead ” The WTCC concludes that in terms of tourism and associated development Greece has many competitive advantages. I. A temperate climate suitable for year round tourism II. A richness of natural and cultural heritage, III. Geographic diversity IV. Proximity to potential markets V. high levels of safety and security. Greece is uniquely position at the heart of the mediterranean enabling “With its strategic geopolitical position as a valuable easy access, within 4 hours by plane - not just from European travellers , asset, Greece has to offer plenty of business but also from the Middle East , Eastern Asia and CIS states opportunities in sectors such as energy, tourism, real estate, transport and services” Arab News 25 March 2008 Tourism and related enterprises in Greece account for 18% of the GDP and at least 750,000 jobs. Greece , due to its idyllic location, extensive coastline , mediterranean climate ,safety and security , together with a series of government backed incentives and planning proposals is moving ever closer to fulfilling its vast potential as a global player in the tourism and development market.

- 3. Crete is the largest Island of Greece and is located in the south of the Aegean Sea and is the most Southernly part of Europe and has such has free and easy travel for citizens from the European Union Crete is one of the most famous Greek islands with a long and often feudal past due to it's strategic importance as a gateway between Europe , Asia , the Gulf , middle east and beyond. Separated in 4 prefectures: Chania, Heraklion, Lassithi and Rethymno, Crete has everything to offer: mountainous landscapes, a coast with many beautiful beaches and rocky coves, beautiful towns and charming villages and harbours, excellent food, ruins of the Minoan Civilization dating back thousands of years and a quiet , virtually crime free way of life. Crete : Key Facts Capital : Heraklion 260km East to west 12-60km North to South Population : 625,000 Language ; Greek ( English widely spoken) Climate : Temperate / Mediterranean Unemployment 4 % (2007) The easternmost and arguably most beautiful and varied prefecture of Crete is Lassithi . Coastline 1046 km Its capital is the lovely coastal town of Agios Nikolaos which has a picturesque port , a beautiful lake and an increasingly cosmopolitan pedestrianised shoppping area .

- 4. Elounda is the undeniable jewel in the crown of Crete. Home to many of the leading hotels in the world, Elounda is fast becoming one of the most desirable destinations in Europe for the discerning traveller seeking that extra special something - indeed the top five hotels in the area regularly feature in international travel awards list, including Conde Nast top ten resorts, The Sunday Times Travel magazine, Good Spa Guide and Vogue, to name but a few. Elounda Bay Palace Gold Medal (2005 Best A La Carte Accomodation TUI) Five star Diamond Award (AAHSMR Awards) "Elounda Bay Palace is the kind of exquisite retreat to which you will always want to return" (Tatler) Porto Elounda Best Spa Worldwide 2007 Sunday Times Travel Elounda Peninsular "Europe's Most Excellent Waterside Hotel" from Elounda Beach Hotel, Pure Decadence Award (Elite Traveler) Conde Nast Johansens 2005 Gold List ( Conde Nast Traveler) The Best Beach Hotels in Europe (GEO SAISON January 2008 ) No. 1 – European Resorts (Conde Nast Traveler April 2003)

- 5. Overview Crete, a comparatively undeveloped ,mediterranean island with large amounts of coastal property , good access to European, Middle East , CIS markets and beyond with significant growth prospects in high end real estate property development and tourism ventures.

- 6. Tourism is the most important financial activity and the island’s largest earner of foreign exchange. It is estimated that approximately 40% of the local population is directly or indirectly involved in tourism or resultant real estate activities. In 2007 tourists paid for 55 million bed nights in Greece , at an occupancy level of 61 % ( 2006 65%), further broken down to Crete which had 13.1 million bed nights with a better than Greece average of 75 % occupancy , with hotel bed nights up by 7.9 % 2006 -2007 In terms of visitor numbers, 2.7 million out of the 11 million air visitors to Greece chose to to go Crete, via either Heraklion ( 2.07 m) or Chania (660k) airports. The Greek government , with new initiatives, as outlined in their unitary plan for 2007 -13 are now actively supporting higher end developments in regions identified for preferential zoning, in order to improve the quality of accommodation and thus the revenue per visitor Within 2500 km , or less than a 3.5 hour Crete To : - flight, are over 400 million potential customers, yet on current statistics from Invest In Greece, 65 % of Greece's existing Kuwait 2,200 km 20 million tourists annually come from Jeddah 2,017 Km outside of this 2000 km zone. Abu Dhabi 3,100 km There is evidence of increasing tourism Riyahd 2,400 km numbers arriving from the Gulf and CIS Moscow 2,400 km members particularly over the last three years. Nevertheless, Greece accounts for only London 2,700 km 0.61% of global tourism

- 7. The island of Crete has an elongated shape - 260 km. from west to east and at its widest 60 km - , the island is a good deal narrower at certain points, such as in the region of Ierapetra where it is only 12 km wide. It has an area of 8261 sq. km and a “jagged” coastline 1046 km long. On this coastline Crete has literally hundreds of beaches, of varying popularity, from small coves to large , long golden sandy beaches. 2007 saw a record year for Crete for the number of these beaches reaching blue flag status, 97 up from previous record of 94 the previous year. Despite it's historic past and having hosted many of the great civilisations over time, population density on Crete is well under average for the European Union, 64 p/km squ ( UK 246, Qatar 74, EU 112) The Population of 2001 census puts Crete at 601,000 inhabitants out of Greece's total of 10 million. As an Island, Crete has a vast coastline , already indicated as over 1000 km . Much of this coastline however, remains undeveloped for tourism purposes. Partly due to : Poor Infrastructure ; Roads, Electricity , Airports. Large areas of coast cut off from development by poor road access Fractured Ownership ; large plots frequently have many owners often in dispute Topography ; large parts of Crete are mountainous Undeveloped market ; North East coast has high density of hotels / Km squ, south and far East coast are relatively untouched. Restrictive Purchase;Border territory ; less than 20 years an an “open market”

- 8. Complicating factors of the Real Estate Market In Crete Lack of Government Initiatives Until very recently, large scale developments were not actively supported on Crete. Poor Infrastructure Roads, Electricity , Airports. Large areas of coast cut off from development by poor road access Fractured Ownership large plots frequently have many owners often in dispute Topography large parts of Crete are mountainous Undeveloped market North East coast has high density of hotels / Km squ, south and far East coast are relatively untouched. Restrictive Purchase 1. Until the advent of EU legislation, until 1990 it was only possible to buy in Crete with a Greek partner. 2. Due to being a “border” territory, restrictions are placed on non-eu residents purchasing. Effectively meaning they will have to buy via an EU company . Forestry Certification Essential to build in Crete , time consuming to achieve Poor land registry Owners – Property rich – cash poor Large Land Plots Market Understanding

- 9. Lack of Government Initiatives Complicating factors of the Real Estate Market In Crete Until very recently, large scale developments were not actively supported on Crete. However, the 2006 amendment of the Investment Incentives Law and the Development programme Introduced by the Ministry of Tourism for the period 2007 – 2013 and specifically PERPO ( regional planning programme) will rapidly facilitate this change. Tourism is the most important financial activity and the island’s largest earner of foreign exchange. It is estimated that approximately 40%of the local population is directly or indirectly involved in tourism or resultant real estate activities. In 2007 tourists paid for 55 million bed nights in Greece , at an occupancy level of 61 % ( 2006 65%), further broken down to Crete which had 13.1 million bed nights with a better than Greece average of 75 % occupancy , with hotel bed nights up by 7.9 % 2006 -2007 In terms of visitor numbers, 2.7 million out of the 11 million air visitors to Greece chose to to go Crete, via either Heraklion ( 2.07 m) or Chania (660k) airports. The Greek government , with new initiatives, as mentioned above in their unitary plan for 2007 -13 are now actively supporting higher end developments in regions identified for preferential zoning, in order to improve the quality of accommodation and thus the Restrictive Purchasing revenue per visitor Eu residents have been able to purchase property freely since 1990. Non EU residents have to produce documents from their resident country to prove they are of good standing in the community , and whilst this is a straightforward process often adds six months to the conveyancing process . Most non-EU purchasers thus opt to purchase through a company to speed up the conveyance. Fractured Ownership One of the largest problems when purchasing property in Crete is fractured ownership. Often land is owned by many people, often more than 3 sometimes up to 20 people, occasionally more. The difficulty in getting agreements between owners in an appropriate time frame is frequently the cause for transactions to break down, particularly when dealing with personal as opposed to commercial purchasers. As time passes and ownership passes to descendants, this problem will only get worse, further frustrating the market. Market Understanding Put quite simply, developers ( in Crete) are not building what the market wants. If a plot can build 20% , developers will build this, without regards to what the market demands or what is best for the plot . There is little evidence of real “luxury” property being built, and the term luxury seems to be applied to virtually all property on the market in East Crete, when in reality it is little more than average. Despite global slowdown there remains strong demands from HNWI from North Europe, but more specifically former CIS countries and the Gulf region. These affluent customers will not find what they are looking for for sale in Crete right now as developers are not building what the market wants and so they are purchasing elsewhere.

- 10. Forestry Certification When purchasing land , you must also obtain from the forestry department a certificate to state the land is free from forestry . You may not disturb forestry land for either residential or commercial development, or indeed for construction of roads for such developments. Obtaining paperwork from relevant forestry authorities will take at the very least three months and in all likelihood much longer. Upon receiving your forestry paperwork, you may either accept or appeal against their decision, if you appeal and have a second decision, this is almost always final and binding. Poor land registry The land registry in Crete is sporadic. Tracing owners is time consuming and difficult. Complicated further by the widespread tradition in Crete of naming children after their grandparents. Thus recurrance of the identical same names on paternal side. Owners – Property rich – cash poor With regard to the above problems, a further complicating factor in Crete is a large number of property owners have issues with either archeological / forestry / fractured ownership or a combination of all of these and yet despite frequently owning large sea front land plots frequently do not have the money , drive or know how to unravel or circumvent these problems. Herein lies a real opportunity. Large Land Plots Many plots in eastern Crete are very large, from 20,000 to many millions of square meters. Understandably, these are far beyond the reach of the average property hunter in Northern Europe ( which makes up the bulk of purchases in Crete ) As fractional ownership continues to complicate the matters, these plots are either being bought by large real investment corporations , private equity establishments , Greek companies ( more often than not with non-EU financial backing ) and sovereign wealth funds. Lack of Exclusivity in Marketing Unlike in most developed countries, vendors in Crete never place their property with a sole agent. Ultimately there is a lack of incentive for any particular agent to engage in specific property marketing as other agents may already be further down the conveyancing route. “Active” Property marketing then is mainly only done by developers on land they already own and thus control.

- 11. “ Complications in the market ” Summary Many factors, mainly localised, to date have combined to slow the progress of real estate development in Greece, but particularly in Crete, from government initiatives (or lack of ) , to bureaucratic paperwork demands and fractional ownership, Virtually all of these problems are easily overcome with drive, patience and knowledge of local procedures, with good strategically placed contacts and understanding of government policies. Despite these complications average real estate prices in Elounda, Aghios Nikoloas and similar coastal resorts have risen consistently at around 8-15 % pa over the last 5 years. There still remain many large sea front plots with direct access to the sea available at prices far below “average” Crete prices and way below virtually all other European countries and certainly below other mediterranean regions such as southern Spain , Italy and the south of France. We outline now some sample plots , some strategies to employ to solve problematic plots and projected resultant outcomes. With the strategy outlined hereafter to further remove these complications from our customers purchases we know there is significant investment potential in property on the Eastern side of Crete, Greece.

- 12. Opportunities in the real estate market in Crete

- 13. Opportunities in the real Estate market in Crete As real estate agents we regularly are presented with properties , before they reach the open market , that represent investment opportunities and may be presented in a variety of ways . The solution to releasing the value is often a matter of time , the correct contacts and know how. As trusted , registered agents since 2003 we have established a network of professionals able to assist us in solving vitually any conveyancing or licencing matter speedily, cost effectively and discretely. 1. Procedural problems Plot E295 Locals in Crete are property rich but cash poor and frequently Forestry Problems need to sell property quickly , yet often do not have the correct paperwork in place to do so legally or quickly in order to obtain the property's market value.. Forestry Problems : Plots may be bought and sold without a forestry certificate, however it is not possible to get a building licence for either residential or commercial development wthout the forestry permission. In practice then, rarely are plots bought without the forestry certificate. Obtaining forestry certificates takes time and of course money. Combined with fractured ownership, these plots are difficult to sell, as individual owners are often reluctant to take control of collecting the required paperwork. Plot E295 is over 100,000 Metres squared, has 300 m of coastline Situated just a few kilometers south of Agios Nikolaos, this plot could be purchased for just over 2,000,00 Euros with a conditional purchase agreement , but with the addition of forestry clearance would sell easily for double. Opportunity to add further value with a commercial building licence.

- 14. 2. Large Land plots. Plot E235 The majority of purchasers require a land plot of around 4,000 m squ ( 1 acre) and rarely above 8,000 m squ. Crete is still littered with a large number of sizable plots that can be split ( subject to planning requirements being met ) and thus sold on at a profit or preferentially developed and either sold “off plan” or as finished properties. A typical , by no means unusual or outstanding example of the wealth of opportunities available would be plot E235. Price at 35,000 Euros / 1,000 m squ, the plot is not expensive. The problem is it comprises two plots , owned by different members of the same family, each of 15,000 m squ and thus puts it beyond the reach of most ordinary purchasers Opportunity 1 : Build a commercial development with a 20% build allowance. 6,000 m squ build allowance. 2000 m squ for Reception, communal facilities, changing rooms, Spa 4,000 m squ available for developers to build sea front serviced villas for sale / rent on a recurring 60 year leasehold / fractional ownership basis, with an annual maintenance fee Opportunity 2. Build 2 Prestigious sea front Villas in large , landscaped grounds with private direct access to sea infinity pools and staff quarters. Plot purchase @ 500,000 euros (1,000,000 euros for two adjacent plots ) Leave as two independent plots of 15,000 m squ ( nearly 4 acres each ) Build allowance of 800m squ per plot , Including basement of 400 m squ. ( basement can accommodate residential , but certain conditions must be met, which are easy to achieve ) Build cost for normal residential property is 1250 -1500 Euros / m squ. To build 800 m squ @ 2000 euros m squ for high quality total build cost including all landscaping work, project management, taxes and fees 2,000,000 Euros Final resale value in excess of 4,500,000 Euros ( conservatively valued) Gross profit per plot in 18 mths ( purchase to completion) 2,000,000 Euros

- 15. Golf Course As already highlighted Crete has many large land plots, together with very favourable government incentives, including grants of up to 40 % of construction costs, golf courses and golf based luxury resorts are actively promoted under the Governments latest development plan A golf course will need at least 400,000 m ( 100 acres ) squ and up to 800,000 m squ ( 200 acres ) . We have sourced several plots suitable for golf course construction of around 2 million m sqare, ( 500 acres ) and above which could be developed as a total resort , ( guided by PERPO and similar ) to include Golf, Hotel , Spa and residential facilities. Plot E301 is just such a plot, available at 10 Euros a m squ. Has a coastline of Plot E301 over 2km and direct road access. Perfect for a complete resort development with interest relief and grants available for large scale projects ( see apendix for scale and scope of grants available ). Plot E301

- 16. Property E33 : Proposal : Build One detached luxury villa 30m from sea Elounda This plot of 7,000 m squ walkable to Elounda being available emphasises the lack of understanding of the Quality demands in the real estate market in Elounda. Situated just 30m from the sea it would perfectly suit a detached villa of 460 m squ ( inc basement ) infinity pool looking out to the crystal clear waters of the mediterranean. Plot purchase including all fees 775,000 Euros Build of 460 m squ @ 2000 Euros m squ inc pool and landscaping 1,200,000 Euros fees and taxes and 15% contingency Resale Value 3,500,000 Euros ( very Conservative ) Gross profit for plot 1,500,000 Euros 18 months turnaround from purchase to completion We have access to at least 10 similar plots within 10 minutes of Elounda

- 17. Property E32 Land Plot E32 Property plots of 100 – 300, 000 Euros. We have access to , as of writing approximately 20 plots of between 1 – 8,000 m squ that could be purchased from 100 – 300 thousand Euros. Varying in investment potential, but a sample would be property E32. Proposals to :- buy and land bank buy and aggressively market buy and add value by securing planning permission buy , get planning permission and build (for sale ) We have access to approximately 20 similar plots within 10 minutes of Elounda

- 18. Land Banking As previously highlighted, Crete has a coastline of over 1,000 km. Within a 10 -15 minute drive of Elounda we have access to a variety of large plots , from 50,000 m squ that would be suitable for a land banking project, in conjunction with the problem solving strategy identified earlier. We have selected a potential portfolio of approximately 5 million square meters in the East of Crete that have problems with fractional ownership and resolvable forestry paperwork that a purchaser could enter into a conditional contract to purchase. Plaka Plaka, the village opposite the former leper colony of Spinalonga, has many large land plots suitable for land banking or for splitting . Plots in Plaka start from 30 Euros a m squ. We have many large sea front plots in Plaka and could secure many , many millions of square meters. Plot E116 up to 300,000 m squ 30 Euros / m squ Plot E34 50,000 m squ 300,000 Euros

- 19. Elounda Land Banking Within walking distance of the village of Elounda we have five very good plots from 20,000 to over 150,000 m squ priced from 50 Euros a meter. These plots would be ideally suited for land banking whilst also adding value by pursuing planning permission for commercial property or, on the larger plots split the plots and sell off in individual plots of 4,000 m squ. Also available plots without forestry clearance to purchase on a conditional agreement. Prices from 20 E / m squ

- 20. Plot 10,000 m + Sea front land plot over looking 5 star hotels. From 10,000 up to 1,000,000 m squ Priced from 50 euros — 200 euros m squ Commercial build possibilities Plot 1000 m squ 150,000 Euros 1,000 m squ plot. One of around 30 we have access to . Landbanking and apply for building licence Plot 7,000 m up to 100,000 m squ with some of the best views of over Elounda Superb options available. Landbanking Commercial Build Building licence / build Serviced Villas with pools

- 21. Fantastic sea front plot , Istron, Crete (15 mins to Elounda) Istron Plot 14,000 m squ, ideal for a detached villa in private grounds direct sea access. No forestry certificate, plot available to buy on conditional purchase (owners are cash poor, need financial assistance with paperwork.) Buy @ 300 — 350, 000 ( subject to forestry approval) all fees, apply for forestry permission, building licence ( 50 -60,000 Euros ) with building licence plot value in excess of 600,000 Euros. Istron plot assembly Amazing sea front plot with direct beach access. 4 adjacent plots from 15,000 up to 60,000 m squ. Total available 200,000 m squ. Opportunity for exclusive villa development with each villa having private sea access. Buy 200,000 m squ @ 40 e/ m squ 8,000,000 Euros develop @ 10 % (20 % build allowance maximum ) 2000 m squ x 1500 E/ m squ 3,000,000 Euros Communal areas / landscaping 1,500,000 Euros Total costs 12,000,000 Euros 6 x 333 m sq Villa , infinity pool each at east 15,000 m private security controlled grounds 6 villas for sale @ 4,000,000 Euros Total Gross return in 18 mths 24,000,000 Euros

- 22. Elounda and Crete in quotes Istron Plot Crete has become an upmarket destination for overseas property investors It is realtively poor and undeveloped «Business life May 2007» Crete may be a minnow in the property development world... but for many that may be the attraction.........old and new properties Crete is like Spain was 15 years ago, but are enjoying healthy appreciation of about 15 % with “only one golf course”. Daily Express July 2007 Crete, probably the best island in the world and Charles Weston-Baker, Savills impossible not to love. Guardian , Roger Alton Elounda, on the island of Crete in Greece, boasts the country's highest concentration of exclusive hotels and is regarded as one of the top luxury destinations on the Mediterranean. What sets it apart from the glamorous, see-and-be-seen resorts on Mykonos and Santorini, is the discretion and privacy reserved for its guests. Here, politicians, royalty and celebrities in search of a low profile retreat can find modern, stylish, five-star hotels set in landscaped grounds planted with eucalyptus, palms and pines. World Travel Guide August 2008 Elounda has blossomed into one of the best-equipped resorts in Crete and attracts a discerning and cosmopolitan clientele. Like nearby Aghios Nikolaos, its location overlooking the dazzling blue Bay of Mirabello is superb, with undulating hills swathed in almond and olive groves providing a suitably lush backdrop...... Sovereign Group Aug 2007

- 23. Underdeveloped Market : Potential for good return on investment due to Why Crete ? (1)fractured ownership (2) new market Istron Plot (3) procedural problems (4) large plots Availability of sea front plots Potential for year round market Climate : Over 300 days of sunshine, mediterranean Market : Proximity to 400 million customers within 4 hours, much of which is an unexplored , yet to be developed Crime Rate : One of the lowest in Europe ( and the world) Cost of Living : 35 % lower than Cyprus 40% lower than Spain EU member Stable democracy Improving infrastructure ( EU funding ) Low entry costs to market compared to other European Destinations such as France , Portugal Spain and Italy Investment / development grants , incentives and Interest rate relief Access to plots /investment opportunities pre-market

- 24. About Location Founded in 2003 , Location is the exclusive property search agency whose office based in the most sought after area of North Eastern Crete, the stunning resort of Elounda. Istron Plot Key Staff at Location Andie Cox , partner in Location, travels regularly between the UK and the Greek Islands sourcing the most interesting property investments in the Greek Market and has been involved in Greek Property since 2003, when with his wife Marie, they bought their first property on the Island of Crete . Prior to working in Greece, Andie worked in production management throughout the UK, most recently as a "troubleshooter" in a first tier supplier in the Automotive Industry. Having project managed many renovation projects, both in the UK and in Greece with a positive "can do" attitude, Andie is well used to assisting both individuals and companies to realise and manage their Greek property transactions with efficiency , transparency and professionalism . Andie is married to Marie and has two boys, Finley and Cawley Anna Dobrzelecka has lived and worked in Greece for over 15 years. Having worked as a personal travel guide escorting VIP customers throughout Crete and in a number of boutique hotels, (including the Elounda Mare and Porto Hotel ) Anna's experience in customer service is vast. Anna is the key contact for our associates and property vendors throughout the Greek Islands . Fluent in Polish, Russian and Greek Anna is available direct on ( 0030 ) 694 914 5600

- 25. Istron Plot Appendix

- 26. Legal Procedure for buying property in Crete EC legislation allows citizens coming from EC members - states to buy and own properties in another EC state. Therefore, the rules and the procedure applied for property purchase is the same for all European citizens. Specific areas of Greece are considered to be military and there should be issued permission before the contract is signed (applied also for Greek citizens). Istron Plot Non European Union citizens who wish to purchase property should apply to the Ministry of External Affairs in order to get prior authorisation otherwise their contract will be void and not legal or property can be purchased through a legally registered company, which an accountant and lawyer can advise on.When purchasing land, regard should also be shown to paperwork required in order to be able to build, such as forestry and archeological departments Deposit To secure a chosen property: a 10% deposit on the purchase price is usually required on signing a pre-contract agreement. The deposit is held in favour of the vendor by the purchasers solicitor and, once placed is non -refundable, unless the property proves to be incapable of being conveyed , or an existing clause in the pre-contract is broken or lapsed. The pre-contract agreement contains the names and description of the parties, the description of the property, the vendor's title, the price, the methods of payment , and any general or specific conditions negotiated by the parties. No deposit or any other amount will be paid before the legal searches of the property are carried out by a lawyer appointed by the purchaser and acting in his /her interests. Purchase All the documents regarding the purchase of a property should be carried out before a Public notary. Therefore, the property purchase contract is always executed before a Notary and in the presence of lawyers representing the seller and the purchaser. A purchaser needs a lawyer to act on his/her behalf in order first to check the vendor's title and his ownership (legal search) and then to assist with the Local Regulations and ensure that he/she will obtain a legal property title. The legal search of the property includes the search of the vendor's ownership as well as the search of third peoples' rights on the property (eg mortgage, right of way etc), and it is always carried out at the local Land Registry of the area of the property. Legal procedures in Greece are not complicated and when the documentation is complete the contract can be signed quite quickly. The purchaser has to be provided with a tax number which is unique for any person and he/she has to pay the conveyance tax before the contract is signed. In case of the contract cancellation, the tax is refundable. The notary will not allow the contract signature if all the documentation is not complete, the tax is not paid and the deeds are not in order. Finally, the contract has to be registered in the local Land Registry . Expenses The Purchase tax, Notary and legal fees as well as land registration fees are always paid by the purchaser and they are calculated on the or "tax office price" of the property, which is usually lower than the true purchase price. The purchase tax differs for civil and agricultural properties. Civil are considered the properties situated in cities or in areas where there is a fire station while agricultural properties are those situated in areas out of the city borders or in areas without a fire station. Tax for civil properties is calculated by your notary and will be between 7 – 11 % of the “tax office” price. The Notary's fee is approximately 2%, land registration fees are 4,75 Euros / 1000 Euros “tax price” Law Society fees 1% for the first 45.000 euros then 0,5% over this amount. Legal search fees approx 500€ For the power of attorney 65 euros. The costs above are normal guidelines and may of course vary in each circumstance.

- 27. BUSINESS ACTIVITIES FALLING UNDER THE PROVISIONS OF THE INVESTMENT INCENTIVES LAW The investment incentives law is applicable to enterprises having business activities in the following sectors: Istron Plot Primary (e.g. greenhouses, animal farms, f isheries etc.). Secondary (e.g. manufacturing, energy etc). Tertiary: - tourism (hotel units, conference centres, marinas, thematic parks, golf courses, development of mineral springs, thalassotherapy centres, health tourism centres, centres for training-sports tourism etc). - other services (e.g. applied industrial research laboratories, commercial centers, sof tware development, supply chain services, logistic centers etc.). Business activities w hich fall under the provisions of the Law are divided in 2 categories and are described in detail. The exempted cases w hich fall under other incentive means are also noted. DIVISION OF THE COUNTRY INTO ZONES For the application of the provisions of the law , the Country is divided into 3 zones as follow s: ZONE A: Includes the Prefectures of Attiki and Thessaloniki apart f rom Industrial and Business Areas (VEPE) and the islands of those Prefectures w hich fall w ithin Zone B. ZONE B: Includes the Prefectures of the Thessaly Region (Karditsa, Larissa, Magnisia, Trikala), the Prefectures of the Southern Aegean Region (Kyclades, Dodekanissos), the Prefectures of the Ionian Islands Region (Kerkyra, Lefkada, Kefallonia, Zakynthos), the Prefectures of the Crete Region (Iraklio, Lasithi, Rethimno and Chania), the Prefectures of the Central Macedonia Region (Chalkidiki, Serres, Kilkis, Pella, Imathia, Pieria), the Prefectures of the Western Macedonia Region (Grevena, Kozani, Florina, Kastoria), and the Prefectures of the Sterea Ellada Region (Fthiotida, Fokida, Evia, Viotia and Evritania). ZONE C: Includes the Prefectures of the Eastern Macedonia and Thrace Region (Kavala, Drama, Xanthi, Rodopi, Evros), the Prefectures of the Epirus Region (Arta, Preveza, Ioannina, Thesprotia), the Prefectures of the Northern Aegean Region (Lesvos, Chios, Samos), the Prefectures of the Peloponnese Region (Lakonia, Messinia, Korinthia, Argolida, Arkadia) and the Prefectures of the Western Greece Region (Achaia, Etoloakarnania and Ilia).

- 28. Istron Plot Map of Investment Zones Greece

- 29. INCENTIVES ON OFFER Istron Plot For the investment projects w hich fall under the provisions of the Law , the following incentives are available: Cash grant, which covers part of the expense for the investment project by the State AND OR Leasing subsidy, which covers part of the payable installments by the State relating to a lease which has been entered into for the use of new mechanical and other equipment OR Wage subsidy for employment created by the investment. OR Tax allowance. This incentive allows income tax exemption on non-distributed gains. The allowance is effective upon completion of the investment for the first ten (10) years of operation. It is created through a tax exempted reserve. The above incentives are offered under the terms and conditions set out in the Investment Incentives Law. For the investment plans, the follow ing incentives are offered according to zone and category, i.e.: Cash grant / Leasing subsidy OR Wage subsidy for employment created Investment Category Zone A Zone B Zone C Category 1 20% 30% 40% Category 2 15% 25% 35% Note: For more detailed and complete information see the section: "Categories of Business Activities" To medium size enterprises, as these are f rom time to time defined in the E.U. legislation, an additional percentage of subsidy up to 10% is granted. To small and very small enterprises an additional percentage of subsidy up to 20% is granted. OR Tax allowance Investment Category Zone A Zone B Zone C Category 1 60% 100% 100% Category 2 50% 100% 100% Note: For more detailed and complete information see the section: "Categories of Business Activities" Please note: Employment positions relative to the investment are considered new employment positions which are created for the assistance of the investment within the first three years of its completion and start of productive operation. The subsidy is payable on the expenses for wages for the total employment positions relative to the investment for the f irst tw o years as of the creation of each employment position. By ‘expenses for wages’ it is understood the salary “before taxes” and the compulsory contributions to social security. Eligible for the grant are enterprises w hich operate in every sector of the economy, if they fulf ill the criteria for the submission to the incentives system, as laid out in the Law .

- 30. TERMS AND CONDITIONS FOR OBTAINING THE INCENTIVES a) Investor’s own participation Istron Plot The percentage of the investor’s own participation in investments which are included in the cash grants and/or leasing subsidies system cannot be less than 25% of the subsidized expenses, w hereas in the investments which are included in the tax exemption or the cash grant for w age expenses for the created employment, at least 25% of the cost should be covered by the f inancial participation of the investor, either by ow n funds or loan, provided that no state subsidy accompanies this part. b) Commencement of realization of the investment plans which fall into the provisions of the Law The commencement of the realization of the investment plans may take place af ter the publication of the decision for submission of the investment in the provisions of the Law. How ever, upon submission of the application for incentives, investors may request an eligibility cerif icate in order to start implementing the investment, w hich is issued w ithin f ive (5) w orking days. Budget revision of the investment cannot exceed 5% of the initial cost. In the decision for eligibility under the provisions of the Law a time limit for completion is set, which may be increased by tw o (2) years maximum, under conditions. SUBSIDIZED EXPENSES The determination of the expenses w hich are subsidized per investment category is made by a Ministerial Decision. The law contains a list of said expenses as well as of the expenses which do not fall under its provisions. The subsidized expenses should involve consolidated assets. The subsidization of intangible investments or fees of consultants is possible, but only up to 10% of the investment plan cost. Operational expenses are not subsidized. PROCEDURES AND APPLICATION OF THE INVESTMENT INCENTIVES LAW H) Submission of petitions for obtaining the incentives under the law Petitions for investments (except those involving the tax exemption subsidy, for w hich no submission of petition is necessary) are submitted during all the year as follows: (a) the General Directorate for Private Investments of the Ministry of Economy and Finance there are submitted petitions relating to i) investments for projects over four million (4.000.000) EURO, w hich take place w ithin the limits of the Region of Central Macedonia as w ell as ii) investments for projects over tw o million (2.000.000) EURO, which take place at the rest of the State as w ell as iii) certain investments irrespective of the amount involved, according to specif ic regulations. (b) the Directorates of Planning and Development of the Regions there are submitted petitions relating to investments for projects up to tw o million (2.000.000) EURO, w hich take place w ithin the limits of each Administrative Region or, in case of the Region of Central Macedonia, projects up to four million (4.000.000) EURO.

- 31. Istron Plot (c) the Invest in Greece Agency there are submitted petitions relating to investments for projects over fifteen million (15.000.000) EURO as well as investments or business plans of three million (3.000.000) EURO or more, in case that at least 50% of the investor’s own participation derives f rom imported capital. (d) the General Secretariat for Industry of the Ministry of Development, certain petitions are submitted relating to specif ic sub-categories and according to specific regulations. I) Supporting documents of the petition (a) study (b) of payment of the required dues (c) additional supporting documents according to each case C) Approval procedure The procedure of evaluation of each petition of investment proposal is completed by the competent authority and the competent consultative committee within tw o (2) months, at the latest, as of the date of submission of the petition.The decision approving the petition is issued within one (1) month, at the latest, as of the issue of the opinion by the consultative committee. Within the same month the summary of the decision is also published in the Government Gazette. For the review of the petitions by the competent consultative committee a strict order of priority is kept, according to the time of submission of each petition. D) Payment of subsidies The Law provides for the conditions, terms and limitations w hich relate to the possibility of using a bank loan. (a) Payment of cash grant: The payment of the subsidized amount is made in installments as follow s: Payment of 50% of the cash grant amount is made after the completion of 50% of the investment and verif ication by the competent monitoring authority of this fact and of the compliance of the investor to the terms of the decision approving the investment. Payment of the remaining 50% of the cash grant amount is made af ter verif ication by the competent monitoring authority of the completion and commencement of the productive operation of the investment. Drawing of the funds is made within 5 months. There exists the possibility of a lump sum advance (as part of the total subsidy), w hich will not exceed 50% of the approved by the relevant decision cash grant, if a bank guarantee is submitted in an amount equal to the advance plus 10%, issued by a bank which is established and operates legally in Greece. The subsidy is paid directly to the investor or directly to the financing bank w hich granted a short term loan to the company w hich carries out the investment plan. (b) Payment of leasing subsidy: Payment is ef fected af ter the mechanical equipment etc has been put in place and the verification of this fact.

- 32. An Istron Plot initial payment of 50% is made until the end of the completion period provided for in the decision approving the investment. The remaining amount is paid af ter the lapse of the completion period, provided that the completion of the investment and the commencement of operation is verif ied. (c) Payment of cash grants for wage expenses: Payment is ef fected every six months, af ter a relevant application of the investor. MONITORING AND CONTROL Monitoring of the approved investments is made by the competent authorities and the various types of controls are made by the teams w hich are created by a decision of the relevant competent authority which is responsible for each investment. SPECIAL CASES UNDER THE PROVISION OF THE INVESTMENT INCENTIVES LAW By joint decisions of the Ministers of Economy and Finance, and Development, as w ell as any jointly responsible ministers as the case may be, there are set out the necessary divergences f rom the regulations of the law, w hich relate to the investor’s participation by own funds, the procedure for the award of the grants, the percentages and the amount of subsidy, the amount of bank loan, the percentages of leasing subsidies, the cash grants for w ages expenses and the tax exemption, the conditions of company shares' transfer as well as the possibility of public corporations participating in the investment, in case of investments of f if ty (50) million EURO, w hich have a significant ef fect on the international competitiveness of the country and the employment (creation of least one hundred and tw enty five (125) permanent job positions, out of w hich a certain number may be created in satellite enterprises as a direct result of the proposed investment). Further, by the same decisions, the construction of special inf rastructure w orks at the expense of the public may be determined for the facilitation of the operation of the unit in general. CATEGORIES OF BUSINESS ACTIVITIES Business activities which fall under the provisions of Incentives Law CATEGORY 1 Investment plans for the establishment of closed parks for public use by privately ow ned vehicles of at least forty (40) lots, in addition to those that are obligatory by the General Planning Code (G.P.C.) for covering the permanent needs which derive f rom the usages of the building, provided that they are run by enterprises for public usages, or for car parks above the ground, underground and/or f loating. Also, investment plans for the establishment of covered and/or semi-covered public usage parks for trucks, busses and other heavy vehicles in general, of 30 lots at least. Investment plans for the production of electricity f rom mild types of energy and especially solar energy, aeolic energy, hydro electrical energy, geothermic energy and biomass, investment plans for co-production of electricity and heat. Investment plans for the relocation of tanneries f rom the Attica, Thessalonica and Chania Prefectures, in Industrial Business Estates (I.B.E.) w here the appropriate infrastructure exists and their setting up is envisaged.

- 33. Istron Plot Modernization of already functioning hotel units (complete type) of at least tw o stars (2*) category, formerly C' class or hotel units w hich have suspended temporarily their operation for f ive years maximum, provided that no change to the use of the building has been made during that period and provided, further, that at the time of the temporary suspension of their operation they belonged to tw o stars (2*) category, formerly C' class, at least. Modernization of already functioning hotel units (complete type) of a low er category than two stars (2*), formerly C' class, which are located in traditional or listed buildings, provided that by such modernization they are upgraded at least to the tw o stars (2*), formerly C' class category. Also, modernization of hotel units (complete type) w hich have suspended temporarily their operation for f ive years maximum, provided that no change to the use of the building has been made during that period and provided, further, that by such modernization they are upgraded at least to the tw o stars (2*), formerly C' class category. Modernization of hotel units involving the creation of additional installations by adding new common areas, new uses of common area, pools and athletic installations to hotel units belonging to two stars (2*) category, formerly C' class, at least, with the objective of providing additional services. Modif ication of traditional or listed buildings into hotel units belonging to tw o stars (2*) category, formerly C' class, at least. Modernization of already functioning organized camping units (complete type) belonging to C' class category, at least. Establishment, expansion, modernization of conference centers. Establishment, expansion, modernization of ski resorts. Establishment, expansion, modernization of development of mineral springs. Establishment, expansion, modernization of tourist marinas for pleasure yachts for investment plans run by any physical or legal person of private law. Establishment, expansion, modernization of golf courses. Establishment, expansion, modernization of thalassotherapy centers. Establishment, expansion, modernization of health tourism centers. Establishment, expansion, modernization of training-athletic tourism centers. Investment plans for cooperating commercial and transport enterprises under a common venture, for thecreation of commercial stations and logistic centers, as such terms will be def ined by a joint ministerial decision. Investment plans by transport enterprises for the creation of infrastructures relating to storage, packing and standardizing as w ell as closed parking areas for trucks, as such terms w ill be defined by a joint ministerial decision.

- 34. Investment plans for the provision of supply chain services. Istron Plot Investment plans for the creation of broadband netw ork inf rastructure and other similar equipment which ensures the access by citizens or enterprises, at the level of municipal authorities, Regions etc or other geographical areas with commercial interest. Investment plans for the provision of innovative broadband telecommunication services, which rely on the broadband inf rastructure. Investment plans for sof tware development. Investment plans for the creation of laboratories of applied industrial, energy, mineral, agricultural, livestock, forestry and f ishery research. Also, investment plans for the development of technologies and industrial plans. Investment plans for the provision of highly advanced technology services. Investment plans for the creation of laboratories for the provision of services relating to quality and/or high technology, certif ication, control testing and verification. Investment plans for enterprises of development of transportation means for humans and merchandise to isolated, inaccessible and remote areas, as such are defined by a joint decision of the Ministers of Economy and Finance and Mercantile Marine. Investment plans for the protection of environment, reduction of pollution relating to ground surfaces, underground surfaces, w aters and the atmosphere, restoration of the natural environment and recycling of w ater and desalination of sea or brackish w ater. Investment plans for the development of renew able sources of energy, substitution of liquid fuels or electrical energy by gas fuels, processed rejected materials f rom local industries, renew able sources of energy, recovery of rejected heat as well as co-production of electrical energy and heat. Investment plans for energy saving, provided that the investment plan do not involve the equipment for the production and, instead, it involves the equipment and installations for the movement and operation of the unit and that at least a 10% decrease of the utilized energy is effected. Investment plans for the production of new products and/or services or products of highly developed technology. Investment plans for the establishment, expansion, modernization of laboratories of applied industrial or mineral or energy research. Investment plans for importing and adapting environmental f riendly technology to he production process . Investment plans for creation of innovative products or services for importing innovations to the production process and commercialization of prototype products and services. Investment plans which aim to the upgrading of quality of the manufactured products or services. Investment plans for acquiring and installing new modern automation systems of processes and computerization of storage places including the necessary sof tw are for establishing, expanding and/or developing in the area of industrial units, in the context of modernization of the supply chain. Investment plans for the establishment or expansion of industrial or arts and craf ts units for the alternative management of packaging and other products w hich have been used up in Greece, for the production of raw materials and other substances. Investment plans for the realization of a complete long term (2-5 years) investment plan by enterprises (w hich have been incorporated for at least f ive (5) years) relating to processing and mining projects of a minimum total cost of 3.000.000 EURO and projects for sof tware development of a minimum total cost of 1.500.000 EURO, including the technological, administrative, organizational and business modernization and development as well as the necessary deeds for the training of the employees, having one or more of the following objectives:

- 35. 1. Reinforcement of their competitive position in the global market. Istron Plot 2. Production and promotion of renow ned products and/or services. 3. Verticalisation of production / development of complete product systems / services or supplemental products and services. 4. Production of products and/or services significantly or totally dif ferentiated f rom the existing basic products or services of the enterprise. 5. Relocation of production / research activities to Greece f rom abroad. 6. Production of products / services by the cooperation of non similar enterprises (preferably f rom different sectors) having as objective the production of signif icantly or totally differentiated products and/or services f rom the existing products or services of the said enterprises. CATEGORY 2 Investment plans for mining and crushing of industrial minerals and inactive materials. Investment plans for mechanical means of sow ing, cultivating and harvesting of agricultural products by agricultural or agricultural/industrial co-operatives or groups of producers or associations of groups of producers, w hich have been established according to Community legislation. Investment plans for standardising, packing or preserving agricultural or livestock products or f ishery and f ish-farming products, w hich do not derive f rom any alteration process. Investment plans for agricultural enterprises of greenhouse type and bio farming, enterprises of livestock breeding (stables or semi-stables type) and f ishery enterprises (aquaculture) using modern technology. Investment plans for mining, treating and utilizing industrial minerals in general. Investment plans for quarrying and utilizing marbles, provided that they include the cutting and manufacturing equipment. Investment plans for minerals. Investment plans for the sector of alteration process, save those for w hich a joint ministerial decision is required for their submission to the Incentives Law . Investment plans for the production of energy in the form of hot water or vapors. Investment plans for the production of bio fuels or solid fuels out of biomass, investment plans for the production of biomass f rom plants with the objective of using same as material for the production of energy. Investment plans for the desalination of sea or brackish water for the production of potable w ater. Investment plans for the production and/or standardization of Geographical Indication Products (G.I.P.) and/or products of Protected Name of Origin (P.N.O.) provided that they are made by enterprises w hich are located in traditional or listed stone buildings and/or building blocks of industrial nature, save those for w hich a joint ministerial decision is required for their submission to the incentives law.

- 36. Istron Plot Establishment, expansion, modernization of thematic parks which consist of organized forms of tourism and w hich dif ferentiate or expand the tourist product and offer complete inf rastructures and services, including (at least) services related to housing, eating, recreation and social care. Establishment, expansion, modernization of highways necessary for the tourist development of the country. Investment plans for building and utilization of arts and craf ts centers and buildings in the special arts and craf ts and industrial zones w hich are determined according to the city and urban planning as w ell as areas for social or cultural operations, central markets and slaughter houses run by municipal enterprises of 1st or 2nd degree or by co-operatives. Also, investment plans by the same interests for the modif ication and rearrangement of old industrial estates and other installations as areas of social and cultural operations, exhibition centers, central markets and slaughter houses. Investment plans for enterprises of liquid fuels and liquid gases, for the production of storage installations or the supply of equipment for the transport of liquid fuels and liquid gases to an island. Investment plans for the establishment of recovery and rehabilitation centers, as these are def ined in article 10 of Law 2072/1992 and investment plans for the supply of housing for independent living to people w ith special needs. Establishment or expansion of hotel units of at least 3 stars (3*), formerly B ' class.