Soma Office Report Q1 2010

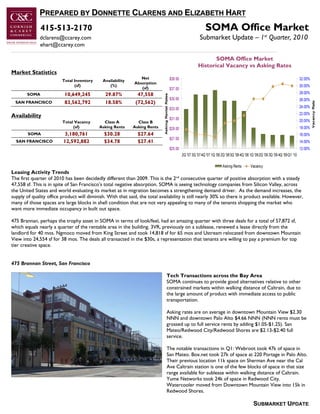

- 1. PREPARED BY DONNETTE CLARENS AND ELIZABETH HART 415-513-2170 SOMA Office Market dclarens@ccarey.com Submarket Update – 1st Quarter, 2010 ehart@ccarey.com _______________________________________________________________________________________________________________________________ SOMA Office Market Historical Vacancy vs Asking Rates Market Statistics Net Total Inventory Availability Absorption (sf) (%) (sf) SOMA 10,649,245 29.87% 47,558 SAN FRANCISCO 83,562,792 18.58% (72,562) Availability Total Vacancy Class A Class B (sf) Asking Rents Asking Rents SOMA 3,180,761 $30.28 $27.64 SAN FRANCISCO 12,592,882 $34.78 $27.41 Leasing Activity Trends The first quarter of 2010 has been decidedly different than 2009. This is the 2nd consecutive quarter of positive absorption with a steady 47,558 sf. This is in spite of San Francisco’s total negative absorption. SOMA is seeing technology companies from Silicon Valley, across the United States and world evaluating its market as in migration becomes a strengthening demand driver. As the demand increases, the supply of quality office product will diminish. With that said, the total availability is still nearly 30% so there is product available. However, many of those spaces are large blocks in shell condition that are not very appealing to many of the tenants shopping the market who want more immediate occupancy in built out space. 475 Brannan, perhaps the trophy asset in SOMA in terms of look/feel, had an amazing quarter with three deals for a total of 57,872 sf, which equals nearly a quarter of the rentable area in the building. 3VR, previously on a sublease, renewed a lease directly from the landlord for 40 mos. Ngmoco moved from King Street and took 14,818 sf for 65 mos and Ustream relocated from downtown Mountain View into 24,554 sf for 38 mos. The deals all transacted in the $30s, a representation that tenants are willing to pay a premium for top tier creative space. 475 Brannan Street, San Francisco Tech Transactions across the Bay Area SOMA continues to provide good alternatives relative to other constrained markets within walking distance of Caltrain, due to the large amount of product with immediate access to public transportation. Asking rates are on average in downtown Mountain View $2.30 NNN and downtown Palo Alto $4.66 NNN (NNN rents must be grossed up to full service rents by adding $1.05-$1.25). San Mateo/Redwood City/Redwood Shores are $2.13-$2.40 full service. The notable transactions in Q1: Webroot took 47k of space in San Mateo. Box.net took 27k of space at 220 Portage in Palo Alto. Their previous location 11k space on Sherman Ave near the Cal Ave Caltrain station is one of the few blocks of space in that size range available for sublease within walking distance of Caltrain. Yume Networks took 24k of space in Redwood City. Watercooler moved from Downtown Mountain View into 15k in Redwood Shores. SUBMARKET UPDATE

- 2. PREPARED BY DONNETTE CLARENS AND ELIZABETH HART 415-513-2170 SOMA Office Market dclarens@ccarey.com Submarket Update -1st Quarter, 2010 ehart@ccarey.com ______________________________________________________________________ Significant SOMA Lease Transactions Tenant Square Feet Type Location WWP 97,203 Renewal 303 Second Street Greenberg Traurig LLP 28,788 Sublease 153 Townsend Street Ustream, Inc. 24,554 Direct 475 Brannan 3VR 18,500 Direct/Previously Occupied 475 Brannan NGMOCO 14,818 Direct 475 Brannan Forecast Continued in migration of technology companies into Soma/San Francisco from Silicon Valley and out of the Bay Area. Rents stabilize in commodity product and uptick in “trophy” Soma assets. Continued constriction in the sub 5,000 sf range and options remain for 50k+ range. Subleases become increasingly difficult to find. The bottom is behind us a slow and steady real estate recovery continues. 153 Townsend Street, San Francisco Office Vacancy by Submarket Greenberg Traurig took 28,788 sf of sublease space from DLA Piper who had previously moved to 555 Mission. The term is through February 2012 and the rate was in the mid teens psf, full service. 26% 33% 5% 10% 303 Second Street, San Francisco WPP renewed for 97,203 sf for 124 months at an effective rate at $35.17/sf with $25/sf in tenant improvements. The 6% 20% deal included 8 months of free rent to get to the effective rate. North Financial District South Financial District North Waterfront/Jackson Sq. Van Ness/Civ ic Center Union Square SSoMa UBMARKET UPDATE