Compare Two Project Cash Flows and Calculate IRR and Profitability Index

•

0 gostou•8 visualizações

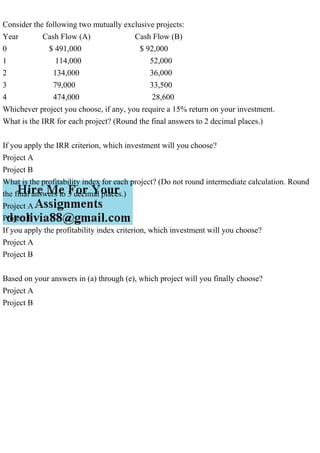

Project A and B are two mutually exclusive investment projects. Project A has higher initial cash flows but lower cash flows in later years, while Project B has lower initial cash flows but higher cash flows in later years. The internal rate of return and profitability index are calculated for each project to determine which project provides a 15% return on investment and has a higher profitability index to select the optimal project.

Denunciar

Compartilhar

Denunciar

Compartilhar

Baixar para ler offline

Recomendados

Recomendados

Mais conteúdo relacionado

Mais de americancolor

Mais de americancolor (20)

Consider the following scenarioIn the last few weeks, residents h.pdf

Consider the following scenarioIn the last few weeks, residents h.pdf

Consider the following wage regression in which you have data on gen.pdf

Consider the following wage regression in which you have data on gen.pdf

core issue in frank by ocbc singapore case studyIn 2010, Jin Kang .pdf

core issue in frank by ocbc singapore case studyIn 2010, Jin Kang .pdf

Coronado Corporation tuvo una utilidad neta de $240 000 y pag� divid.pdf

Coronado Corporation tuvo una utilidad neta de $240 000 y pag� divid.pdf

convert this python code to java script. Make sure it works on Eclip.pdf

convert this python code to java script. Make sure it works on Eclip.pdf

Convert M9 to a regular expression. Consider the following generalis.pdf

Convert M9 to a regular expression. Consider the following generalis.pdf

Control en Netflix Los gerentes no solo controlan los procesos d.pdf

Control en Netflix Los gerentes no solo controlan los procesos d.pdf

CONTRATO DE ARRENDAMIENTO COMERCIAL Este Contrato de Arrendamiento C.pdf

CONTRATO DE ARRENDAMIENTO COMERCIAL Este Contrato de Arrendamiento C.pdf

Contrast the oral and poster method of presenting research at a conf.pdf

Contrast the oral and poster method of presenting research at a conf.pdf

Contribution Margin Molly Company sells 40,000 units at $14 per unit.pdf

Contribution Margin Molly Company sells 40,000 units at $14 per unit.pdf

ContextualizeWhat are YOUR learning goals What are the course .pdf

ContextualizeWhat are YOUR learning goals What are the course .pdf

Contesta las preguntas del siguiente p�rrafo �Deber�a respons.pdf

Contesta las preguntas del siguiente p�rrafo �Deber�a respons.pdf

CONTABILIDAD GERENCIAL - DECLARACIONES VERDADERAS O FALSAS.(SALTE .pdf

CONTABILIDAD GERENCIAL - DECLARACIONES VERDADERAS O FALSAS.(SALTE .pdf

Continental Airlines vuela alto con su almac�n de datos en tiempo re.pdf

Continental Airlines vuela alto con su almac�n de datos en tiempo re.pdf

Consider this scenario. Miguel is an experienced forensic evidence a.pdf

Consider this scenario. Miguel is an experienced forensic evidence a.pdf

Considere una econom�a donde la industria dominante es la producci�n.pdf

Considere una econom�a donde la industria dominante es la producci�n.pdf

Considere una econom�a descrita por las siguientes ecuacionesY .pdf

Considere una econom�a descrita por las siguientes ecuacionesY .pdf

Considere un pa�s con un producto interno bruto (PIB) nominal de $ 1.pdf

Considere un pa�s con un producto interno bruto (PIB) nominal de $ 1.pdf

Considere todo lo que ha aprendido en este curso sobre problemas soc.pdf

Considere todo lo que ha aprendido en este curso sobre problemas soc.pdf

Considere los virus en soluci�n como una suspensi�n. �C�mo esperar�a.pdf

Considere los virus en soluci�n como una suspensi�n. �C�mo esperar�a.pdf

Último

Organic Name Reactions for the students and aspirants of Chemistry12th.pptx

Organic Name Reactions for the students and aspirants of Chemistry12th.pptxVS Mahajan Coaching Centre

Mattingly "AI & Prompt Design: Structured Data, Assistants, & RAG"

Mattingly "AI & Prompt Design: Structured Data, Assistants, & RAG"National Information Standards Organization (NISO)

Último (20)

JAPAN: ORGANISATION OF PMDA, PHARMACEUTICAL LAWS & REGULATIONS, TYPES OF REGI...

JAPAN: ORGANISATION OF PMDA, PHARMACEUTICAL LAWS & REGULATIONS, TYPES OF REGI...

Organic Name Reactions for the students and aspirants of Chemistry12th.pptx

Organic Name Reactions for the students and aspirants of Chemistry12th.pptx

A Critique of the Proposed National Education Policy Reform

A Critique of the Proposed National Education Policy Reform

Russian Call Girls in Andheri Airport Mumbai WhatsApp 9167673311 💞 Full Nigh...

Russian Call Girls in Andheri Airport Mumbai WhatsApp 9167673311 💞 Full Nigh...

9548086042 for call girls in Indira Nagar with room service

9548086042 for call girls in Indira Nagar with room service

Presentation by Andreas Schleicher Tackling the School Absenteeism Crisis 30 ...

Presentation by Andreas Schleicher Tackling the School Absenteeism Crisis 30 ...

Kisan Call Centre - To harness potential of ICT in Agriculture by answer farm...

Kisan Call Centre - To harness potential of ICT in Agriculture by answer farm...

Mattingly "AI & Prompt Design: Structured Data, Assistants, & RAG"

Mattingly "AI & Prompt Design: Structured Data, Assistants, & RAG"

Compare Two Project Cash Flows and Calculate IRR and Profitability Index

- 1. Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 $ 491,000 $ 92,000 1 114,000 52,000 2 134,000 36,000 3 79,000 33,500 4 474,000 28,600 Whichever project you choose, if any, you require a 15% return on your investment. What is the IRR for each project? (Round the final answers to 2 decimal places.) If you apply the IRR criterion, which investment will you choose? Project A Project B What is the profitability index for each project? (Do not round intermediate calculation. Round the final answers to 3 decimal places.) Project A Project B If you apply the profitability index criterion, which investment will you choose? Project A Project B Based on your answers in (a) through (e), which project will you finally choose? Project A Project B