QNBFS Daily Market Report July 31, 2016

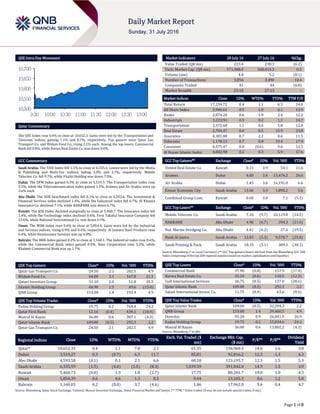

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.4% to close at 10,652.3. Gains were led by the Transportation and Telecoms indices, gaining 1.1% and 0.7%, respectively. Top gainers were Qatar Gas Transport Co. and Widam Food Co., rising 2.1% each. Among the top losers, Commercial Bank fell 0.8%, while Barwa Real Estate Co. was down 0.6%. GCC Commentary Saudi Arabia: The TASI Index fell 1.5% to close at 6,335.6. Losses were led by the Media & Publishing and Multi-Inv. indices, falling 3.0% and 2.7%, respectively. Mobile Telecom. Co. fell 9.7%, while Fitaihi Holding was down 7.0%. Dubai: The DFM Index gained 0.3% to close at 3,519.3. The Transportation index rose 3.5%, while the Telecommunication index gained 1.5%. Aramex and Air Arabia were up 3.6% each. Abu Dhabi: The ADX benchmark index fell 0.1% to close at 4,593.6. The Investment & Financial Services index declined 1.4%, while the Industrial index fell 0.7%. Al Khazna Insurance Co. declined 7.1%, while RAKBANK was down 6.7%. Kuwait: The KSE Index declined marginally to close at 5,460.7. The Insurance index fell 1.4%, while the Technology index declined 0.6%. First Takaful Insurance Company fell 13.6%, while National International Co. was down 6.9%. Oman: The MSM Index rose 0.6% to close at 5,854.4. Gains were led by the Industrial and Services indices, rising 0.9% and 0.4%, respectively. Al Jazeera Steel Products rose 6.4%, while Renaissance Services was up 4.0%. Bahrain: The BHB Index gained 0.2% to close at 1,160.1. The Industrial index rose 0.6%, while the Commercial Bank index gained 0.5%. Nass Corporation rose 3.2%, while Khaleeji Commercial Bank was up 1.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. 24.50 2.1 282.5 4.9 Widam Food Co. 64.00 2.1 167.8 21.2 Qatari Investors Group 51.10 2.0 51.8 35.5 Islamic Holding Group 66.90 1.5 49.6 (15.0) QNB Group 153.00 1.4 193.4 4.9 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 19.75 0.2 764.4 24.2 Qatar First Bank 12.16 (0.4) 439.3 (18.9) Masraf Al Rayan 36.00 0.6 387.1 (4.3) Qatar Islamic Bank 109.00 (0.5) 292.3 2.2 Qatar Gas Transport Co. 24.50 2.1 282.5 4.9 Market Indicators 28 July 16 27 July 16 %Chg. Value Traded (QR mn) 223.4 238.3 (6.2) Exch. Market Cap. (QR mn) 571,388.0 568,414.3 0.5 Volume (mn) 4.8 5.2 (8.1) Number of Transactions 3,854 3,490 10.4 Companies Traded 41 44 (6.8) Market Breadth 23:10 27:13 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,234.72 0.4 1.1 6.3 14.6 All Share Index 2,946.61 0.5 1.0 6.1 13.9 Banks 2,874.20 0.6 1.9 2.4 12.2 Industrials 3,223.92 0.3 0.2 1.2 14.7 Transportation 2,572.60 1.1 0.6 5.8 12.0 Real Estate 2,704.47 0.0 0.5 15.9 23.8 Insurance 4,381.80 0.7 2.2 8.6 11.5 Telecoms 1,178.13 0.7 0.8 19.4 17.9 Consumer 6,575.47 0.0 (0.6) 9.6 13.5 Al Rayan Islamic Index 4,082.98 0.2 0.3 5.9 17.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% United Real Estate Co. Kuwait 0.11 3.9 54.1 11.6 Aramex Dubai 4.00 3.6 13,476.2 26.6 Air Arabia Dubai 1.45 3.6 16,191.0 6.6 Emaar Economic City Saudi Arabia 13.66 3.3 1,890.2 5.6 Combined Group Cont. Kuwait 0.68 3.0 7.1 (5.3) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Mobile Telecom. Co. Saudi Arabia 7.16 (9.7) 10,129.8 (14.5) RAKBANK Abu Dhabi 4.90 (6.7) 394.3 (21.6) Nat. Marine Dredging Co. Abu Dhabi 4.41 (6.2) 27.6 (19.5) Bank Al-Jazira Saudi Arabia 12.03 (5.3) 9,570.7 (25.8) Saudi Printing & Pack. Saudi Arabia 18.33 (5.1) 389.5 (30.3) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Commercial Bank 37.90 (0.8) 157.9 (17.4) Barwa Real Estate Co. 35.10 (0.6) 110.5 (12.3) Gulf International Services 36.75 (0.5) 137.0 (28.6) Qatar Islamic Bank 109.00 (0.5) 292.3 2.2 Salam International Invest. Co. 11.75 (0.4) 63.6 (0.6) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Islamic Bank 109.00 (0.5) 32,294.3 2.2 QNB Group 153.00 1.4 29,460.5 4.9 Ooredoo 95.20 0.9 26,041.9 26.9 Ezdan Holding Group 19.75 0.2 15,034.6 24.2 Masraf Al Rayan 36.00 0.6 13,802.2 (4.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,652.31 0.4 1.1 7.8 2.1 61.35 156,960.3 14.6 1.6 3.8 Dubai 3,519.27 0.3 (0.7) 6.3 11.7 85.81 92,816.2 12.3 1.3 4.3 Abu Dhabi 4,593.58 (0.1) 0.1 2.1 6.6 60.18 123,195.7 12.3 1.5 5.3 Saudi Arabia 6,335.59 (1.5) (4.0) (2.5) (8.3) 1,039.59 391,842.0 14.9 1.5 3.9 Kuwait 5,460.73 (0.0) 1.3 1.8 (2.7) 17.75 80,201.7 19.0 1.0 4.3 Oman 5,854.39 0.6 0.6 1.3 8.3 9.44 23,105.3 8.6 1.2 5.0 Bahrain 1,160.05 0.2 (0.0) 3.7 (4.6) 1.86 17,962.0 9.6 0.4 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,500 10,550 10,600 10,650 10,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index rose 0.4% to close at 10,652.3. The Transportation and Telecoms indices led the gains. The index rose on the back of buying support from non-Qatari and GCC shareholders despite selling pressure from Qatari shareholders. Qatar Gas Transport Co. and Widam Food Co. were the top gainers, rising 2.1% each. Among the top losers, Commercial Bank fell 0.8%, while Barwa Real Estate Co. was down 0.6%. Volume of shares traded on Thursday fell by 8.1% to 4.8mn from 5.2mn on Wednesday. However, as compared to the 30-day moving average of 4.6mn, volume for the day was 4.3% higher. Ezdan Holding Group and Qatar First Bank were the most active stocks, contributing 15.9% and 9.2% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Bahrain Telecommunications Co. Fitch Bahrain LT-IDR BB+ BB+ – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency) Earnings Releases Company Market Currency Revenue (mn) 2Q2016 % Change YoY Operating Profit (mn) 2Q2016 % Change YoY Net Profit (mn) 2Q2016 % Change YoY Mobile Telecommunication Co. Saudi Arabia SR – – -108.0 NA -329.0 NA Saudi Automotive Services Co. Saudi Arabia SR – – 2.8 -42.7% 4.4 19.1% Saudi Printing & Packaging Co. Saudi Arabia SR – – 12.0 -52.2% 0.5 -98.2% Astra Industrial Group Saudi Arabia SR – – 5.6 2.0% 22.2 10.4% Saudi Industrial Investment Group Saudi Arabia SR – – 546.0 -28.3% 216.0 -36.3% National Petrochemical Co. Saudi Arabia SR – – 421.8 -25.3% 208.6 -31.7% Saudi Real Estate Co. Saudi Arabia SR – – 45.7 15.0% 19.0 -48.3% Saudi Industrial Development Co. Saudi Arabia SR – – 1.0 -90.1% 7.7 -38.4% Electrical Industries Co. Saudi Arabia SR – – 9.2 -60.9% 10.5 -47.5% Saudi Vitrified Clay Pipes Co. Saudi Arabia SR – – 25.1 -27.0% 23.9 -27.1% Fitaihi Holding Group Saudi Arabia SR – – -14.5 NA -5.0 NA Alandalus Property Co. Saudi Arabia SR – – 26.5 -2.6% 24.8 0.6% Al Yamamah Steel Industries Co. Saudi Arabia SR – – 100.4 38.1% 66.4 22.1% Etihad Atheeb Telecommunication Saudi Arabia SR – – -0.4 NA -65.4 NA Kingdom Holding Company Saudi Arabia SR – – 302.9 -14.4% 185.8 -22.0% Saudi Research & Marketing Group Saudi Arabia SR – – -37.4 NA -51.5 NA Alkhaleej Training & Education Co. Saudi Arabia SR – – -0.1 NA -4.0 NA Al Hammadi Co. for Dev. & Inv. Saudi Arabia SR – – 26.2 -30.9% 20.9 -43.3% Saudi Cable Co. Saudi Arabia SR – – -11.7 NA -18.2 NA Saudi Paper Manufacturing Co. Saudi Arabia SR – – 3.8 -34.0% -6.1 NA Bishah Agricultural Development Co. Saudi Arabia SR – – -0.3 NA -0.3 NA Knowledge Economic City Saudi Arabia SR – – -0.5 NA 0.2 NA Abdulmohsen Alhokair Group Saudi Arabia SR – – 14.3 -59.4% 18.8 -56.4% Qassim Agricultural Co. Saudi Arabia SR – – -0.4 NA 1.3 179.5% Savola Group Saudi Arabia SR – – 414.2 -23.7% 246.7 -43.2% Aramex Dubai AED 1,105.0 16.8% – – 125.7 35.9% Al Mazaya Holding Co. Dubai KD 9.7 -21.1% – – 2.3 -4.3% National Central Cooling Co. Dubai AED 323.1 2.3% 108.2 3.1% 97.0 5.3% Arkan Building Materials Co. Abu Dhabi AED 199.0 -11.1% – – 9.4 -65.6% RAK Cement Co. Abu Dhabi AED 57.1 11.8% – – 2.5 NA Oman Cement* Oman OMR 30.1 18.0% – – 7.6 26.0% Oman Chlorine* Oman OMR 3.5 -6.5% – – 0.9 -31.0% Shell Oman Marketing Oman OMR 183.4 10.7% – – 8.8 27.5% Esterad Investment Co.* Bahrain BHD – – – – 0.5 -55.9% Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 20.76% 43.78% (51,413,715.58) Qatari Institutions 13.91% 20.29% (14,247,815.02) Qatari 34.67% 64.07% (65,661,530.60) GCC Individuals 2.02% 1.35% 1,490,453.48 GCC Institutions 12.95% 2.76% 22,771,038.15 GCC 14.97% 4.11% 24,261,491.63 Non-Qatari Individuals 9.14% 11.42% (5,084,150.58) Non-Qatari Institutions 41.21% 20.41% 46,484,189.55 Non-Qatari 50.35% 31.83% 41,400,038.97

- 3. Page 3 of 8 Source: Company data, DFM, ADX, MSM (*6M2016 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/28 US Department of Labor Initial Jobless Claims 23-July 266k 262k 252k 07/28 US Department of Labor Continuing Claims 16-July 2,139k 2,136k 2,132k 07/28 EU European Commission Consumer Confidence July F -7.9 -7.9 -7.9 07/29 EU Eurostat CPI Core YoY July A 0.90% 0.80% 0.90% 07/29 EU Eurostat GDP SA QoQ 2Q2016 A 0.30% 0.30% 0.60% 07/29 EU Eurostat GDP SA YoY 2Q2016 A 1.60% 1.50% 1.70% 07/28 Germany Destatis CPI MoM July P 0.30% 0.20% 0.10% 07/28 Germany Destatis CPI YoY July P 0.40% 0.30% 0.30% 07/29 France INSEE CPI MoM July P -0.40% -0.40% 0.10% 07/29 France INSEE CPI YoY July P 0.20% 0.30% 0.20% 07/29 Japan Ministry of Internal Affairs and Communications Jobless Rate June 3.10% 3.20% 3.20% 07/29 Japan Ministry of Internal Affairs and Communications Tokyo CPI YoY July -0.40% -0.50% -0.50% 07/29 Japan Ministry of Economy Trade Industrial Production MoM June P 1.90% 0.50% -2.60% 07/29 Japan Ministry of Economy Trade Industrial Production YoY June P -1.90% -2.90% -0.40% 07/29 India Controller General of Accounts Fiscal Deficit INR Crore June 97,337 – 91,660 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 2Q2016 results No. of days remaining Status QGRI Qatar General Insurance & Reinsurance 31-Jul-16 0 Due QCFS Qatar Cinema & Film Distribution Company 1-Aug-16 1 Due AKHI Al Khaleej Takaful Insurance 2-Aug-16 2 Due MRDS Mazaya Qatar 2-Aug-16 2 Due GISS Gulf International Services 2-Aug-16 2 Due QNNS Qatar Navigation (Milaha) 3-Aug-16 3 Due IQCD Industries Qatar 3-Aug-16 3 Due QFLS Qatar Fuel Company 4-Aug-16 4 Due DOHI Doha Insurance 8-Aug-16 8 Due MPHC Mesaieed Petrochemical Holding Company 9-Aug-16 9 Due MERS Al Meera Consumer Goods Company 9-Aug-16 9 Due QISI Qatar Islamic Insurance 10-Aug-16 10 Due MCCS Mannai Corp. 10-Aug-16 10 Due DBIS Dlala Brokerage & Investment Holding Company 10-Aug-16 10 Due MCGS Medicare Group 10-Aug-16 10 Due SIIS Salam International Investment 11-Aug-16 11 Due WDAM Widam Food Company 11-Aug-16 11 Due QGMD Qatar German Company for Medical Devices 14-Aug-16 14 Due ZHCD Zad Holding Company 14-Aug-16 14 Due Source: QSE

- 4. Page 4 of 8 News Qatar QNCD reports net profit of QR127.9mn in 2Q2016 – Qatar National Cement Company (QNCD) reported a net profit of QR127.9mn in 2Q2016, indicating a growth of 3.3% QoQ and 9.5% YoY. The company’s revenue declined 6.5% QoQ and 3.0% YoY to QR282.6mn in 2Q2016. (QSE, QNBFS Research) ORDS provides supplementary update on M&A deals – Ooredoo (ORDS) provided supplementary information pertaining to the sale, completed on March 27, 2016, by its subsidiary wi-tribe limited of wi-tribe Pakistan to HB Offshore Investment Ltd. for an amount of approximately QR32.7mn. HB Group is established in the telecommunications sector in Pakistan and is planning to expand further. The company also provided supplementary information on its subsidiary Ooredoo Kuwait’s acquisition, announced on April 28, 2016, of FASTtelco for KD11mn. (QSE) ORDS to consider stake sale in StarHub owner – Ooredoo (ORDS) is considering selling its indirect stake in Singapore’s StarHub Ltd. The company is working with HSBC Holdings to gauge potential interest in its stake in Asia Mobile Holdings. According to the Singapore-based company’s annual report, Ooredoo owns about 25% of Asia Mobile Holdings, which in turn holds 55.8% stake in StarHub. (Gulf-Times.com) QNB Suisse moves to new location by Lake Geneva – QNB Group, announced the relocation of QNB Suisse to its new location by the famous Lake Geneva at Rue Quai du Mont Blanc. The new building enjoys a strategic location at the heart of Geneva city with its stunning view of the lake, thus enabling it to serve the city’s vital and most populated areas. (QNB Group Press Release) QA to raise stake in British Airways owner to 20% – Qatar Airways (QA) will further raise its stake in British Airways owner IAG SA, adding to its holding after the shares plunged in the wake of the Brexit vote. The state-owned carrier, already IAG’s largest investor, will boost its holding to around 20% from 15.7%. The increased stake could be announced in the coming days. (Bloomberg) World Bank: Qatar may run $8bn budget deficit – According to a recent World Bank report on crashing oil prices, Qatar is expected to run a budget deficit of $8bn, equivalent to 5% of GDP in 2016 — the lowest among GCC countries. Yet, given that the country’s budget planners calculated oil at $48, Qatar’s deficit may increase further. The World Bank’s “Mena quarterly economic brief for July” noted the group of Gulf Cooperation Council (GCC) countries lost $157bn in oil revenues in 2015 and is expected to lose another $100bn in 2016. In the MENA region, Saudi Arabia has lost $178bn from its reserves, followed by Algeria ($28bn) and Iraq ($27bn) in 2015. (Peninsula Qatar) BMI: Fuel subsidy reform would help Qatar reduce budget deficit – According to BMI Research, a Fitch Group company, the fuel subsidy reform would help Qatar reduce its budget deficit by allowing spending to decrease. BMI Research’s Analysts Christopher Haines and Olivier Najar said, “The fuel subsidy reform in Qatar will not increase revenues for the Qatari government, but will allow spending to decrease, thus reducing the budget deficit.” Qatar expects to post a deficit of QR46.5bn in 2016 as per the country’s budget for the current fiscal. Fuel prices in Qatar were allowed to fluctuate in response to changes in the global market from May 1, 2016. The monthly revision in local fuel prices followed the government’s decision on the fuel subsidy reform in Qatar. (Gulf-Times.com) US trade surplus with Qatar jumps to QR9.35bn – The US trade surplus with Qatar for the first five months (January-May) of 2016 has jumped to QR9.35bn ($2.57bn), witnessing a triple-digit growth as compared to figures for the same period in 2015. The US trade balance with Qatar (which represents the difference between value of exports and imports of goods) for January-May 2016 period has increased by 117.5% as compared to $1.18bn registered during the corresponding period last year, data available at the US Census Bureau suggests. The bilateral trade volume between the two countries from January to May 2016 touched $3.65bn, up 40.39% as compared to $2.61bn witnessed during the same period in the previous year. (Peninsula Qatar) Petrol to cost more in August 2016 – An announcement by the Ministry of Energy & Industry shows petrol prices in Qatar will go up by Dh5 a liter in August 2016, while there will not be any change in the diesel price in August. According to the Ministry of Energy & Industry, the 91-octane Premium gasoline will cost QR1.35/liter (QR1.3 currently) and Super will cost QR1.45/liter (QR1.4 currently). The current price for this month for Premium and Super will be in effect until July 31. However, diesel price will remain unchanged at QR1.4/liter in August. (Gulf-Times.com) Ministry of Public Health expanding medical services – As part of the government’s efforts to provide “comprehensive health services to workers where they are located”, HE the Minister of Public Health Dr Hanan Mohamed al-Kuwari inaugurated the Al Hemaila Medical Center in the Industrial Area. Equipped to receive up to 24,000 visiting patients per month, the new center will be operated by the Qatar Red Crescent Society under an agreement with the Ministry of Public Health. The new medical facility is the second expatriate workers’ health center to be opened in 2016 after the Mesaimeer Health Center, which was opened on May 6, 2016. (Gulf-Times.com) Ninety two outlets closed in six months for violations – Fines amounting to over QR3.1mn were imposed on different outlets within the Doha Municipality’s jurisdiction in 1H2016 for violating food safety regulations. Some 92 outlets within the jurisdiction of the municipality were also closed during this period for flouting norms. (Gulf-Times.com) Qatar and Argentina agree to expand bilateral relations – HH the Emir Sheikh Tamim bin Hamad al-Thani, at the invitation of Argentinian President Mauricio Macri, paid an official visit, along with a high-level delegation to Argentina. The visit helped in enhancing the friendship and cooperation between the two countries, which started 42 years ago. The two leaders held a round of official talks characterized by a spirit of understanding and keenness on developing bilateral relations on all fronts. They also expressed their satisfaction at the good level that bilateral ties between the two countries have reached in the political, economic and investment arenas. (Gulf-Times.com) Agreement signed for delivery of integrated health records system in Qatar – An agreement has been signed to deliver an integrated electronic records system for the private healthcare sector in Qatar. The project, which is due to roll out over a five-year period, has been described by its promoters as the “first of its kind” in the country and is valued at QR102mn. The initiative will see the use of the SystmOne clinical system across the country in order to establish a more advanced healthcare system. A collaboration agreement was signed recently in this connection between health software provider TPP Middle East and Integrated Intelligence Services (IIS). Under this agreement, TPP Middle East will deliver the SystmOne clinical system to approximately 300 primary care sites across Qatar. (Gulf-Times.com) International US labor costs increase 0.6% in 2Q2016 – The US Labor Department said that the country’s labor costs rose steadily in 2Q2016, pointing to still-moderate wage inflation, which could see the Federal Reserve keeping interest rates unchanged for a while.

- 5. Page 5 of 8 The department said that the Employment Cost Index, the broadest measure of labor costs, increased 0.6% after a similar gain in 1Q2016. In the 12 months through June, labor costs rose 2.3%, well below the 3% threshold that economists say is needed to bring inflation closer to the Federal Reserve's 2% inflation target. Labor costs increased 1.9% in the year to March. (Reuters) Inventory reduction curbs US economic growth – The US Commerce Department said that the country’s economic growth unexpectedly remained tepid in 2Q2016 as inventories fell for the first time in nearly five years and business investment weakened further, offsetting robust consumer spending. The US Gross domestic product (GDP) increased at a 1.2% YoY after rising by a downwardly revised 0.8% pace in 1Q2016. In addition, the GDP growth estimate for 4Q2016 was cut by five-tenths of a percentage point to a 0.9% rate. The three straight quarters of growth rates around 1% suggest a significant loss of momentum that puts the economy at the risk of stalling, but economists expect an acceleration in the 2H2016 against the backdrop of strong consumption. Though the inventory drawdown weighed on GDP growth, which is likely to provide a boost to output in the coming quarters as businesses order merchandise to restock depleted warehouses. (Reuters) CBI: UK firms expect growth to stagnate over next three months – The Confederation of British Industry (CBI) said that the British businesses expect economic growth to grind almost to a halt over the next three months due to weaker investment and consumer confidence after June's vote to leave the European Union (EU). The CBI said that the outlook was the weakest since December 2012 as the proportion of firms expecting lower output was now 3% points higher than the share expecting growth. This marked a sharp turnaround from June, when there was a 16% point margin in favor of those anticipating growth. The CBI's figures were partly based on its gloomy surveys of manufacturers' order books and retailers, with additional material from other services companies which make up the bulk of Britain's private-sector economy. (Reuters) Eurozone economic growth slows in 2Q2016 – Economic growth in the Eurozone slowed in 2Q2016 as uncertainty before the British vote to leave the European Union swirled and economists said that it could be a sign of weak future growth. European statistics office Eurostat said that the Gross domestic product (GDP) in the 19 countries sharing the euro rose 0.3% QoQ in 2Q2016, halving from the 0.6% growth in 1Q2016. A slowdown was expected after the strong Eurozone growth in 1Q2016, but it may have been compounded by the uncertainty preceding the June 23, 2016 British referendum. Although first confidence data after Brexit showed unexpected optimism in the Eurozone, the economic impact of Britain's decision to leave the union may be felt later. (Reuters) Eurozone inflation rises more than expected to 0.2% in July – According to a first estimate from the European Union’s statistics agency (Eurostat), inflation in Eurozone rose more than expected in July, driven mostly by higher prices of food, alcohol and tobacco products. Eurostat said that inflation in the 19 countries sharing the euro increased to 0.2% YoY in July from 0.1% in June. Core inflation was unchanged at 0.8%, in line with market expectations. Excluding energy, food, alcohol and tobacco products, the inflation rate remained stable at 0.9%. A larger fall in energy prices than in June was offset by higher inflation in the other components of the indicator. Energy prices dropped by 6.6% YoY, more than the 6.4% fall recorded in June. But prices in food, alcohol and tobacco products went up 1.4%, much higher than the 0.9% rise in June. In the services sector, the largest in the Eurozone economy, prices slightly rose 1.2% YoY, from 1.1% in June 2016. (Reuters) French 2Q2016 unexpectedly grinds to a halt on weak consumer spending – According to official data, French economic growth stalled unexpectedly in 2Q2016 on weak consumer spending and investment in a blow to President Francois Hollande's claims the economy is getting stronger. The result fell short of economists expectations for growth of 0.2% from 1Q2016. It also marks a sharp slowdown from 1Q2016 when the economy grew 0.7%, the strongest rate in nearly three years. The INSEE statistics office revised that figure up from a preliminary estimate of 0.6%. Finance Minister Michel Sapin said that the "disappointing figures" reflected exceptional factors like strikes at refineries in addition to the slowdown from the particularly strong 1Q2016. He said that the government was nonetheless sticking with its 2016 growth forecast of 1.5%.(Reuters) Greek central bank head sees primary surplus at 1.3% of GDP – Greece's Central Bank Governor, Yannis Stournaras said that the central bank has forecasted that the country will post a primary surplus of 1.3% of gross domestic product (GDP) in 2016. Under its third international bailout signed last summer, Greece aims at a primary surplus - which excludes debt servicing costs - of 0.5% of GDP in 2016. The bank had forecast earlier in July 2016 that the country would achieve a surplus of 0.9% in 2016. (Reuters) Japan jobless rate falls to 3.1%, BOJ index shows consumer prices +0.8% YoY in June – According to the Japanese Ministry of Internal Affairs and Communications , the country’s seasonally adjusted unemployment rate fell to 3.1% MoM in June. The data by the Labor Ministry revealed that the jobs-applicants ratio rose to 1.37 in June from 1.36 in May, to reach the highest since August 1991. That matched the median estimate. The Bank of Japan (BOJ) said that the Japanese consumer prices rose 0.8% YoY in June when stripping out energy and fresh food costs, at the same pace as in May. The BOJ uses the government's core CPI, which excludes fresh food but includes energy costs, as its key price measurement in guiding monetary policy. That index fell 0.5% YoY in June. (Reuters) Regional OPEC oil output set to reach record high in July – OPEC's oil output is likely to reach its highest in recent history in July, as Iraq pumps more and Nigeria manages to export additional crude despite militant attacks on oil installations. Top OPEC exporter Saudi Arabia has kept output close to a record high, as it meets seasonally higher domestic demand and focuses on maintaining market share rather than trimming supply to boost prices. (Reuters) JLL: Vision 2030 to stimulate dull Riyadh, Jeddah real estate market – JLL, in its 2Q2016 Riyadh and Jeddah real estate overview, said that with Saudi Arabia Vision 2030 pivotal to the diversification and restructuring of the economy in lieu of decreasing oil prices, both Riyadh and Jeddah continued to maintain an overall slowdown in performance. JLL KSA National Director & Country Head Jamil Ghaznawi said JLL has witnessed a general softening of the residential market in 2Q2016, with a marginal decline in both rentals in Riyadh and sale prices in Jeddah. Further delays have been experienced in the completion of projects in Jeddah, despite increased efforts being made to address the shortage of affordable housing. However, with the White Land Tax being introduced earlier in June, the future development pipeline is likely to increase, which could push both land and housing costs down in 2017 and 2018. (GulfBase.com) IMF praises ambitious KSA reform goals, resilient system – IMF said that reforms have helped Saudi Arabia strengthen the financial system while the banking sector is well positioned to weather low oil prices and slower growth. The organization welcomed the Kingdom's timely response to oil price volatility, which supported

- 6. Page 6 of 8 by sizable fiscal buffers and a resilient financial system, has maintained macroeconomic growth and stability. (Bloomberg) KSA’s central bank net foreign assets drop $11bn in June – KSA net foreign assets held at central bank fell by $11bn from the previous month to $562bn in June as the government drew down its reserves to cover a budget deficit caused by low oil prices. Assets shrank 15.9% from June 2015, to their lowest level since early 2012. They reached a record high of $737bn in August 2014 before starting to drop. (Bloomberg) IMF: Saudi Arabia’s economy set to recover in 2017 – IMF said that Saudi Arabia's real GDP growth is expected to slow to 1.2% in 2016, but recover to 2% in 2017 as the pace of fiscal consolidation eases and to settle around 2¼ -2½% over the medium-term. Inflation has risen in recent months to over 4% as energy & water prices increased, and is expected to ease to 2% in 2017. (Bloomberg) SADAFCO’s solar project starts operation – Saudia Dairy & Foodstuff Company (SADAFCO) has now commenced operations utilizing a photovoltaic (PV)-diesel hybrid system that can deliver up to 40% of the facility’s daytime energy requirements. (GulfBase.com) Al Hokair Group BoD announces dividend for 1H2016 – Abdulmohsen Alhokair Group for Tourism & Development (Al Hokair Group) Board of Directors (BoD) has recommended a dividend distribution of SR0.65 representing 6.5% of the face value to its shareholders for 1H2016. (Tadawul) Oil poised for a drop of 20% since early June – The bullish spirit, which gripped oil traders as industry giants from Saudi Arabia to Goldman Sachs Group declared the supply glut over, is rapidly ebbing away. Oil is poised for a drop of 20% since early June, meeting the definition of a bear market. While excess crude production is abating, inventories around the world are brimming, especially for gasoline, and a revival in US drilling threatens to swell supplies further. Morgan Stanley predicts that as the output disruptions that cleared some of the surplus earlier in 2016 begin to be resolved, crude could again slump up to $30 a barrel. (Bloomberg) IMF: UAE should ease pace of spending cuts – The IMF said to help nudge growth higher in 2016, the UAE should ease the pace of spending cuts and instead use its ample financial reserves to balance the budget. The fund’s growth forecast for the UAE is 2.3% for 2016, down from the 4% growth of 2015. The country has embarked on a number of cost-reducing initiatives since oil prices fell from their summer 2014 peak, including a reduction in energy subsidies and other public spending cuts. (GulfBase.com) Publishing industry continues to suffer in UAE market – The UAE publishing industry continues to suffer as advertisers cut back their budgets in an increasingly cautious market. The advertising market has softened over the past 18 months as low oil prices and regional instability weakens commercial and consumer confidence. The soft sentiment, said to be the worst since 2009 and is expected to remain in 2H2016 with oil prices continuing to trade below $50 a barrel as compared to $115 a barrel almost two years ago. (GulfBase.com) UAE to make up 90% of Middle East leisure tourism market – According to sources, the UAE is forecast to make up 90% of the leisure tourism market in the Middle East region by 2020. Phil Taylor, Director at Team Leisure, said the UAE is about to take a huge step on to the world leisure stage with some 10 to 15 major leisure attractions due to open in 2016 and many more in the pipeline. This is the next big step in the UAE’s tourism strategy and the single biggest driver of growth in the hotel market for the next five years. (GulfBase.com) Western Union, du join hands to offer service benefits – The Western Union Company, a leader in global payment services, has signed an agreement with du, a leading telecom provider in the UAE, aiming to pursue joint efforts to benefit subscribers. The agreement will benefit users of Western Union and du in the UAE, through joint initiatives that will leverage Western Union’s market leadership and relationships with different communities, as well as du’s position as the telecom service provider of choice. (GulfBase.com) Jaona Investment buys stake in Aramex – Jaona Investment bought a stake in Dubai-based logistics company Aramex for $119mn. DFM said that Jaona Investment purchased 99.4mn Aramex shares at AED4.4 each in a direct deal on the Dubai Financial Market. (Bloomberg) Dubai aims to produce 7% of power from renewable energy sources – The Energy production will always be synonymous with the Middle East region. Just as the discovery of oil underground changed the face of the region’s economy a century ago, another resource way above ground is doing likewise today. Dubai alone has set itself a goal to become the city with the lowest carbon footprint in the world. Its target is to produce 7% of its power from clean energy sources by 2020, 25% by 2030, and a whopping 75% by 2050. (GulfTimes.com) RAKBANK reports AED195.70mn net profit in 2Q2016 – National Bank of Ras Al-Khaimah (RAKBANK) reported a net profit of AED195.70mn in 2Q2016 as compared to AED353.92mn in 2Q2015. Net interest income declined to AED620.27mn in 2Q2016 as compared to AED658.91mn in 2Q2015. Total assets stood at AED40.90bn at the end of June 30, 2016 as compared to AED40.55bn at the end of December 31, 2015. Net loans & advances stood at AED28.30bn, while Customer deposits stood at AED28.0bn at the end of June 30, 2016. EPS amounted to AED0.12 in 2Q2016 as compared to AED0.21 in 2Q2015. (DFM) DP World signs lease agreement with Canada's Rodney Container Terminal – DP World, one of the world's biggest port operators, has signed a long-term lease agreement for the expansion & operation of Canada's Rodney Container Terminal. DP World will start running existing operations on January 1, 2017 and work in partnership with the port authority of Saint John, New Brunswick, on a planned expansion program expected to be completed in 2021, with the lease continuing for 30 years after. (Bloomberg) DED sees 16.3% YoY increase in 1H2016 Commercial permits – Commercial permits issued by Dubai's Department of Economic Development (DED) for activities including marketing campaigns, sales promotions and exhibitions increased 16.3% YoY in 1H2016, reflecting the intense competition among companies through efficient and innovative marketing strategies. (Bloomberg) DSI wins $61.5mn Iraqi oil field contract – Dubai-based Drake & Scull International (DSI) has been awarded a $61.5mn engineering, procurement & construction (EPC) contract for the construction of a water injection network installation project at the Zubair oil field in Basra, Iraq. The contract has been awarded by ENI Iraq, a subsidiary of the Italian oil & gas multinational firm ENI. (Bloomberg) Muscat port operator seeks government purchase of private shares – Port Services Corporation (PSC), which operates and manages Muscat’s Port Sultan Qaboos (PSQ), says that it expects compensation for any revenue loss stemming from the government’s decision to transfer the port’s assets before the expiry of its current concession agreement. At the same time, citing the continued uncertainty of the corporation’s future and its role, the board has also urged the government to consider acquiring all of the private shares in the corporation, or alternatively liquidating it altogether. (GulfBase.com)

- 7. Page 7 of 8 Transfer of OEIHC shares from MOF to OIF – Oman’s Ministry of Finance (MoF) holding 5.3mn equity shares in Oman & Emirates Inv. Holding (OEIHC), representing 4.33% stake, has decided to transfer the shares in the name of Oman Investment Fund (OIF) , owned by the Government of Oman pursuant to an internal decision on management of government investments. It is expected that the transfer process shall be completed soon. (MSM) Bank Dhofar BoD approves rights issue – Oman’s Bank Dhofar, the second-largest lender in the Sultanate by assets, said the board of directors (BoD) has approved a rights issue to raise up to $103.9mn. (Reuters) Investcorp strengthens shareholder base with agreed Investment from Mubadala – lnvestcorp, a global provider & manager of alternative investment products, and Mubadala Development Company, the Abu Dhabi-based investment & development company, have agreed that Mubadala will acquire a 20% interest in Investcorp. The two-step transaction sees Mubadala acquire a 9.99% ownership stake immediately, with a further 10.01% following necessary regulatory approvals. (BahrainBourse.com) Alba to raise $500mn from banks – Aluminium Bahrain (Alba) is planning to approach local banks to raise around $500mn in order to finance its Line 6 Expansion Project. (BHB)

- 8. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. WLL One Person Company Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. WLL One Person Company (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 QSEIndex S&PPan Arab S&PGCC (1.5%) 0.4% (0.0%) 0.2% 0.6% (0.1%) 0.3% (2.0%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,351.00 1.1 2.2 27.3 MSCI World Index 1,721.79 0.8 0.9 3.5 Silver/Ounce 20.34 0.6 3.6 46.8 DJ Industrial 18,432.24 (0.1) (0.7) 5.8 Crude Oil (Brent)/Barrel (FM Future) 42.46 (0.6) (7.1) 13.9 S&P 500 2,173.60 0.2 (0.1) 6.3 Crude Oil (WTI)/Barrel (FM Future) 41.60 1.1 (5.9) 12.3 NASDAQ 100 5,162.13 0.1 1.2 3.1 Natural Gas (Henry Hub)/MMBtu 2.94 6.5 6.0 27.3 STOXX 600 341.89 1.4 2.2 (4.0) LPG Propane (Arab Gulf)/Ton 43.00 1.8 (9.7) 12.0 DAX 10,337.50 1.3 3.6 (1.6) LPG Butane (Arab Gulf)/Ton 49.38 (2.2) (9.4) (10.4) FTSE 100 6,724.43 0.7 0.8 (3.3) Euro 1.12 0.9 1.8 2.9 CAC 40 4,439.81 1.2 3.1 (1.7) Yen 102.06 (3.0) (3.8) (15.1) Nikkei 16,569.27 3.0 3.4 2.6 GBP 1.32 0.5 0.9 (10.2) MSCI EM 873.47 (0.2) 0.5 10.0 CHF 1.03 1.2 1.8 3.4 SHANGHAI SE Composite 2,979.34 (0.2) (0.6) (17.7) AUD 0.76 1.2 1.8 4.3 HANG SENG 21,891.37 (1.3) (0.4) (0.2) USD Index 95.53 (1.2) (2.0) (3.1) BSE SENSEX 28,051.86 (0.3) 1.5 6.5 RUB 65.94 (1.4) 1.8 (9.1) Bovespa 57,308.21 2.3 2.1 61.2 BRL 0.31 1.2 0.2 21.8 RTS 927.57 0.5 (0.9) 22.5 126.6 96.5 96.3