McKinsey Survey: Argentinian consumer sentiment during the coronavirus crisis

•

0 gostou•2,336 visualizações

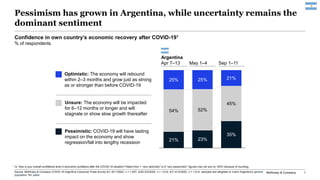

Argentine consumers remain concerned about the economy and taking care of their families during the COVID-19 crisis. These exhibits are based on survey data collected in Argentina from September 1–11, 2020. Check back for regular updates on Argentines’ consumer sentiments, behaviors, income, spending, and expectations.

Denunciar

Compartilhar

Denunciar

Compartilhar

Recomendados

Filipino consumers generally remained as optimistic in October as they were in April; however, optimism among lower-income groups declined significantly.

As the government’s COVID-19 restrictions ease, Filipino consumers are cautiously resuming spending activity. While overall optimism remained the same from April to October, optimism in the lowest income group dropped significantly, while those in the highest income group increased. Optimism among 20- to 24-year-olds also declined. Additionally, approximately 50 percent of respondents believe their finances will be impacted for at least six more months, up from only about 10 percent last April. Overall decreases in spending are expected to soften after the pandemic, but most categories will likely see spending declines linger for the long term.

These exhibits are based on survey data collected in the Philippines from April 17 to 20, and October 1 to 12, 2020. McKinsey Survey: Filipino consumer sentiment during the coronavirus crisis

McKinsey Survey: Filipino consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Portuguese consumers are concerned about the health of family members as well as the economy, and are cutting back on spending.

Portuguese consumers continue to feel the economic effects of the crisis, and their concerns about health, safety, and the economy are increasing. Most consumers still believe that the personal and financial impact of COVID-19 will continue to last well beyond two months. They expect to cut their spending across almost all categories. However, the proportion of consumers’ income, spending, and savings affected by the COVID-19 situation has decreased slightly since the last pulse. Portuguese consumers have been leaving home mainly to shop and meet family, and expect to continue doing so in the near future. In addition to lifted restrictions, consumers are waiting for the endorsement of medical authorities prior to engaging in out-of-home activities.

These exhibits are based on survey data collected in Portugal from June 19–21, 2020. Check back for regular updates on Portuguese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Portuguese consumer sentiment during the coronavirus crisis

McKinsey Survey: Portuguese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Although Japanese consumer optimism about economic recovery is improving steadily, the majority of consumers are still cautious about reengaging in out-of-home activities.

These exhibits are based on survey data collected in Japan from February 24–27, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumers in the Dominican Republic are concerned about the COVID-19 crisis and uncertain about its impact on the economy. Over 50 percent of consumers have mixed feelings about economic recovery.

These exhibits are based on survey data collected in the Dominican Republic from September 1–29, 2020. Check back for regular updates on consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Dominican consumer sentiment during the coronavirus crisis

McKinsey Survey: Dominican consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Optimism and spend intent returning

Consumer optimism regarding economic conditions after COVID-19 up by more than 50% since February (from 21% to 34%); strongest growth in spend intent for out-of-home entertainment and travel, but most categories are increasingMcKinsey Survey: Italian consumer sentiment during the coronavirus crisis

McKinsey Survey: Italian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Chileans remain concerned about the COVID-19 crisis and uncertain about economic recovery, with only one in three consumers being optimistic about a quick recovery.

These exhibits are based on survey data collected in Chile from September 1–16, 2020. Check back for regular updates on Chilean consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chilean consumer sentiment during the coronavirus crisis

McKinsey Survey: Chilean consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Despite an ongoing lockdown, German consumers’ expectations for economic recovery are stable, with half believing their routines will return to normal by the end of 2021.

These exhibits are based on survey data collected in Germany from February 23–27, 2021. Check back for regular updates on German consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Recomendados

Filipino consumers generally remained as optimistic in October as they were in April; however, optimism among lower-income groups declined significantly.

As the government’s COVID-19 restrictions ease, Filipino consumers are cautiously resuming spending activity. While overall optimism remained the same from April to October, optimism in the lowest income group dropped significantly, while those in the highest income group increased. Optimism among 20- to 24-year-olds also declined. Additionally, approximately 50 percent of respondents believe their finances will be impacted for at least six more months, up from only about 10 percent last April. Overall decreases in spending are expected to soften after the pandemic, but most categories will likely see spending declines linger for the long term.

These exhibits are based on survey data collected in the Philippines from April 17 to 20, and October 1 to 12, 2020. McKinsey Survey: Filipino consumer sentiment during the coronavirus crisis

McKinsey Survey: Filipino consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Portuguese consumers are concerned about the health of family members as well as the economy, and are cutting back on spending.

Portuguese consumers continue to feel the economic effects of the crisis, and their concerns about health, safety, and the economy are increasing. Most consumers still believe that the personal and financial impact of COVID-19 will continue to last well beyond two months. They expect to cut their spending across almost all categories. However, the proportion of consumers’ income, spending, and savings affected by the COVID-19 situation has decreased slightly since the last pulse. Portuguese consumers have been leaving home mainly to shop and meet family, and expect to continue doing so in the near future. In addition to lifted restrictions, consumers are waiting for the endorsement of medical authorities prior to engaging in out-of-home activities.

These exhibits are based on survey data collected in Portugal from June 19–21, 2020. Check back for regular updates on Portuguese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Portuguese consumer sentiment during the coronavirus crisis

McKinsey Survey: Portuguese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Although Japanese consumer optimism about economic recovery is improving steadily, the majority of consumers are still cautious about reengaging in out-of-home activities.

These exhibits are based on survey data collected in Japan from February 24–27, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumers in the Dominican Republic are concerned about the COVID-19 crisis and uncertain about its impact on the economy. Over 50 percent of consumers have mixed feelings about economic recovery.

These exhibits are based on survey data collected in the Dominican Republic from September 1–29, 2020. Check back for regular updates on consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Dominican consumer sentiment during the coronavirus crisis

McKinsey Survey: Dominican consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Optimism and spend intent returning

Consumer optimism regarding economic conditions after COVID-19 up by more than 50% since February (from 21% to 34%); strongest growth in spend intent for out-of-home entertainment and travel, but most categories are increasingMcKinsey Survey: Italian consumer sentiment during the coronavirus crisis

McKinsey Survey: Italian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Chileans remain concerned about the COVID-19 crisis and uncertain about economic recovery, with only one in three consumers being optimistic about a quick recovery.

These exhibits are based on survey data collected in Chile from September 1–16, 2020. Check back for regular updates on Chilean consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chilean consumer sentiment during the coronavirus crisis

McKinsey Survey: Chilean consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Despite an ongoing lockdown, German consumers’ expectations for economic recovery are stable, with half believing their routines will return to normal by the end of 2021.

These exhibits are based on survey data collected in Germany from February 23–27, 2021. Check back for regular updates on German consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Boost in optimism and spend intent

Consumer optimism regarding economic conditions after COVID-19 are up by more than 50% since February; strongest growth in spend intent is for out-of-home entertainment, dining out, and travel.McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Optimism grows as categories recover

One-third (32%) of French consumers are optimistic for the future —the highest rate seen in our surveys; while net spending intent remains negative, it is trending up across all categoriesMcKinsey Survey: French consumer sentiment during the coronavirus crisis

McKinsey Survey: French consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Spanish consumers’ overall economic pessimism has decreased since November, but caution about engaging in out-of-home activities continues.

These exhibits are based on survey data collected in Spain from February 23–27, 2021. Check back for regular updates on Spanish consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Despite ongoing lockdowns, European optimism about economic recovery remains steady, except in the United Kingdom, where it is at its highest of the pandemic.

These exhibits are based on survey data collected in the France, Germany, Italy, Spain, and the United Kingdom from February 23–27, 2021. Check back for regular updates on the European consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: European consumer sentiment during the coronavirus crisis

McKinsey Survey: European consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Belgian confidence about the economy during the COVID-19 crisis is beginning to increase, but spending intent is still below pre-COVID-19 levels.

These exhibits are based on survey data collected in Belgium from June 18–21, 2020. Check back for regular updates on Belgian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Belgian consumer sentiment during the coronavirus crisis

McKinsey Survey: Belgian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

After steadily improving, Japanese consumer optimism stabilizes and a majority of consumers remain cautious about returning to out-of-home activities.

These exhibits are based on survey data collected in Japan from October 15 to 22, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Although Japanese consumer optimism about economic recovery is improving steadily, the majority of consumers are still cautious about reengaging in out-of-home activities.

These exhibits are based on survey data collected in Japan from February 24–27, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Colombian consumers are most worried about public health, caring for their families, and the country’s economy during the COVID-19 crisis.

These exhibits are based on survey data collected in Colombia from September 1–11, 2020. Check back for regular updates on Argentines consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Colombian consumer sentiment during the coronavirus crisis

McKinsey Survey: Colombian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Central American consumers from Panama, Costa Rica, Guatemala, Honduras, and El Salvador are most concerned about their safety, the health and safety of their families, and public health generally during the COVID-19 crisis.

These exhibits are based on survey data collected in Central America from September 1–11, 2020. Check back for regular updates on Central American consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Central American consumer sentiment during the coronavirus c...

McKinsey Survey: Central American consumer sentiment during the coronavirus c...McKinsey on Marketing & Sales

Indian consumers are optimistic about the economy and plan to spend more. They are open to new shopping behaviors as they transition to out-of-home activities.

These exhibits are based on survey data collected in India from October 15 to 22, 2021. Check back for regular updates on Indian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Indian consumer sentiment during the coronavirus crisis

McKinsey Survey: Indian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In China, almost all consumers have already returned to normal out-of-home activities, and 97 percent of respondents report working outside the home in the two weeks prior to being surveyed.

These exhibits are based on survey data collected in China from Feb. 20 to March 8, 2021. Check back for regular updates on Chinese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumer optimism in Asia is highest in China, India, and Indonesia, where consumers continue to expect a quick recovery from the effects of COVID-19.

These exhibits are based on survey data collected in Australia, China, India, Indonesia, and Japan from September 4–30, 2020. Check back for regular updates on APAC consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Asian consumer sentiment during the coronavirus crisis

McKinsey Survey: Asian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In Turkey, consumers’ income and household finances have been affected by COVID-19. A majority of Turkish consumers are concerned about personal health, the economy, and the duration of the crisis. Both the observed effects and the uncertainty around the situation are manifesting as decreased spending across most categories. A spike in online spending on household essentials and entertainment is expected to continue, at least in the short term.

These exhibits are based on survey data collected in Turkey from April 7–9, 2020. Check back for regular updates on Turkish consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Turkish consumer sentiment during the coronavirus crisis

McKinsey Survey: Turkish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In Qatar, the prevailing sentiment is uncertainty about the health of family members and the duration of the COVID-19 crisis. Although consumers are optimistic about the country’s economic recovery after the COVID-19 situation subsides, they are cutting their spending on almost all categories. During the crisis, consumers have both adopted and increased their usage of digital activities such as remote learning, videoconferencing, and contactless delivery and pickup of food and supplies.

These exhibits are based on survey data collected in Qatar from April 24–May 1, 2020. Check back for regular updates on Qatari residents’ consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Qatari consumer sentiment during the coronavirus crisis

McKinsey Survey: Qatari consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

The prevailing sentiment among Polish consumers is similar to those in other European countries, with uncertainty about health and the economy as the biggest concerns. With over half of Poles expecting their income to decrease, we observe a sharp decline in consumers’ intentions to purchase discretionary products, especially in-store. It is also important to note that the majority of Poles expect their finances and personal routines to be impacted for more than four months.

These exhibits are based on survey data collected in Poland from April 2–5, 2020. Check back for regular updates on Polish consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Polish consumer sentiment during the coronavirus crisis

McKinsey Survey: Polish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Mexican consumers continue to be worried about their economy during the COVID-19 crisis, with optimism about a recovery climbing slowly.

These exhibits are based on survey data collected in Mexico from February 20–March 2, 2021. Check back for regular updates on Mexican consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Peruvian consumers are most concerned about taking care of their families, public health, and the economy during the COVID-19 crisis.

These exhibits are based on survey data collected in Peru from September 1–11, 2020. Check back for regular updates on Peruvian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisis

McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Since May 2020, more Canadians are feeling more pessimistic about the economic recovery and believe COVID-19 will have a lasting impact on the economy .

These exhibits are based on survey data collected in Canada from August 14–19, 2020. Check back for regular updates on Canadian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Canadian consumer sentiment during the coronavirus crisis

McKinsey Survey: Canadian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Mais conteúdo relacionado

Mais procurados

Boost in optimism and spend intent

Consumer optimism regarding economic conditions after COVID-19 are up by more than 50% since February; strongest growth in spend intent is for out-of-home entertainment, dining out, and travel.McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Optimism grows as categories recover

One-third (32%) of French consumers are optimistic for the future —the highest rate seen in our surveys; while net spending intent remains negative, it is trending up across all categoriesMcKinsey Survey: French consumer sentiment during the coronavirus crisis

McKinsey Survey: French consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Spanish consumers’ overall economic pessimism has decreased since November, but caution about engaging in out-of-home activities continues.

These exhibits are based on survey data collected in Spain from February 23–27, 2021. Check back for regular updates on Spanish consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Despite ongoing lockdowns, European optimism about economic recovery remains steady, except in the United Kingdom, where it is at its highest of the pandemic.

These exhibits are based on survey data collected in the France, Germany, Italy, Spain, and the United Kingdom from February 23–27, 2021. Check back for regular updates on the European consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: European consumer sentiment during the coronavirus crisis

McKinsey Survey: European consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Belgian confidence about the economy during the COVID-19 crisis is beginning to increase, but spending intent is still below pre-COVID-19 levels.

These exhibits are based on survey data collected in Belgium from June 18–21, 2020. Check back for regular updates on Belgian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Belgian consumer sentiment during the coronavirus crisis

McKinsey Survey: Belgian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

After steadily improving, Japanese consumer optimism stabilizes and a majority of consumers remain cautious about returning to out-of-home activities.

These exhibits are based on survey data collected in Japan from October 15 to 22, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Although Japanese consumer optimism about economic recovery is improving steadily, the majority of consumers are still cautious about reengaging in out-of-home activities.

These exhibits are based on survey data collected in Japan from February 24–27, 2021. Check back for regular updates on Japanese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Colombian consumers are most worried about public health, caring for their families, and the country’s economy during the COVID-19 crisis.

These exhibits are based on survey data collected in Colombia from September 1–11, 2020. Check back for regular updates on Argentines consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Colombian consumer sentiment during the coronavirus crisis

McKinsey Survey: Colombian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Central American consumers from Panama, Costa Rica, Guatemala, Honduras, and El Salvador are most concerned about their safety, the health and safety of their families, and public health generally during the COVID-19 crisis.

These exhibits are based on survey data collected in Central America from September 1–11, 2020. Check back for regular updates on Central American consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Central American consumer sentiment during the coronavirus c...

McKinsey Survey: Central American consumer sentiment during the coronavirus c...McKinsey on Marketing & Sales

Indian consumers are optimistic about the economy and plan to spend more. They are open to new shopping behaviors as they transition to out-of-home activities.

These exhibits are based on survey data collected in India from October 15 to 22, 2021. Check back for regular updates on Indian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Indian consumer sentiment during the coronavirus crisis

McKinsey Survey: Indian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In China, almost all consumers have already returned to normal out-of-home activities, and 97 percent of respondents report working outside the home in the two weeks prior to being surveyed.

These exhibits are based on survey data collected in China from Feb. 20 to March 8, 2021. Check back for regular updates on Chinese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumer optimism in Asia is highest in China, India, and Indonesia, where consumers continue to expect a quick recovery from the effects of COVID-19.

These exhibits are based on survey data collected in Australia, China, India, Indonesia, and Japan from September 4–30, 2020. Check back for regular updates on APAC consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Asian consumer sentiment during the coronavirus crisis

McKinsey Survey: Asian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In Turkey, consumers’ income and household finances have been affected by COVID-19. A majority of Turkish consumers are concerned about personal health, the economy, and the duration of the crisis. Both the observed effects and the uncertainty around the situation are manifesting as decreased spending across most categories. A spike in online spending on household essentials and entertainment is expected to continue, at least in the short term.

These exhibits are based on survey data collected in Turkey from April 7–9, 2020. Check back for regular updates on Turkish consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Turkish consumer sentiment during the coronavirus crisis

McKinsey Survey: Turkish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In Qatar, the prevailing sentiment is uncertainty about the health of family members and the duration of the COVID-19 crisis. Although consumers are optimistic about the country’s economic recovery after the COVID-19 situation subsides, they are cutting their spending on almost all categories. During the crisis, consumers have both adopted and increased their usage of digital activities such as remote learning, videoconferencing, and contactless delivery and pickup of food and supplies.

These exhibits are based on survey data collected in Qatar from April 24–May 1, 2020. Check back for regular updates on Qatari residents’ consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Qatari consumer sentiment during the coronavirus crisis

McKinsey Survey: Qatari consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

The prevailing sentiment among Polish consumers is similar to those in other European countries, with uncertainty about health and the economy as the biggest concerns. With over half of Poles expecting their income to decrease, we observe a sharp decline in consumers’ intentions to purchase discretionary products, especially in-store. It is also important to note that the majority of Poles expect their finances and personal routines to be impacted for more than four months.

These exhibits are based on survey data collected in Poland from April 2–5, 2020. Check back for regular updates on Polish consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Polish consumer sentiment during the coronavirus crisis

McKinsey Survey: Polish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Mexican consumers continue to be worried about their economy during the COVID-19 crisis, with optimism about a recovery climbing slowly.

These exhibits are based on survey data collected in Mexico from February 20–March 2, 2021. Check back for regular updates on Mexican consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Mais procurados (20)

McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: French consumer sentiment during the coronavirus crisis

McKinsey Survey: French consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: European consumer sentiment during the coronavirus crisis

McKinsey Survey: European consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: Belgian consumer sentiment during the coronavirus crisis

McKinsey Survey: Belgian consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Colombian consumer sentiment during the coronavirus crisis

McKinsey Survey: Colombian consumer sentiment during the coronavirus crisis

McKinsey Survey: Central American consumer sentiment during the coronavirus c...

McKinsey Survey: Central American consumer sentiment during the coronavirus c...

McKinsey Survey: Indian consumer sentiment during the coronavirus crisis

McKinsey Survey: Indian consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Asian consumer sentiment during the coronavirus crisis

McKinsey Survey: Asian consumer sentiment during the coronavirus crisis

McKinsey Survey: Turkish consumer sentiment during the coronavirus crisis

McKinsey Survey: Turkish consumer sentiment during the coronavirus crisis

McKinsey Survey: Qatari consumer sentiment during the coronavirus crisis

McKinsey Survey: Qatari consumer sentiment during the coronavirus crisis

McKinsey Survey: Polish consumer sentiment during the coronavirus crisis

McKinsey Survey: Polish consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

McKinsey Survey: Mexican consumer sentiment during the coronavirus crisis

20200330 asia covid 19 - grocery retail survey - indonesia v final-ds

20200330 asia covid 19 - grocery retail survey - indonesia v final-ds

McKinsey Survey: UK consumer sentiment during the coronavirus crisis

McKinsey Survey: UK consumer sentiment during the coronavirus crisis

Semelhante a McKinsey Survey: Argentinian consumer sentiment during the coronavirus crisis

Peruvian consumers are most concerned about taking care of their families, public health, and the economy during the COVID-19 crisis.

These exhibits are based on survey data collected in Peru from September 1–11, 2020. Check back for regular updates on Peruvian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisis

McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Since May 2020, more Canadians are feeling more pessimistic about the economic recovery and believe COVID-19 will have a lasting impact on the economy .

These exhibits are based on survey data collected in Canada from August 14–19, 2020. Check back for regular updates on Canadian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Canadian consumer sentiment during the coronavirus crisis

McKinsey Survey: Canadian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumer optimism in UAE has remained steady since mid-March, but spending patterns have changed.

These exhibits are based on survey data collected in the UAE from June 16–18, 2020. Check back for regular updates on UAE consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Chinese optimism has improved to the highest level since March. Most Chinese consumers expect their routines and finances to return to normal within three months.

These exhibits are based on survey data collected in China from September 16–24, 2020. Check back for regular updates on Chinese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumer optimism in Saudi Arabia has remained steady since mid-March, but spending patterns have changed to focus more on essential goods.

In KSA, a smaller proportion of consumers saw a decline in income and savings, but more than half continue to report a decline. The effect is seen in spending patterns and new habits adopted by consumers. Category spending indicates that consumers are stocking up in anticipation of the country’s upcoming tax increase on July 1, 2020. Consumers are not yet fully comfortable going back to “regular” out-of-home activities and are waiting for milestones beyond government lifting restrictions to return to normal patterns. Thus, they have started adopting new digital and low-touch activities, including grocery delivery.

These exhibits are based on survey data collected in KSA from June 16–18, 2020. Check back for regular updates on KSA consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Despite an ongoing lockdown, German consumers’ expectations for economic recovery are stable, with half believing their routines will return to normal by the end of 2021.

These exhibits are based on survey data collected in Germany from February 23–27, 2021. Check back for regular updates on German consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Despite an ongoing lockdown, German consumers’ expectations for economic recovery are stable, with half believing their routines will return to normal by the end of 2021.

These exhibits are based on survey data collected in Germany from February 23–27, 2021. Check back for regular updates on German consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Chinese consumers’ optimism hit a new high in October. More than 80 percent say they are returning to normal routines—and many embrace digital shopping.

These exhibits are based on survey data collected in China from October 15 to 22, 2021. Check back for regular updates on Chinese consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Saudi consumers remain optimistic about economic recovery, however they continue to spend less on discretionary items and more on essential goods.

These exhibits are based on survey data collected in Saudi Arabia from January 25 to February 10, 2021. Check back for regular updates on Saudi consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Australian consumers, in view of the omicron variant, are feeling less optimistic about economic recovery than last year and remain cautious on spending.

In Australia, optimism about economic recovery has declined since the November 2020 pulse survey but remains higher than at the onset of the COVID-19 pandemic. Six in ten consumers predict routines will return to normal only after June 2022; two-thirds do not plan to splurge in 2022. Although Australian households increased their spending in the past month, net intent to spend remains negative. Digital and omnichannel adoption continues in most categories, and intent to use out-of-home services rose. Seventy-five percent of consumers have addressed the rise of omicron by changing how they engage in out-of-home activities. Most consumers have tried a different brand or retailer, especially to switch brands in pursuit of value.McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Optimism and spend intent returning

Consumer optimism regarding economic conditions after COVID-19 up by more than 50% since February (from 21% to 34%); strongest growth in spend intent for out-of-home entertainment and travel, but most categories are increasingMcKinsey Survey: Italian consumer sentiment during the coronavirus crisis

McKinsey Survey: Italian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

As containment measures have been lifted, Australian consumers’ optimism has returned to April levels, though spending intent is still negative.

These exhibits are based on survey data collected in Australia from Sep 4–7, 2020. Check back for regular updates on Australian consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Australian consumers, in view of the omicron variant, are feeling less optimistic about economic recovery than last year and remain cautious on spending.

In Australia, optimism about economic recovery has declined since the November 2020 pulse survey but remains higher than at the onset of the COVID-19 pandemic. Six in ten consumers predict routines will return to normal only after June 2022; two-thirds do not plan to splurge in 2022. Although Australian households increased their spending in the past month, net intent to spend remains negative. Digital and omnichannel adoption continues in most categories, and intent to use out-of-home services rose. Seventy-five percent of consumers have addressed the rise of omicron by changing how they engage in out-of-home activities. Most consumers have tried a different brand or retailer, especially to switch brands in pursuit of value.McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Consumer optimism regarding the United Arab Emirates’ economic recovery has increased significantly, but overall spending remains low as consumers adopt ways to save more.

These exhibits are based on survey data collected in the UAE from January 25 to February 10, 2021. Check back for regular updates on UAE consumer sentiments, behaviors, income, spending, and expectations.McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

In Spain, consumer optimism about the economy has doubled since February 2021, reaching 33 percent. Consumers indicated greater intent to spend, and almost half intended to splurge this year. At equal rates of 60 percent, Spanish consumers said they are omnichannel shoppers and have returned to participating in out-of-home activities (way up from 20 percent in February 2021). More than four in ten reported changing brands, mainly for price. Over one-third said more of their holiday shopping would be online in 2021 than in 2020, and about 40 percent said they would start shopping earlier.McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Semelhante a McKinsey Survey: Argentinian consumer sentiment during the coronavirus crisis (20)

McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisis

McKinsey Survey: Peruvian consumer sentiment during the coronavirus crisis

McKinsey Survey: Canadian consumer sentiment during the coronavirus crisis

McKinsey Survey: Canadian consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

20200407 asia covid 19 - grocery retail survey - japan v final-ds v2

20200407 asia covid 19 - grocery retail survey - japan v final-ds v2

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: German consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: Chinese consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: US consumer sentiment during the coronavirus crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Saudi consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Italian consumer sentiment during the coronavirus crisis

McKinsey Survey: Italian consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Australian consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Emirati consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

McKinsey Survey: Spanish consumer sentiment during the coronavirus crisis

Mais de McKinsey on Marketing & Sales

Spanish consumers are pessimistic about the economy. Rising prices, unemployment, and the invasion of Ukraine are top concerns, and consumers are trading down.

In Spain, consumers are most concerned about rising prices, unemployment, and the invasion of Ukraine. Their views of the current and future state of the economy remain pessimistic, at a level comparable to attitudes in the early months of the COVID-19 pandemic. Spend for groceries and gasoline soared, while consumers reduced money directed to savings and spent less on non-essentials. Of the 80 percent of consumers who have assumed new shopping behaviors in the last three months in search of value for money, more than half tried private labels. Trade-down in retailers visited and brands is evident, with the key drivers of choice being prices and value for money. However, 39 percent of consumers say they plan to splurge in 2022.McKinsey European consumer sentiment survey: How current events are shaping S...

McKinsey European consumer sentiment survey: How current events are shaping S...McKinsey on Marketing & Sales

UK consumers are pessimistic about the economy. Rising prices and the invasion of Ukraine are top concerns, and consumers are trading down significantly.

In the United Kingdom, consumers are most concerned about rising prices and the invasion of Ukraine. Their views of the current and future state of the economy are extremely pessimistic, worse than throughout the entire COVID-19 pandemic. Spend for groceries and gasoline soared, while consumers reduced spend in non-essential categories. Almost two-thirds of consumers have assumed new shopping behaviors in the last four to six weeks, with more than four out of ten trying private label. Trade-down in retailers visited and brands is evident, with the key drivers of choice being prices and value for money.McKinsey European consumer sentiment survey: How current events are shaping U...

McKinsey European consumer sentiment survey: How current events are shaping U...McKinsey on Marketing & Sales

COVID-19 is no longer among Italian consumers’ top concerns. Consumers remain pessimistic about economic recovery and inflation; many aim to reduce their spend.

Italian consumers are increasingly worried about the effects of rising prices and the invasion of Ukraine. Unemployment is a number-two concern for respondents in Gen Z, millennials, and the low-income group. Almost six out of ten share a negative view of Italy’s current economic state; hopes for an economic recovery are lower than during the entire COVID-19 pandemic. Consumers observed the highest price increases in groceries and gasoline. To cope with inflation, Italian consumers are changing their purchase behavior, shifting toward discounters and private labels. The leading factors for these choices are prices and value for money.McKinsey European consumer sentiment survey: How current events are shaping I...

McKinsey European consumer sentiment survey: How current events are shaping I...McKinsey on Marketing & Sales

German consumers are pessimistic about the economy. Rising prices and the invasion of Ukraine are top concerns, and we see a significant down-trade in shopping.

In Germany, consumers’ top concerns are rising prices and the invasion of Ukraine, followed by climate change and COVID-19. Pessimism about the current and future state of the economy has eased but remains at a level comparable to attitudes in the early months of the COVID-19-pandemic. As spend for groceries and gasoline soared, consumers reduced money directed to savings and spent less on non-essentials. Of the 70 percent of consumers who have assumed new shopping behaviors in the last three months, more than four out of ten tried private labels. Trade-down in stores visited and brands is clearly visible, with the key drivers of choice being prices and value for money. However, 46 percent of consumers say they plan to splurge in 2022.McKinsey European consumer sentiment survey: How current events are shaping G...

McKinsey European consumer sentiment survey: How current events are shaping G...McKinsey on Marketing & Sales

For consumers in France, inflation eclipses other sources of concern. It triggers changes in shopping behaviors as consumers seek better value for money.

French consumers’ optimism regarding the economic recovery is stable at around 14 percent—a level last seen in the depths of COVID-19 lockdowns. Top sources of concern are rising prices (cited by 54 percent), followed by the invasion of Ukraine (13 percent) and climate change (10 percent) and far ahead of COVID-19 (4 percent). Nine out of ten survey respondents perceive high price inflation in the country. These trends have implications for brand and retailer loyalty: of the 73 percent of respondents saying they have tried new shopping behaviors in the last three months, 40 percent say they purchased private labels. Household products remain the category most affected by this trading-down trend.McKinsey European consumer sentiment survey: How current events are shaping F...

McKinsey European consumer sentiment survey: How current events are shaping F...McKinsey on Marketing & Sales

Japanese consumers’ behaviors and finances are gradually recovering to normal, though their responses indicate a slight increase in pessimism. The long-lasting impact of COVID-19 is prolonging Japanese consumers’ intent to stay conservative about spending across categories. In a further sign of cautiousness, the trend of shrinking pessimism over the past few years reversed for the first time. Meanwhile, people’s demand for travel is rising, considering the next seasonal vacations.McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Indian consumers’ optimism has remained high since October 2021 and has reached the highest levels across other Asian markets since COVID-19 started.

Nearly three-quarters of India’s consumers are optimistic about economic recovery, and net intent to spend is growing and positive across many categories. Omnichannel usage continues across the majority of categories, and social-media influence is high, especially for Gen Z and millennials. More than 90 percent are engaging in social media and entertainment platforms. There is an upward trend for new technology, such as crypto and augmented reality/virtual reality, and consumers intend to continue digital activities as the COVID-19 crisis subsides.

About 40 percent of consumers are engaging in out-of-home activities, especially among the vaccinated segment. Most consumers have tried new shopping behaviors such as new retail outlets and new brands.McKinsey Survey: Indian consumer sentiment during the coronavirus crisis

McKinsey Survey: Indian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Indonesian consumers remain optimistic on the economy, expecting higher incomes and spending. Many tried and plan to keep using digital services and omnichannel methods.

In Indonesia, optimism about future economic conditions increased more than 25 percent over September 2020 from an already high base, boosted by planning for the upcoming holiday season. Eight out of ten consumers say they will dine out, shop for gifts, and redecorate. Out-of-home activities are generally rising but remain far below prepandemic levels. Optimism about the economy is tempered by views of household finances; half predict finances won’t return to normal before June. The loyalty shake-up continues, with 60 percent citing value as their primary reason to try a new brand. New digital behaviors are starting to show evidence of stickiness: 60 percent say they intend to use new shopping methods when the pandemic subsides.McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

Most Korean consumers expect that normalcy will return to routines only after June 2022, yet there are signs of pre-COVID-19 routines returning.

Korean customers have been less optimistic than those in other countries about the economic recovery. But optimism in Korea is much higher now than two years ago. Half of consumers indicate a desire to splurge, with intent to do so being the strongest in Gen Z and millennials. One-eighth of consumers say they have returned to out-of-home activities.McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisisMcKinsey on Marketing & Sales

As inflation rises, French consumer hopes for economic recovery wane, with optimism sinking back to the lows of lockdown.

Optimism regarding the economic recovery has decreased to 14 percent in France—levels last seen in the depths of COVID-19 lockdown. Top sources of concern are rising prices, the invasion of Ukraine, and political uncertainty. Nine out of ten survey respondents perceive high price inflation in the country, and 60 percent expect prices to rise further over the next year. These trends have implications for loyalty: in the search for higher purchasing power, 69 percent of respondents have tried new shopping behaviors in the last four to six weeks. Household products remain the most impacted category, with 65 percent of consumers switching for cheaper options.McKinsey European consumer sentiment survey: How current events are shaping F...

McKinsey European consumer sentiment survey: How current events are shaping F...McKinsey on Marketing & Sales

Pessimism about recovery is at an all-time high in the United Kingdom. Rising prices are the top concern, with consumers significantly trading down in stores and products. UK consumers are feeling great economic uncertainty. With energy and transport costs eating away at consumer savings and non-food spend, the top reasons given by survey participants for economic anxiety are the gas supply, supply-chain shortages, and energy issues. Consumers report the highest perceived price increases in groceries and household supplies, with two-thirds becoming more conscious about energy usage. Half of consumers changed their grocery brands in the last four to six weeks, with trading down a clear trend: price and value were the strongest drivers here. McKinsey European consumer sentiment survey: How current events are shaping U...

McKinsey European consumer sentiment survey: How current events are shaping U...McKinsey on Marketing & Sales

Rising prices and the Ukraine invasion are top concerns for German consumers, fueling a general slide into economic pessimism.

German consumers are experiencing intense unease regarding the state of the economy and its future outlook—with public sentiment sinking lower than at any time during the COVID-19 pandemic. Survey participants felt the greatest concern about rising prices and the invasion of Ukraine. Spend on groceries and gasoline has soared, even as consumers cut spending in non-essential categories. Almost two-thirds have assumed new shopping behaviors in the last four to six weeks, with more than forty percent trying private-label brands. There’s a clear trade-down trend in stores visited and brands chosen, with prices and value for money as key drivers. McKinsey European consumer sentiment survey: How current events are shaping G...

McKinsey European consumer sentiment survey: How current events are shaping G...McKinsey on Marketing & Sales

Across the continent, the pattern holds: Europeans are anxious about the state of their countries’ economies, and worried about the future. Russia’s invasion of Ukraine and price inflation overshadow other concerns, and consumer anxieties in turn are impacting confidence in household finances and national economies, especially among vulnerable populations.

Worried about spending more on food, transport and fuel, consumers report cutting back on less essential items. Most say they’ve changed their shopping behaviors in recent months, trading down to more affordable brands and retailers. With no relief clearly in sight, 2022 continues to prove a challenging year for the continental consumer.McKinsey European consumer sentiment survey: How current events in Europe are...

McKinsey European consumer sentiment survey: How current events in Europe are...McKinsey on Marketing & Sales

Spanish consumers are primarily concerned about inflation and the invasion of Ukraine, and are becoming increasingly pessimistic about the economy.

Only 14 percent of Spanish consumers are optimistic about economic recovery, with concerns focused on inflation and the invasion of Ukraine. Four in ten have an increasingly negative sense of the economic outlook—mostly due to petrol and supply-chain shortages, as well as unemployment. Price-increase Perceptions of price increases are particularly high regarding groceries (at 95 percent) and other household products. In these categories, more than half of respondents have reacted to inflation by trying less costly brands. Over the last six weeks, half have tried a private-label brand, 30 percent have switched brands, and a quarter have tried out a different retailer.McKinsey European consumer sentiment survey: How current events are shaping S...

McKinsey European consumer sentiment survey: How current events are shaping S...McKinsey on Marketing & Sales

Italian consumers are increasingly pessimistic about the economy, with many aiming to reduce spending and modify consumption habits.

Italian consumers are increasingly worried about the effects of rising prices, as well as the invasion of Ukraine. Of Italians surveyed, six in ten expressed a negative view of the current economy; hopes for an economic recovery are lower than they were throughout the entire COVID-19 pandemic. Consumers perceived the highest price increases in groceries and fuel, along with strong increase in spend. These sentiments have translated into reduced consumption. Changed consumer behavior is also apparent, with a shift towards discounters and private-label brands. Price, value for money and availability are the biggest drivers of these choices.McKinsey European consumer sentiment survey: How current events are shaping I...

McKinsey European consumer sentiment survey: How current events are shaping I...McKinsey on Marketing & Sales

Rising prices and the Ukraine invasion are top concerns for German consumers, fueling a general slide into economic pessimism.

German consumers are experiencing intense unease regarding the state of the economy and its future outlook—with public sentiment sinking lower than at any time during the COVID-19 pandemic. Survey participants felt the greatest concern about rising prices and the invasion of Ukraine. Spend on groceries and gasoline has soared, even as consumers cut spending in non-essential categories. Almost two-thirds have assumed new shopping behaviors in the last four to six weeks, with more than forty percent trying private-label brands. There’s a clear trade-down trend in stores visited and brands chosen, with prices and value for money as key drivers. McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...McKinsey on Marketing & Sales

As inflation rises, French consumer hopes for economic recovery wane, with optimism sinking back to the lows of lockdown. Optimism regarding the economic recovery has decreased to 14 percent in France—levels last seen in the depths of COVID-19 lockdown. Top sources of concern are rising prices, the invasion of Ukraine, and political uncertainty. Nine out of ten survey respondents perceive high price inflation in the country, and 60 percent expect prices to rise further over the next year. These trends have implications for loyalty: in the search for higher purchasing power, 69 percent of respondents have tried new shopping behaviors in the last four to six weeks. Household products remain the most impacted category, with 65 percent of consumers switching for cheaper options.McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...McKinsey on Marketing & Sales

Pessimism about recovery is at an all-time high in the United Kingdom. Rising prices are the top concern, with consumers significantly trading down in stores and products. UK consumers are feeling great economic uncertainty. With energy and transport costs eating away at consumer savings and non-food spend, the top reasons given by survey participants for economic anxiety are the gas supply, supply-chain shortages, and energy issues. Consumers report the highest perceived price increases in groceries and household supplies, with two-thirds becoming more conscious about energy usage. Half of consumers changed their grocery brands in the last four to six weeks, with trading down a clear trend: price and value were the strongest drivers here. McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...McKinsey on Marketing & Sales

Spanish consumers are primarily concerned about inflation and the invasion of Ukraine, and are becoming increasingly pessimistic about the economy.

Only 14 percent of Spanish consumers are optimistic about economic recovery, with concerns focused on inflation and the invasion of Ukraine. Four in ten have an increasingly negative sense of the economic outlook—mostly due to petrol and supply-chain shortages, as well as unemployment. Price-increase Perceptions of price increases are particularly high regarding groceries (at 95 percent) and other household products. In these categories, more than half of respondents have reacted to inflation by trying less costly brands. Over the last six weeks, half have tried a private-label brand, 30 percent have switched brands, and a quarter have tried out a different retailer.McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...McKinsey on Marketing & Sales

Italian consumers are increasingly pessimistic about the economy, with many aiming to reduce spending and modify consumption habits.

Italian consumers are increasingly worried about the effects of rising prices, as well as the invasion of Ukraine. Of Italians surveyed, six in ten expressed a negative view of the current economy; hopes for an economic recovery are lower than they were throughout the entire COVID-19 pandemic. Consumers perceived the highest price increases in groceries and fuel, along with strong increase in spend. These sentiments have translated into reduced consumption. Changed consumer behavior is also apparent, with a shift towards discounters and private-label brands. Price, value for money and availability are the biggest drivers of these choices.McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...McKinsey on Marketing & Sales

Mais de McKinsey on Marketing & Sales (20)

McKinsey European consumer sentiment survey: How current events are shaping S...

McKinsey European consumer sentiment survey: How current events are shaping S...

McKinsey European consumer sentiment survey: How current events are shaping U...

McKinsey European consumer sentiment survey: How current events are shaping U...

McKinsey European consumer sentiment survey: How current events are shaping I...

McKinsey European consumer sentiment survey: How current events are shaping I...

McKinsey European consumer sentiment survey: How current events are shaping G...

McKinsey European consumer sentiment survey: How current events are shaping G...

McKinsey European consumer sentiment survey: How current events are shaping F...

McKinsey European consumer sentiment survey: How current events are shaping F...

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Japanese consumer sentiment during the coronavirus crisis

McKinsey Survey: Indian consumer sentiment during the coronavirus crisis

McKinsey Survey: Indian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey: Survey: Indonesian consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey Survey: Korean consumer sentiment during the coronavirus crisis

McKinsey European consumer sentiment survey: How current events are shaping F...

McKinsey European consumer sentiment survey: How current events are shaping F...

McKinsey European consumer sentiment survey: How current events are shaping U...

McKinsey European consumer sentiment survey: How current events are shaping U...

McKinsey European consumer sentiment survey: How current events are shaping G...

McKinsey European consumer sentiment survey: How current events are shaping G...

McKinsey European consumer sentiment survey: How current events in Europe are...

McKinsey European consumer sentiment survey: How current events in Europe are...

McKinsey European consumer sentiment survey: How current events are shaping S...

McKinsey European consumer sentiment survey: How current events are shaping S...

McKinsey European consumer sentiment survey: How current events are shaping I...

McKinsey European consumer sentiment survey: How current events are shaping I...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

McKinsey survey: European consumer sentiment survey: How current events are s...

Último

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

Último (20)

Ooty Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Avail...

Ooty Call Gril 80022//12248 Only For Sex And High Profile Best Gril Sex Avail...

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

PARK STREET 💋 Call Girl 9827461493 Call Girls in Escort service book now

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Berhampur 70918*19311 CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Challenges and Opportunities: A Qualitative Study on Tax Compliance in Pakistan

Puri CALL GIRL ❤️8084732287❤️ CALL GIRLS IN ESCORT SERVICE WE ARW PROVIDING

Puri CALL GIRL ❤️8084732287❤️ CALL GIRLS IN ESCORT SERVICE WE ARW PROVIDING

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Bangalore Call Girl Just Call♥️ 8084732287 ♥️Top Class Call Girl Service Avai...

Bangalore Call Girl Just Call♥️ 8084732287 ♥️Top Class Call Girl Service Avai...

Nanded Call Girl Just Call 8084732287 Top Class Call Girl Service Available

Nanded Call Girl Just Call 8084732287 Top Class Call Girl Service Available

HomeRoots Pitch Deck | Investor Insights | April 2024

HomeRoots Pitch Deck | Investor Insights | April 2024

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: Empowering Your Business Growth

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Berhampur Call Girl Just Call 8084732287 Top Class Call Girl Service Available

Berhampur Call Girl Just Call 8084732287 Top Class Call Girl Service Available

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Durg CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN durg ESCORTS

Durg CALL GIRL ❤ 82729*64427❤ CALL GIRLS IN durg ESCORTS

McKinsey Survey: Argentinian consumer sentiment during the coronavirus crisis

- 1. McKinsey & Company 1 Pessimism has grown in Argentina, while uncertainty remains the dominant sentiment 21% 23% 35% 54% 52% 45% 25% 25% 21% Confidence in own country’s economic recovery after COVID-191 % of respondents Unsure: The economy will be impacted for 6–12 months or longer and will stagnate or show slow growth thereafter Pessimistic: COVID-19 will have lasting impact on the economy and show regression/fall into lengthy recession Optimistic: The economy will rebound within 2–3 months and grow just as strong as or stronger than before COVID-19 1 Q: How is your overall confidence level in economic conditions after the COVID-19 situation? Rated from 1 “very optimistic” to 6 “very pessimistic”; figures may not sum to 100% because of rounding. Source: McKinsey & Company COVID-19 Argentina Consumer Pulse Survey 9/1–9/11/2020, n = 1,007; 4/29–5/3/2020, n = 1,014; 4/7–4/12/2020, n = 1,014, sampled and weighted to match Argentina’s general population 18+ years Apr 7–13 Argentina May 1–4 Sep 1–11

- 2. McKinsey & Company 2 Consumers remain careful about spending, with most consumers delaying purchases and cutting back Overall sentiment in the general population in Argentina1 % of respondents 1 Q: Please indicate how strongly you agree or disagree with each of the following statements. Please select only one response for each statement; figures may not sum to 100% because of rounding. 2 Measures difference in “strongly agree / agree” between current and last pulse survey. 47% 25% 21% 16% 15% 27% 39% 36% 38% 36% 37% 33% 29% 26% 36% 43% 46% 49% 57% 60% 67% 7% 6% 3% Strongly disagree / disagree Somewhat disagree / agree Strongly agree / agree Strongly agree/ agree difference since last survey2 Source: McKinsey & Company COVID-19 Argentina Consumer Pulse Survey 9/1–9/11/2020, n = 1,007; 4/29–5/3/2020, n = 1,014, sampled and weighted to match Argentina’s general population 18+ years I have been personally affected by the coronavirus or COVID-19 I am very concerned about losing my job My ability to work has been reduced by coronavirus or COVID-19 My ability to make financial ends meet has been negatively impacted by coronavirus or COVID-19 My income has been negatively impacted by coronavirus or COVID-19 Uncertainty about the economy is preventing me from making purchases or investments that I would otherwise make Given the economy and my personal finances, I have to be very careful how I spend my money I am cutting back on my spending -1 -12 -15 -12 -9 -3 -7 -11

- 3. McKinsey & Company 3 Household income1,2 % of respondents Reduce slightly / reduce a lot About the same Increase slightly / increase a lot Past 2 weeks Past 2 weeks 4% 6% 24% 51% 72% 43% 10% 57% 33% Next 2 weeks 1 Q: How has the COVID-19 situation affected your (family’s) overall available income, spending, and savings in the past two weeks? Figures may not sum to 100% because of rounding. 2 Q: How do you think your overall available income, spending, and savings may change in the next two weeks? Figures may not sum to 100% because of rounding. While consumers see more stabilization in their personal finances compared to May, most experienced reduction in income and savings Household spending1,2 % of respondents 44% 36% 29% 22% 42% 28% Past 2 weeks Past 2 weeks 35% 46% 19% Next 2 weeks May 1–4 September 1–11 May 1–4 September 1–11 Household savings1,2 % of respondents 54% 77% Past 2 weeks 9% 67% 15% 11% 22% Past 2 weeks 10% 36% Next 2 weeks May 1–4 September 1–11 Source: McKinsey & Company COVID-19 Argentina Consumer Pulse Survey 9/1–9/11/2020, n = 1,007; 4/29–5/3/2020, n = 1,014, sampled and weighted to match Argentina’s general population 18+ years

- 4. McKinsey & Company 4 Purchase intent remains negative across most categories, except for groceries, household supplies, personal-care, and home entertainment 8 29 24 29 33 44 48 78 47 62 54 18 8 10 35 59 20 8 13 18 11 9 10 11 6 8 16 18 13 9 11 2 Groceries Snacks Non-food child products Tobacco products Food takeout & delivery Quick-service restaurant Alcohol Restaurant Footwear Apparel Personal-care products Jewelry Accessories Household supplies Skin care & makeup Furnishings & appliances Expected spending per category over the next two weeks compared to usual1 % of respondents Decrease Stay the same Increase 9 40 54 64 29 36 39 28 50 46 55 57 69 58 70 71 19 10 10 9 9 15 8 15 14 11 8 14 9 9 6 5 Entertainment at home Out-of-home entertainment Hotel/resort stays Books/magazines/newspapers Fitness & wellness Consumer electronics Pet-care services Personal-care services International flights Gasoline Vehicle purchases Cruises Short-term home rentals Travel by car Adventures & tours Domestic flights Net intent2 1 Q: Over the next two weeks, do you expect that you will spend more, about the same, or less money on these categories than usual? Figures may not sum to 100% because of rounding. 2 Net intent is calculated by subtracting the % of respondents stating they expect to decrease spending from the % of respondents stating they expect to increase spending. +10 -30 -45 -55 -20 -20 -31 -13 -36 -35 -47 -43 -59 -49 -64 -65 Net intent2 +12 -2 +10 -48 -21 -11 -11 -22 -35 -38 -76 -36 -56 -46 +3 -26 Source: McKinsey & Company COVID-19 Argentina Consumer Pulse Survey 9/1–9/11/2020, n = 1,007, sampled and weighted to match Argentina’s general population 18+ years