International Standards on Auditing for Cayman Funds (2016)

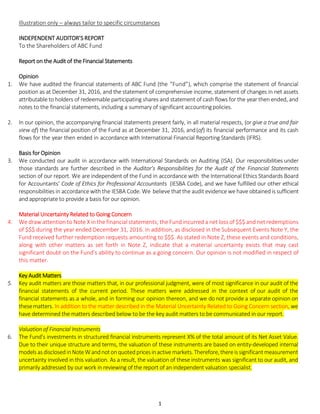

- 1. 1 Illustration only – always tailor to specific circumstances INDEPENDENT AUDITOR’S REPORT To the Shareholders of ABC Fund Report on the Audit of the Financial Statements Opinion 1. We have audited the financial statements of ABC Fund (the “Fund”), which comprise the statement of financial position as at December 31, 2016, and the statement of comprehensive income, statement of changes in net assets attributable to holders of redeemable participating shares and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies. 2. In our opinion, the accompanying financial statements present fairly, in all material respects, (orgive a true and fair view of) the financial position of the Fund as at December 31, 2016, and(of) its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRS). Basis for Opinion 3. We conducted our audit in accordance with International Standards on Auditing (ISA). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Fund in accordance with the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants (IESBA Code), and we have fulfilled our other ethical responsibilities in accordance with the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Material Uncertainty Related to Going Concern 4. We draw attention to Note X in the financial statements; the Fund incurred a net loss of $$$ and net redemptions of $$$ during the year ended December 31, 2016. In addition, as disclosed in the Subsequent Events Note Y, the Fund received further redemption requests amounting to $$$. As stated in Note Z, these events and conditions, along with other matters as set forth in Note Z, indicate that a material uncertainty exists that may cast significant doubt on the Fund’s ability to continue as a going concern. Our opinion is not modified in respect of this matter. Key Audit Matters 5. Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on thesematters. In addition to the matter described in the Material Uncertainty Related to Going Concern section, we have determined the matters described below to be the key audit matters to be communicated in our report. Valuation of Financial Instruments 6. The Fund’s investments in structured financial instruments represent X% of the total amount of its Net Asset Value. Due to their unique structure and terms, the valuation of these instruments are based on entity-developed internal models asdisclosedinNoteWandnotonquotedpricesinactivemarkets.Therefore,thereissignificantmeasurement uncertainty involved in this valuation. As a result, the valuation of these instruments was significant to our audit, and primarily addressed by our work in reviewing of the report of an independent valuation specialist.

- 2. 2 Emphasis of Matter 7. We draw attention to Note Y of the financial statements, which describes the material value of redemption requests received by the Fund subsequent to the year end, as a result of which the Fund has imposed a gate on redemptions. Our opinion is not modified in respect of this matter. Other Information 8. Management is responsible for the other information. The other information comprises the [Directors’ Report], but does not include the financial statements and our auditor’s report thereon, which we obtained prior to the date of this auditor’s report, and the [Investment Manager’s Report], which is expected to be made available to us after that date. 9. Our opinion on the financial statements does not cover the other information and we do not [and will not] express any form of assurance conclusion thereon. 10. In connection with our audit of the financial statements, our responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. 11. If, based on the work we have performed on the other information that we obtained prior to the date of this auditor’s report, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard. 12. When we read the [Investment Manager’s Report], if we conclude that there is a material misstatement therein, we are required to communicate the matter to those charged with governance and [describe actions applicable in the jurisdiction.] Responsibilities of Management and Those Charged with Governance for the Financial Statements 13. Management is responsible for the preparation and fair presentation of the financial statements in accordance with IFRS, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. 14. In preparing the financial statements, management is responsible for assessing the Fund’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Fund or to cease operations, or has no realistic alternative but to doso. 15. Those charged with governance are responsible for overseeing the Fund’s financial reporting process. Auditor’s Responsibilities for the Audit of the Financial Statements 16. Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISA will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financialstatements.

- 3. 3 17. [A further description of the auditor’s responsibilities for the audit of the financial statements is located at [Organisation’s] website at: [website link]. This description forms part of our auditor’s report.] 18. As part of an audit in accordance with ISA, we exercise professional judgment and maintain professional scepticism throughout the audit. Wealso: i. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. ii. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control. iii. Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. iv. Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Fund’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Fund to cease to continue as a going concern. v. Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation. vi. [Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.] 19. We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards. 20. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. 21. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances,we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. 22. Report on Other Legal and Regulatory Requirements…

- 4. 4 Other Matter 23. This report, including the opinion, has been prepared for and only for the Fund’s shareholders as a body and for no other purpose. We do not, in giving this opinion, accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come. 24. The engagement partner on the audit resulting in this independent auditor’s report is [name]. 25. Signature in the name of the audit firm [or personal name of the auditor, or both, as appropriate for the particular jurisdiction] 26. Auditor Address 27. Date

- 5. David Walker Candice Czeremuszkin Etienne Jensen-Fontaine 18 October 2016 International Standards on Auditing (2016) with a focus on Cayman Funds 1

- 6. DISCLAIMER CIIPA and the presenters disclaim any responsibility or liability resulting from the use and application of this presentation. 2

- 7. AGENDA 1. Audit Planning Considerations 2. Internal Controls & Risk Assessment Considerations 3. Auditing Specific Accounting Cycles 4. Audit Completion, New & Revised Auditor Reporting Standards 3

- 9. AUDIT PLANNING CONSIDERATIONS Service Providers Engagement (Re-) Acceptance Requirements & Deliverables New Requirements Fraud & Risk Assessments Preliminary Analytical Review Deadlines & Timetable Audit Planning & Documentation 5

- 10. • Audit planning meeting • Fund structure, ownership and related parties • Inherent risks of the Fund’s FS assertions • Controls implemented over the FS assertions • Internal controls and any changes • FS format for the current year, and any issues such as: ‒ Expected modifications to the audit report ‒ Non-standard or subjective disclosures ‒ Consider IAS 1 (Revised) effective for periods ≥ 1 Jan 2016 ‒ ISA’s revised by IAASB Disclosures project effective for periods ≥ 15 Dec 2016 ‒ Valuation and liquidity risks and estimates ‒ Significant legal issues or expenses ‒ Any lock-up periods, NAV suspension, gates ‒ Going concern assessment, and any known subsequent events 6 AUDIT PLANNING CONSIDERATIONS

- 11. AUDIT PLANNING CONSIDERATIONS • Applicability of any prior year audit issues • Staffing & staff supervision • What controls may be relied upon effectively • Related party transactions and disclosures • Support for the valuation and disclosures of Level 3 investments • NAV restatements or estimated values • Investor side-letters, side pockets, complaints, capital transactions pending, missing due diligence • Board minutes & resolutions & latest offering documents • Plan and execute necessary audit confirmation requests • Going concern assessment • Communication with Those Charged with Governance 7

- 12. AUDIT PLANNING CONSIDERATIONS: LAWS & REGULATIONS (ISA 250) RiskResponse ReportingRiskAssessment • Is material non-compliance disclosed/reported if required? • Report to Those Charged with Governance • Obtain management representations • Identify any non- compliance • Discuss with management, if appropriate • Evaluate impact • Legal & regulatory framework for funds • How entity is complying? • Inquire about compliance • Review regulatory correspondence 8

- 13. AUDIT PLANNING CONSIDERATIONS: LAWS & REGULATIONS • IAASB (2015) Handbook of International Quality Control, Auditing, Other Assurance, and Related Service Pronouncements IAASB.org • IESBA Code of Ethics for Professional Accountants • Directors Registration and Licensing Law, 2014 • Companies Law (2016 Revision), Mutual Funds Law (2015 Revision) • Mutual Funds (Annual Returns) Regulations (Revised) • The Confidential Information Disclosure Law, 2016 • Proceeds of Crime Law (2016 Revision) • Money Laundering Regulations (2013 Revision) • Financial Reporting Authority (CAYFIN) FRA.gov.ky • Judicial.ky/Laws/Cayman-Enacted • CImoney.com.ky/Regulatory_Framework/default.aspx?id=358 9

- 14. AUDIT PLANNING CONSIDERATIONS: DRAFT LAWS & REGULATIONS • IAASB.org/Projects • The Accountants (Quality Assurance) Regulations, 2016 • The Accountants (Disciplinary) Regulations, 2016 • The Accountants (Application, Renewal and Fees) Regulations, 2016 • The Auditors Oversight (Amendment) Bill, 2016 • The Monetary Authority (Amendment) Bill, 2016 • IFRS Conceptual Framework for Financial Reporting, ED/2015/3 • IFRS Practice Statement: Application of Materiality to Financial Statements, ED/2015/8. • gov.ky/portal/page/portal/gazhome/publications/extraordinary- gazettes-supplements/2016 10

- 15. AUDIT PLANNING CONSIDERATIONS: RELATED PARTIES ReportingRiskAssessment • Has sufficient appropriate evidence been obtained? • Does a material misstatement exist? • Is financial statement disclosure adequate? • Obtain management representations. Report on any findings. • Any indication of undisclosed related parties? • Obtain support for management’s assertions about the nature, extent, and purpose of transactions • If consider significance, measurement and recognition of transactions, as well as any fraud risk • Identify related parties, including and any changes • Understand nature, extent, & purpose of transactions • Consider potential for fraud • Remain alert for undisclosed related-party transactions 11RiskResponse

- 16. AUDIT PLANNING CONSIDERATIONS: WORKING WITH OTHER AUDITORS / REISSUES / LOCAL AUDIT SIGN-OFF ENGAGEMENTS • Involves different Audit Practitioners at different locations: • Cayman “Principal Auditor” signs audit report, where the Fund is domiciled; • “Other Auditor” in different jurisdiction where management or records based. • Cayman Practitioner: • Sign the Engagement Letter • Supervises Other Auditor • Review Other Auditor’s work • Cayman auditor involvement in audit planning, risk assessment and review: ‒ Which auditor is responsible for communication to the Directors? ‒ Can the auditors effectively collaborate to meet the client deadline? ‒ Does the “Other auditor” have adequate funds audit experience? 12

- 17. ISA 600 — Special Considerations: Audits of Group Financial Statements (Including the Work of Component Auditors) ISA 220, Quality Control for an Audit of Financial Statements: • Applies to all audit engagements conducted under ISA. ISQC 1: Applies to all firms conducting audits under ISA. ISA 600: May also be useful for other situations where an auditor involves another auditor in some part of the audit of financial statements. • This could include… performing specific procedures at a remote location. IAASB Staff Audit Practice Alert (August 2015): RESPONSIBILITIES OF THE ENGAGEMENT PARTNER IN CIRCUMSTANCES WHEN THE ENGAGEMENT PARTNER IS NOT LOCATED WHERE THE MAJORITY OF THE AUDIT WORK IS PERFORMED • The auditor may find ISA 600, adapted as necessary in the circumstances, useful when the auditor involves other auditors in the audit of financial statements that are not group financial statements. 13

- 19. 2. Internal Controls & Risk Assessment Considerations 15

- 20. INTERNAL CONTROL & RISK ASSESSMENT If placing reliance on an internal controls assurance report: • Type two report with an unmodified opinion? • Free from relevant findings? • Are all critical controls tested? • Are the service auditors reputable? • For critical controls, review procedures, results, and assess the impact of any exceptions • Document the audit risk assessment and resultant audit approach AND/OR: Perform controls reliance testing. REMEMBER: Consider prior year audit adjustments and any other significant deficiencies. 16

- 21. • Confirmations • Proof-in-total roll- forward calculations • Substantive analytical review procedures • Tests of detail • Walkthroughs • Tests of control • Substantive procedures • May we rely on controls? • Service auditor’s report? • Risks of fraud? • Risks of errors? • Substantive analytical review? INTERNAL CONTROL & RISK ASSESSMENT: DOCUMENTATION Only rely on documented controls that are evidenced to work 17

- 22. INTERNAL CONTROL & RISK ASSESSMENT: SMALLER ENTITIES Certain relevant control activities at smaller entities might mitigate: • Significant risks • Risks that cannot easily be addressed by substantive procedures • Other risks of material misstatement Auditor’s judgment about whether a control is relevant to the audit is influenced by: • Knowledge of any other relevant control activities identified • The existence of multiple control activities that achieve the same objective • Increased efficiency from testing the operating effectiveness of certain key controls Control Activities in Smaller Entities Informal and Limited Documentation Limited Scope Risks May be Mitigated by the Control Environment 18

- 23. Internal Control & Risk Assessment: MANAGEMENT OVERRIDE Management override and fraudulent revenue recognition are presumed to be significant risks and as a result, there are certain audit procedures that would be performed in every audit. Procedures to Address Management Override Risk Examine: • Journal Entries • Estimates • Significant Transactions • Revenue Recognition 19

- 24. 2. Internal Controls & Risk Assessment Considerations QUESTIONS? 20

- 25. 3. Auditing Specific Accounting Cycles 21

- 26. Auditing Specific Accounting Cycles – OPENING BALANCES Obtain sufficient and appropriate audit evidence about whether: • Opening balances contain material misstatements, by • Agree prior year closing balances to current year opening balances; • Determine whether the opening balances reflect the application of appropriate accounting policies; and verify the opening balances by: • Review any predecessor auditor working papers; or • Evaluate relevant procedures performed in the current year; or • Perform specific procedures to obtain evidence regarding opening balances. • Any changes in Accounting policies are appropriately accounted for and adequately disclosed in accordance with IFRS. 22

- 27. Auditing Specific Accounting Cycles – CASH AND CASH EQUIVALENTS,& DUE FROM/TO BROKERS Document an understanding of controls Justify any reliance on controls Reconcile balances to lead schedules, FS and audit confirmations Investigate reconciling or unusual items Verify FX rates Verify credit facility limits, any breaches, any facility renewal dates Review offsetting disclosures for validity and transparency Review post year-end statements Evidence any charges over assets, restricted balances, collateral & related FS disclosures Recalculate cash flow statement workings 23

- 28. Auditing Specific Accounting Cycles: INVESTMENTS Assess any MANAGEMENT ESTIMATES for reasonableness and related FS disclosures DOCUMENT WHETHER ADDITIONAL WORK IS REQUIRED Review post-year end portfolio Confirm observable prices independently Audit any valuation techniques Consider additional procedures for significant related party transactions Confirm quantities with custodian Analytical review Investment roll forward calculation Obtained sufficient and appropriate audit evidence for Level 3 investments especially Audit the valuation, classification, levelling and risk disclosures Review any breaches of restrictions/policy/strategy Query any unusual investments or investment transactions 24

- 29. Auditing Specific Accounting Cycles: INVESTMENTS Document and justify any reliance on controls Reconcile balances to lead schedules, FS and audit confirmations Investigate reconciling or unusual items, and FX rates Auditing the Statement of comprehensive income • Interest & dividend income • Other net changes in FV on financial assets and liabilities at FVTPL Side pockets or designated investments Audit FS disclosures, including: • Qualitative and quantitative risk disclosures • Management’s methods to monitor and mitigate risk • Offsetting disclosure requirements 25

- 30. Auditing Specific Accounting Cycles: INVESTMENTS IESBA Handbook of the Code of Ethics for Professional Accountants (2016): Audit clients that are public interest entities: 290.176 A firm shall not provide valuation services… if the valuations would have a material effect, separately or in the aggregate… Audit clients that are not public interest entities: 290.175 …if the valuation service has a material effect… and the valuation involves a significant degree of subjectivity, no safeguards could reduce the self-review threat to an acceptable level… a firm shall not provide such a valuation service... Take care with any Audit Adjustments to client investment valuations, especially if material, subjective, or for a PIE 26

- 31. Auditing Specific Accounting Cycles: SHARE CAPITAL Recalculate were applicable: • NAV/share at Y/E • Analytical review of NAV/share per class • Financial Highlights DOCUMENT WHETHER ADDITIONAL WORK IS REQUIRED Share capital roll-forward recalculation: • Agree opening to prior year • Agree movement and closing amounts to an audit confirmation • Agree FS disclosures Document & test allocation of income/expenses between share classes. Only repy on documented controls that are evidenced to work. Review any gates, suspensions, or investor lock-in agreements. Sample: • Subs, Reds & Transfers • Signed investor instructions • Transaction authorisation • Recalculate using NAV/share at transaction date • Agree bank receipt / payment / in-kind transfer • Verification of investor 27

- 32. Auditing Specific Accounting Cycles: EXPENSES & OTHER RECEIVABLES/PAYABLES NAV-Based Fees • Recalculate a sample or total based on the service-agreement or prospectus • Fees payable at year-end might be verified to after date settlement • Review breakdown of payments during the year and consider analytical techniques Other Expenses • Review any significant legal fee invoices • Directors’ fees to be compared with FS disclosures, OM, directors’ service agreements • Consider whether any expenses are contrary to the offering document Other Payables/Receivables For significant balances, obtain adequate support, e.g.: • Any post year end settlement • Outstanding invoices • Settlement terms and consider documenting reasons for any undue delay Disclosure of Related Party Transactions 28

- 33. Auditing Specific Accounting Cycles: GOING CONCERN – ISA 570 (Revised) Change in terminology from going concern assumption to going concern basis of accounting ALL auditor report’s will now include: • New description of management’s responsibility for assessing the entity’s ability to continue as a going concern and whether the use of the going concern basis of accounting is appropriate • New statement that the auditor’s responsibilities are to conclude on the appropriateness of management’s use of the going concern basis of accounting, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern. • Use of the term ‘Material Uncertainty Related to Going Concern’ replacing the term Emphasis of Matter What’s new 29

- 34. Auditing Specific Accounting Cycles: GOING CONCERN Determine: • Does a material uncertainty exists in relation to the identified issue? • Is the going concern basis of accounting appropriate? • Are the FS disclosures sufficient? Obtain management representations Consider management’s assessment of issues that may cast doubt on the going concern basis of accounting: • Review management’s assessment • Remain alert for possible conditions or events For any issues are identified: • Evaluate management’s plans • Review management’s cash flow forecasts • Ask management about events/conditions beyond their assessment period • Consider any additional facts or information available RiskResponse Reporting Risk Assessment 30

- 35. Any events that may cast significant doubt on entity's ability to continue as a going concern? Ask management for a preliminary assessment of the entity’s ability to continue as a going concern YES Discuss any issues with management and obtain their response Remain alert throughout audit for evidence of events/conditions that may cast significant doubt on entity's ability to continue as a going concern. Identify any events/ conditions and obtain management’s action plans in response Conclude if a material uncertainty exists or if the going concern basis of accounting is inappropriate Auditing Specific Accounting Cycles: GOING CONCERN NO Evaluate management’s plan of action and supporting documentation 31

- 36. Auditing Specific Accounting Cycles: GOING CONCERN Determine the impact of identified events/conditions on the audit report and communicate the decision to management and those charged with governance, where applicable: Use of Going Concern Basis of Accounting Inappropriate Do financial statements fully describe events/ conditions and disclose existence of material uncertainty? Unmodified opinion plus “Material Uncertainty Related to Going Concern” (NEW REQUIREMENT) Express a qualified or adverse opinion, and state material uncertainty exists Express an adverse opinion Use of Going Concern Basis of Accounting Appropriate but a Material Uncertainty Exists YES NO 32

- 37. Auditing Specific Accounting Cycles: SUBSEQUENT EVENTS - OVERVIEW RISKS: • Erroneous disclosure or missing financial statement disclosures • Incorrect valuations at year-end PROCEDURES TO INCLUDE: • Document the date to which we have identified all material subsequent events • Review post year end board minutes • Review the latest NAV pack • Review post year end subscriptions and redemptions • Review the latest investor/shareholder newsletters • Obtain Management confirmation of no undisclosed subsequent events 33

- 38. Auditing Specific Accounting Cycles: SUBSEQUENT EVENTS - TIMELINE Date of Financial Statements Date of Management Approval of Financial Statements Date of Auditor’s Report on Financial Statements Date Financial Statements Are Issued Obtain evidence about subsequent events Respondto newfactsthat becomeknown TIMELINE 34

- 39. Auditing Specific Accounting Cycles: FINANCIAL STATEMENTS REVIEW PROCESS Document whether any additional risks are identified during the audit fieldwork Substantive examination of material journal entries, including “top-side” journals (ISA 330.20) Design and perform analytical procedures near the end of the audit that assist forming an overall conclusion as to whether the financial statements are consistent with the auditor’s understanding of the entity (ISA 520.6) Document a review of the FS and the notes Document a review of Other Information in documents containing audited financial statements (ISA 720) 35

- 40. 3. Auditing Specific Accounting Cycles QUESTIONS? 36

- 41. 4. Audit Completion, New & Revised Auditor Reporting Standards 37

- 42. AUDIT FINALISATION CONSIDERATIONS Seek General Representations of: Seek FS Representations that: Seek Management Representations of any: • Responsibilities • Appropriate books & records, minutes & resolutions made available • Material transactions properly recorded • Responsibility for establishing and maintaining adequate internal controls • Responsibility for assessing fraud risk • FS presented fairly • Reflect ownership • Investments, other assets & liabilities, valued per prospectus, FS disclosures and accounting policies complete and correct • Subsequent events are disclosed / adjusted for • All related party transactions disclosed • Breaches of law, regulation, investment restriction or prospectus • Investor complaints • Contingent events and any assets / liabilties • Significant deficiencies identified • Internal control weaknesses • Adjusted & unadjusted audit differences The Directors Should Review and When Satisfied, Approve the Audited Financial Statements (SoG 6.16) & Representation Letter 38

- 43. NEW & REVISED AUDITOR REPORTING STANDARDS •ISA 260 (Revised) Communication with Those Charged with Governance •ISA 570 (Revised) Going Concern •ISA 700 (Revised) Forming an Opinion and Reporting on Financial Statements •ISA 701 Communicating Key Audit Matters in the Independent Auditor’s Report •ISA 705 (Revised) Modifications to the Opinion in the Independent Auditor’s Report •ISA 706 (Revised) Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report •ISA 720 (Revised) The Auditor’s Responsibilities Relating to Other Information •ISA 810 (Revised) Engagements to Report on Summary FS •Conforming amendments to other ISA 39 ISA effective for periods ending on/after 15 December 2016

- 44. ISA 260 (Revised) Communication with Those Charged With Governance 40 • The Auditor’s Responsibilities • Overview of the planned scope, timing and significant risks identified • Qualitative Aspects of Accounting Practices • Significant Difficulties Encountered • Significant Matters Arising Relevant to Financial Reporting • Written Representations • Circumstances Affecting the Audit Report • Key Audit Matters, if any • Auditor Independence NEW & REVISED AUDITOR REPORTING STANDARDS

- 45. ISA 700 (Revised) Forming an Opinion and Reporting on Financial Statements 41 • Audit opinion is now at the start of the report. • More explicit statement on independence, other ethical responsibilities, and which standards or code were followed by the auditor. • New section in the audit report when a material uncertainty over going concern exists which refers to adequate disclosure in the FS. • New section to cover the auditor’s work in relation to other information in the annual report (ISA 720 (Revised)) • Going concern explanation wording clarified, referencing the going concern “basis of accounting” concept (as separate from a “solvency” definition). • Enhanced description of the responsibilities of management and the auditor, (with an option to move text on certain responsibilities to an appendix or website). NEW & REVISED AUDITOR REPORTING STANDARDS

- 46. ISA 701 Communicating Key Audit Matters in the Independent Auditor’s Report 42 Applies to Listed Entities or Voluntary Adopters • A new section in the audit report to explain key audit matters (KAM). • A succinct description of the matter being included as a KAM, and a meaningful summary of the audit procedures undertaken to address the matter. • KAM are those of most significance in the audit, which are a subset of matters communicated to TCWG: • With a higher risk of material misstatement • Requiring significant judgement, including accounting estimates • Where there was a significant event or transaction in the year • Required for any reason to have modified the Opinion • Replaces any Emphasis of Matter / Other Matter paragraph except the new “Material Uncertainty Related to Going Concern” paragraph, if applicable • Wording must not imply discrete opinions on separate elements of the FS. NEW & REVISED AUDITOR REPORTING STANDARDS

- 47. ISA 705 (Rev) Modifications to the Opinion in the Independent Auditor’s Report 43 NEW & REVISED AUDITOR REPORTING STANDARDS QUALIFIED: Material Misstatement QUALIFIED: Material Inability to Obtain Audit Evidence ADVERSE: Material & Pervasive Misstatement DISCLAIMER: Material & Pervasive Inability to Obtain Audit Evidence TYPES OF MODIFICATIONS

- 48. ISA 705 (Revised) & ISA 570 (Revised) 44 Qualified Opinion [Illustrative Extract as an Example] We have audited the financial statements… In our opinion, except for the incomplete disclosure of the information referred to in the Basis for Qualified Opinion section of our report, the accompanying financial statements present fairly (or do give a true and fair view of), the financial position of the Company as at December 31, 2016, and of its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs). Basis for Qualified Opinion As discussed in Note YY, the Company’s financing arrangements expire and the amounts outstanding are payable on December 31, 2016. The Company has been unable to conclude re-negotiations or obtain replacement financing. This situation indicates that a material uncertainty exists that may cast significant doubt on the Company’s ability to continue as a going concern. The financial statements do not adequately disclose this matter. NEW & REVISED AUDITOR REPORTING STANDARDS

- 49. ISA 705 (Revised) & ISA 570 (Revised) 45 Adverse Opinion [Illustrative Extract as an Example] We have audited the financial statements… In our opinion, because of the omission of the information mentioned in the Basis for Adverse Opinion section of our report, the accompanying financial statements do not present fairly (or do not give a true and fair view of), the financial position of the Company as at December 31, 2016, and of its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs). Basis for Adverse Opinion The Company’s financing arrangements expired and the amount outstanding was payable on December 31, 2016. The Company has been unable to conclude re- negotiations or obtain replacement financing and is considering filing for bankruptcy. This situation indicates that a material uncertainty exists that may cast significant doubt on the Company’s ability to continue as a going concern. The financial statements do not adequately disclose this fact. NEW & REVISED AUDITOR REPORTING STANDARDS

- 50. ISA 705 (Rev) Modifications to the Opinion in the Independent Auditor’s Report 46 Disclaimer of Opinion [Illustrative Extract as an Example] We were engaged to audit the financial statements of ABC Fund… We do not express an opinion on the accompanying financial statements of the Fund. Because of the significance of the matter described in the Basis for Disclaimer of Opinion section of our report, we have not been able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on these financial statements. Basis for Disclaimer of Opinion… Responsibilities of Management and TCWG for the FS… Auditor’s Responsibilities for the Audit of the Financial Statements Our responsibility is to conduct an audit of the Fund’s financial statements in accordance with International Standards on Auditing and to issue an auditor’s report. However, because of the matter described in the Basis for Disclaimer of Opinion section of our report, we were not able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on these financial statements. We are independent… NEW & REVISED AUDITOR REPORTING STANDARDS

- 51. ISA 706 (Revised) Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report 47 EoM can also be required by: • ISA 210, Agreeing the Terms of Audit Engagements – paragraph 19(b) • ISA 560, Subsequent Events – paragraph 12 (b) and 16 • ISA 800, Special Considerations – Audits of Financial Statements Prepared in Accordance with Special Purpose Frameworks – paragraph 14 Other Matter paragraph can also be required by: • ISA 560, Subsequent Events – paragraphs 12 (b) and 16 • ISA 710, Comparative Information – Corresponding Figures and Comparative Financial Statements – paragraphs 13-14, 16-17 and 19 • ISA 720, The Auditor’s Responsibilities Related to Other Information in Documents Containing Audited Financial Statements – paragraph 10 (a) NEW & REVISED AUDITOR REPORTING STANDARDS

- 52. ISA 250 (Revised) Consideration of Laws and Regulations in an Audit of FS 48 • Updated to reflect IESBA’s Code of Ethics for Professional Accountants addressing Non-Compliance with Laws and Regulations (NOCLAR) • Effective for audit periods beginning ≥ 15 December 2017 • Pathway for auditors/professional accountants to disclose potential non-compliance situations to appropriate public authorities without constraints of the ethical duty of confidentiality. • Promoting compliance, preventing of non-compliance NEW & REVISED AUDITOR REPORTING STANDARDS

- 53. 4. Audit Completion, New & Revised Auditor Reporting Standards QUESTIONS? 49

- 54. “ THANK YOU! 50