Case analysis of nike

•Transferir como DOCX, PDF•

2 gostaram•5,944 visualizações

S

sdhlThis document analyzes errors made by Joanna Cohen in calculating the weighted average cost of capital (WACC) for Nike, Inc. The assistant identifies several mistakes in Cohen's assumptions and calculations for the cost of equity, market value of equity, cost of debt, and debt values. The assistant then provides their own analysis and calculations for Nike's WACC, using updated values for short-term treasury yields, liquidation value for equity, discounted long-term debt value, and debt coupon rates, ultimately determining the WACC to be 8.59% rather than Cohen's 8.4%.

Denunciar

Compartilhar

Denunciar

Compartilhar

Recomendados

In this report we will discuss about Phase– Introduction, Introduction of a Company, Brief History, International / National Introduction, Vision, Mission, Core Values, Goals, Nature of Business, Type of Ownership, Identify Key Players and Roles, Organizational Hierarchy, Location(s) of Facility, Number of Technical Employees, Products / Services (single product), Phase– EXTERNAL ANALYSIS, Natural Environment:, Natural Resource Coca Cola need, Present and Future needs of Natural Resources, International Arrangement of Water, Issues they face during arranging and managing, Task Environment: Porter’sForces Model, When (situation), Why (objective / reasons), How (process), who (participants), Issues faced, In what format they collected the data of Porter’s Analysis, What benefits they get from conducting PORTER’s Analysis, Societal Environment: PESTEL Analysis, Phase– Internal Analysis: Organizational Perspective, Vision / Mission / Core Values (discuss separately), Vision, Mission, Core Values, Organizational Policies, CLIMATE CHANGE POLICY, CODE OF BUSINESS CONDUCT(INTEGRITY IN THE COMPANY), GUIDANCE FROM CORE COMPLIANCE OFFICER, ENVIRONMENTAL POLICY, HUMAN RIGHTS POLICY, POST-CONSUMER PACKAGING WASTE MANAGEMENT POLICY STATEMENT, Organizational Culture, How Policies and Core Values are helping in developing culture in their organization (examples), What Factors are Influencing their culture and How, Through what method(s) keep the culture alive, Organizational Structure, Degree to which organizational design elements exit in company structure , Core competencies, What are the company-wide core competencies, Which and How capabilities are linked with each core competency, Which and How resources are linked with each capabilities, On the basis of market analysis (Phase ), evaluate each core competency through Criteria Matrix, Coca - Cola Porter's Value Chain Analysis, Inbound Logistics, Operations, Outbound Logistics, Sales and Marketing, Service, Strategic Objectives, WE FOCUSED ON DRIVING REVENUE AND PROFIT GROWTH, WE INVESTED IN OUR BRANDS AND BUSINESS, WE BECAME MORE EFFICIENT, WE SIMPLIFIED OUR COMPANY, Current Strategies (to achieve above objective) (combination of strategies / single strategy for each objective), Corporate Level Strategies, Business level strategies, Functional level strategies, Financial Strategies, Identify Rival Firms: PepsiCo, PepsiCo’s Strengths (Internal Strategic Factors), PepsiCo’s Weaknesses (Internal Strategic Factors), Opportunities for PepsiCo (External Strategic Factors), Threats Facing PepsiCo (External Strategic Factors), Objectives of PepsiCo, PepsiCo’s Generic Strategies, SWOT Analysis , Phase– Gap Analysis & Recommendations, External Analysis, Internal AnalysisCoca Cola Company Strategic Management Project ( A Comprehensive Analysis on ...

Coca Cola Company Strategic Management Project ( A Comprehensive Analysis on ...IBA - Institute of Business Administration

Mais conteúdo relacionado

Mais procurados

In this report we will discuss about Phase– Introduction, Introduction of a Company, Brief History, International / National Introduction, Vision, Mission, Core Values, Goals, Nature of Business, Type of Ownership, Identify Key Players and Roles, Organizational Hierarchy, Location(s) of Facility, Number of Technical Employees, Products / Services (single product), Phase– EXTERNAL ANALYSIS, Natural Environment:, Natural Resource Coca Cola need, Present and Future needs of Natural Resources, International Arrangement of Water, Issues they face during arranging and managing, Task Environment: Porter’sForces Model, When (situation), Why (objective / reasons), How (process), who (participants), Issues faced, In what format they collected the data of Porter’s Analysis, What benefits they get from conducting PORTER’s Analysis, Societal Environment: PESTEL Analysis, Phase– Internal Analysis: Organizational Perspective, Vision / Mission / Core Values (discuss separately), Vision, Mission, Core Values, Organizational Policies, CLIMATE CHANGE POLICY, CODE OF BUSINESS CONDUCT(INTEGRITY IN THE COMPANY), GUIDANCE FROM CORE COMPLIANCE OFFICER, ENVIRONMENTAL POLICY, HUMAN RIGHTS POLICY, POST-CONSUMER PACKAGING WASTE MANAGEMENT POLICY STATEMENT, Organizational Culture, How Policies and Core Values are helping in developing culture in their organization (examples), What Factors are Influencing their culture and How, Through what method(s) keep the culture alive, Organizational Structure, Degree to which organizational design elements exit in company structure , Core competencies, What are the company-wide core competencies, Which and How capabilities are linked with each core competency, Which and How resources are linked with each capabilities, On the basis of market analysis (Phase ), evaluate each core competency through Criteria Matrix, Coca - Cola Porter's Value Chain Analysis, Inbound Logistics, Operations, Outbound Logistics, Sales and Marketing, Service, Strategic Objectives, WE FOCUSED ON DRIVING REVENUE AND PROFIT GROWTH, WE INVESTED IN OUR BRANDS AND BUSINESS, WE BECAME MORE EFFICIENT, WE SIMPLIFIED OUR COMPANY, Current Strategies (to achieve above objective) (combination of strategies / single strategy for each objective), Corporate Level Strategies, Business level strategies, Functional level strategies, Financial Strategies, Identify Rival Firms: PepsiCo, PepsiCo’s Strengths (Internal Strategic Factors), PepsiCo’s Weaknesses (Internal Strategic Factors), Opportunities for PepsiCo (External Strategic Factors), Threats Facing PepsiCo (External Strategic Factors), Objectives of PepsiCo, PepsiCo’s Generic Strategies, SWOT Analysis , Phase– Gap Analysis & Recommendations, External Analysis, Internal AnalysisCoca Cola Company Strategic Management Project ( A Comprehensive Analysis on ...

Coca Cola Company Strategic Management Project ( A Comprehensive Analysis on ...IBA - Institute of Business Administration

Mais procurados (20)

Coca Cola Company Strategic Management Project ( A Comprehensive Analysis on ...

Coca Cola Company Strategic Management Project ( A Comprehensive Analysis on ...

Case Analysis of Molycorp: Financing the Production of Rare Earth Minerals”

Case Analysis of Molycorp: Financing the Production of Rare Earth Minerals”

Case Solution for Jaguar Land Rover plc: Bond Valuation

Case Solution for Jaguar Land Rover plc: Bond Valuation

Segmentation, Targeting & Positioning of Coca-Cola

Segmentation, Targeting & Positioning of Coca-Cola

Corporate Financial Management Assignment - Ratio Analysis of Hays plc

Corporate Financial Management Assignment - Ratio Analysis of Hays plc

Semelhante a Case analysis of nike

Semelhante a Case analysis of nike (20)

Sheet4Assignment 1 LASA # 2—Capital Budgeting TechniquesSheet1So.docx

Sheet4Assignment 1 LASA # 2—Capital Budgeting TechniquesSheet1So.docx

PART IComplete the following program exercises. When you hav.docx

PART IComplete the following program exercises. When you hav.docx

BlueBookAcademy.com - Value companies using Discounted Cash Flow Valuation

BlueBookAcademy.com - Value companies using Discounted Cash Flow Valuation

1Valuation ConceptsThe valuation of a financial asset is b.docx

1Valuation ConceptsThe valuation of a financial asset is b.docx

Unit 3 Cost of capital JNTUA Syllabus_Financial Management

Unit 3 Cost of capital JNTUA Syllabus_Financial Management

Último

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS Live

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(07-May-2024(PSS)VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit is a combination of two medicines, ounwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE AbudhabiAbortion pills in Kuwait Cytotec pills in Kuwait

Último (20)

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

VVVIP Call Girls In Greater Kailash ➡️ Delhi ➡️ 9999965857 🚀 No Advance 24HRS...

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Insurers' journeys to build a mastery in the IoT usage

Insurers' journeys to build a mastery in the IoT usage

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Nelamangala Call Girls: 🍓 7737669865 🍓 High Profile Model Escorts | Bangalore...

Nelamangala Call Girls: 🍓 7737669865 🍓 High Profile Model Escorts | Bangalore...

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Case analysis of nike

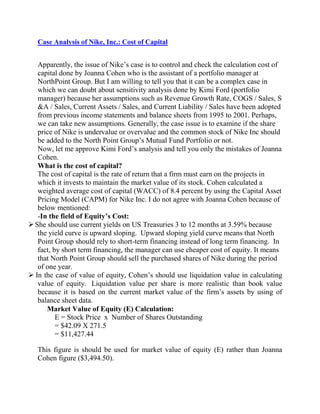

- 1. Case Analysis of Nike, Inc.: Cost of Capital Apparently, the issue of Nike’s case is to control and check the calculation cost of capital done by Joanna Cohen who is the assistant of a portfolio manager at NorthPoint Group. But I am willing to tell you that it can be a complex case in which we can doubt about sensitivity analysis done by Kimi Ford (portfolio manager) because her assumptions such as Revenue Growth Rate, COGS / Sales, S &A / Sales, Current Assets / Sales, and Current Liability / Sales have been adopted from previous income statements and balance sheets from 1995 to 2001. Perhaps, we can take new assumptions. Generally, the case issue is to examine if the share price of Nike is undervalue or overvalue and the common stock of Nike Inc should be added to the North Point Group’s Mutual Fund Portfolio or not. Now, let me approve Kimi Ford’s analysis and tell you only the mistakes of Joanna Cohen. What is the cost of capital? The cost of capital is the rate of return that a firm must earn on the projects in which it invests to maintain the market value of its stock. Cohen calculated a weighted average cost of capital (WACC) of 8.4 percent by using the Capital Asset Pricing Model (CAPM) for Nike Inc. I do not agree with Joanna Cohen because of below mentioned: -In the field of Equity’s Cost: She should use current yields on US Treasuries 3 to 12 months at 3.59% because the yield curve is upward sloping. Upward sloping yield curve means that North Point Group should rely to short-term financing instead of long term financing. In fact, by short term financing, the manager can use cheaper cost of equity. It means that North Point Group should sell the purchased shares of Nike during the period of one year. In the case of value of equity, Cohen’s should use liquidation value in calculating value of equity. Liquidation value per share is more realistic than book value because it is based on the current market value of the firm’s assets by using of balance sheet data. Market Value of Equity (E) Calculation: E = Stock Price x Number of Shares Outstanding = $42.09 X 271.5 = $11,427.44 This figure is should be used for market value of equity (E) rather than Joanna Cohen figure ($3,494.50).

- 2. -In the field of Debt’s Cost: In calculating value of debt, Cohen should have discounted the value of long-term debt that appears on the balance sheet. It means she should also consider the future value of total long term debt base on coupon rate. To calculate total value of debt, the steps are as follows: Market Value of Debt (D) Calculation: I considered the total amount of Debt for all items which are included by a interest rate as follows: -Current portion of long -term debt -Notes payable -Long - term debt -Redeemable preferred stock D = Current LT + Notes Payable + LT Debt (discounted) = $5.40 + $855.30 + $435.9 + 0.3 = $1296.9 Using these figures, we can now find the market value of Nike Inc., and the company’s capital structure. The Calculation of Weighs: The weights of debt and equity are calculated using the market values of debt and equity as follows: Weight of Debt (WD) D + E = 1296.9 + 11,427.44 = 12724.34 WD = D/ D+E WD = $ 1296.9 /$12724.34 = 10.2% Weight of Equity (WE) WE = E/ D +E WE = 11,427.44/ 12724.34 =89.8% Cost of Debt

- 3. There are two types of interest rate for Nike, Inc. as follows: 1) For Notes payable, Current portion of long - term debt and Redeemable preferred stock, all these debts should be cleared during the period of maximum 12 months. Therefore, I calculated the interest rate in accordance with Exhibit 1(Income Statement) for 2001 year as follows: Interest rate = Interest payment / Operating income Cost of Debt = Interest rate = (58.7 / 1014.2) * 100 = 5.78% You can see this interest rate is approximately equal to 20 year yields on U.S Treasuries (Exhibit 4). 2) For Long - term debt, Nike, Inc. had issued the Bonds in which the Cost of debt was calculated by finding the yield to maturity on 20-year Nike Inc. debt with a 6.75% coupon semi-annually. I assumed Nike Inc. to have a single cost of capital since its multiple business segments (shoes, apparel, sports equipment, etc.) are not very different and would experience similar risks and betas. Before-Tax Cost of Debt I used three (3) methods as follows: -Method (1): Using Cost Quotations Based on Coupon Interest Rate and Yield to Maturity (YTM) Cost of Debt = 14.14% -Method (2): Based on calculating the IRR Cost of Debt = 14.15% -Method (3): Approximating the Cost Based on the Value Bond and Coupon Rate Cost of Debt = 14% All of the calculations have been included in my spreadsheet.

- 4. As we can see, all three methods present us approximately the same amount of the cost of debt. I have chosen 14.15% for the cost of debt. It is important to find the relationship between the required return and the coupon interest rate. When the required return is greater than the coupon interest rate, the bond value will be less than its par value. We choose cost of debt as 14.15% because it is rational (coupon value annually is 13.50%). When current value of bond is less than par, required return will be more than coupon rate. Weight Average of Cost of Debt: As I mentioned, there are two types of debt and consequently we have two types of Cost of Debt. I calculated the weight average for Cost of debt as follows: Total debt type 1 = $5.40 + $855.30 + 0.3 = $861 Total debt type 2 = $435.9 Total debt = $1296.9 W (type 1) = (861 / 1296.9) * 100 = 66.4% , Cost of Debt (type 1) = 5.78% W (type 2) = (435.9 / 1296.9) * 100 = 33.6% , Cost of debt (type 2) = 14.15% Weight Average of Cost of Debt = (66.4% * 5.78) + (33.6% * 14.15) = 3.84 + 4.75 = 8.59% Therefore, the Cost of Debt is equal 8.6% After-Tax Cost of Debt Cost of financing must be stated on an after-tax basis. Because interest on debt is tax deductible, it reduces the firm’s taxable income.

- 5. ri =rd x (1 –T) =8.6% x (1 – 38%) =5.33% Cost of Equity I have calculated the cost of equity by using of two methods as follows: Capital Asset Pricing Model (CAPM) Constant-Growth Valuation (Gordon) Model To be continued…….