NMCE Weekly Commodity Report 15th 20th Feb, 2010

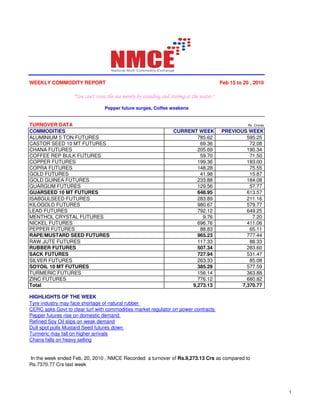

- 1. WEEKLY COMMODITY REPORT Feb 15 to 20 , 2010 Pepper future surges, Coffee weakens TURNOVER DATA Rs .Crores COMMODITIES CURRENT WEEK PREVIOUS WEEK ALUMINIUM 5 TON FUTURES 785.62 595.25 CASTOR SEED 10 MT FUTURES 69.36 72.08 CHANA FUTURES 205.69 190.34 COFFEE REP BULK FUTURES 59.70 71.50 COPPER FUTURES 199.36 183.00 COPRA FUTURES 148.28 75.55 GOLD FUTURES 41.98 15.87 GOLD GUINEA FUTURES 233.88 184.08 GUARGUM FUTURES 129.56 57.77 GUARSEED 10 MT FUTURES 648.95 613.57 ISABGULSEED FUTURES 283.89 211.16 KILOGOLD FUTURES 980.67 579.77 LEAD FUTURES 792.12 649.25 MENTHOL CRYSTAL FUTURES 9.76 7.20 NICKEL FUTURES 696.76 411.06 PEPPER FUTURES 88.83 65.11 RAPE/MUSTARD SEED FUTURES 965.23 777.44 RAW JUTE FUTURES 117.33 88.33 RUBBER FUTURES 507.34 283.60 SACK FUTURES 727.94 531.47 SILVER FUTURES 263.33 85.08 SOYOIL 10 MT FUTURES 385.29 577.59 TURMERIC FUTURES 156.14 363.88 ZINC FUTURES 776.12 680.82 Total 9,273.13 7,370.77 HIGHLIGHTS OF THE WEEK Tyre industry may face shortage of natural rubber CERC asks Govt to clear turf with commodities market regulator on power contracts Pepper futures rise on domestic demand Refined Soy Oil slips on weak demand Dull spot pulls Mustard Seed futures down Turmeric may fall on higher arrivals Chana falls on heavy selling In the week ended Feb, 20, 2010 , NMCE Recorded a turnover of Rs.9,273.13 Crs as compared to Rs.7370.77 Crs last week 1

- 2. SERIES TREND DURING THIS WEEK Castor seed futures : APR Series CASTOR SEED 10 MT FUTURES PRICE TREND 2,899.80 2,879.80 2,859.80 (Rs/100 Kg) 2,839.80 2,819.80 2,799.80 2,779.80 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 2,815.00 2,823.00 2,791.00 2,798.00 2,800.00 15-Feb-10 2,795.00 2,795.00 2,777.00 2,784.80 2,802.00 16-Feb-10 2,785.00 2,821.00 2,785.00 2,813.50 2,785.00 17-Feb-10 2,818.00 2,824.00 2,806.00 2,807.50 2,825.00 18-Feb-10 2,813.00 2,827.00 2,806.00 2,826.30 2,815.00 19-Feb-10 2,830.00 2,862.00 2,829.00 2,848.00 2,850.00 20-Feb-10 2,852.00 2,861.60 2,840.00 2,847.00 2,855.00 Castor seed futures positive Castor seed futures APR series Closed at Rs.2847 up by Rs.49 from Rs.2798 the previous week.During the outgoing week, intra-day trade touched a high of Rs.2862 and a low of Rs.2777 .Spot Price Closed at Rs.2855 gaining Rs.55 over Rs.2800 the previous week Market Buzz: NMCE Castor seed futures prices moved up on most days this week Near series rose from sub-2,800 levels to Rs.2,852.00 today With the castor seed conference in Ahmedabad being attended by a lot of international delegates, there were talks of trading in castor oil Castor seed stocks are at lows despite the arrival beginning since more than a month Demand for castor oil remains firm especially from Europe 3

- 3. Chana futures : FEB Series CHANA FUTURES PRICE TREND 2,281.00 2,261.00 (Rs/100 Kg) 2,241.00 2,221.00 2,201.00 2,181.00 2,161.00 13-Feb-10 14-Feb-10 15-Feb-10 16-Feb-10 17-Feb-10 18-Feb-10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 2,243.00 2,244.00 2,240.00 2,244.00 2,288.00 15-Feb-10 2,244.00 2,275.00 2,222.00 2,222.00 2,288.00 16-Feb-10 2,222.00 2,265.00 2,179.00 2,181.00 2,263.00 17-Feb-10 2,181.00 2,224.00 2,138.00 2,166.00 2,250.00 18-Feb-10 2,166.00 2,171.00 2,166.00 2,171.00 2,225.00 Chana future drops Chana futures FEB series Closed at Rs.2171 down by Rs.73 from Rs.2244 the previous week.During the outgoing week, intra-day trade touched a high of Rs.2275 and a low of Rs.2138 .Spot Price Closed at Rs.2225 losing Rs.63 over Rs.2288 the previous week Market Buzz: NMCE Chana futures were bearish over the week Near series last traded around Rs.2,189.00 today Overall trend is down due to higher production estimate of chana The production of winter-sown pulses is likely to be 10.53 million tonnes in 2009/10 against 9.88 million tonnes produced a year ago Prices decreased due to sluggish demand in physical market and from dal mills. 4

- 4. Coffee rep bulk futures : MAR Series COFFEE REP BULK FUTURES PRICE TREND 7,195.00 7,095.00 (Rs/100 Kg) 6,995.00 6,895.00 6,795.00 6,695.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 7,205.00 7,250.00 7,205.00 7,220.00 6,870.00 15-Feb-10 7,220.00 7,250.00 7,050.00 7,070.00 6,825.00 16-Feb-10 7,070.00 7,070.00 6,966.00 6,970.00 6,775.00 17-Feb-10 6,970.00 6,970.00 6,930.00 6,945.00 6,750.00 18-Feb-10 6,945.00 6,970.00 6,913.00 6,955.00 6,725.00 19-Feb-10 6,955.00 6,955.00 6,911.00 6,911.00 6,700.00 20-Feb-10 6,880.00 6,920.00 6,880.00 6,901.00 6,700.00 Coffee rep bulk future weakens Coffee rep bulk futures MAR series Closed at Rs.6901 down by Rs.319 from Rs.7220 the previous week.During the outgoing week, intra-day trade touched a high of Rs.7250 and a low of Rs.6880 .Spot Price Closed at Rs.6700 losing Rs.170 over Rs.6870 the previous week Market Buzz: NMCE Coffee Robusta futures saw a downward trend this week Near series traded around Rs.6,881 today Prices fell as overseas demand remained poor Export interest was limited as international coffee prices both at New York and London terminals continued to be on a downward trend 5

- 5. Copra futures : MAR Series COPRA FUTURES PRICE TREND 3,695.00 3,675.00 3,655.00 (Rs/100 Kg) 3,635.00 3,615.00 3,595.00 3,575.00 3,555.00 3,535.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 3,650.00 3,697.50 3,650.00 3,690.00 3,600.00 15-Feb-10 3,654.00 3,687.00 3,620.00 3,620.00 3,583.00 16-Feb-10 3,656.00 3,692.00 3,549.00 3,605.00 3,550.00 17-Feb-10 3,630.00 3,676.00 3,568.00 3,615.00 3,540.00 18-Feb-10 3,650.00 3,687.00 3,544.00 3,627.00 3,550.00 19-Feb-10 3,591.00 3,697.00 3,555.00 3,653.00 3,600.00 20-Feb-10 3,617.00 3,661.00 3,617.00 3,661.00 3,600.00 Copra futures in red Copra futures MAR series Closed at Rs.3661 down by Rs.29 from Rs.3690 the previous week.During the outgoing week, intra-day trade touched a high of Rs.3697 and a low of Rs.3544 .Spot Price Closed at Rs.3600 remaining unchanged from the previous week Market Buzz: NMCE Copra prices made slight gains this week Near series moved from below Rs.3,550 to above Rs.3,620 over the week Increasing consumption of copra as a dry fruit has prompted the coconut development board (CDB) to develop a technology for easy conversion of coconut into edible white copra Two types of copra, milling and edible, are made in India. Milling copra is used to extract oil while edible grade copra is consumed as a dry fruit and used for religious purposes. CDB has been trying to promote value addition in coconut to prevent a slump in coconut prices because of rising supplies. In 2008-09, India emerged as the largest producer of coconut in nut terms with a production of 15.84 billion nuts. It overtook Indonesia, whose production was 15.2 billion 6

- 6. Guargum futures : MAR Series GUARGUM FUTURES PRICE TREND 5,100.00 5,050.00 5,000.00 (Rs/100 Kg) 4,950.00 4,900.00 4,850.00 4,800.00 4,750.00 4,700.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 5,065.00 5,066.00 5,035.00 5,035.00 5,038.00 15-Feb-10 5,035.00 5,120.00 5,035.00 5,075.00 5,075.00 16-Feb-10 5,075.00 5,075.00 5,050.00 5,050.00 5,125.00 17-Feb-10 5,050.00 5,201.40 4,848.00 4,848.00 4,975.00 18-Feb-10 4,848.00 4,915.00 4,709.00 4,768.00 4,900.00 19-Feb-10 4,768.00 4,865.00 4,768.00 4,865.00 4,925.00 20-Feb-10 4,865.00 4,865.00 4,754.00 4,754.00 4,900.00 Guargum future drops Guargum futures MAR series Closed at Rs.4754 down by Rs.281 from Rs.5035 the previous week.During the outgoing week, intra-day trade touched a high of Rs.5201.4 and a low of Rs.4709 .Spot Price Closed at Rs.4900 losing Rs.138 over Rs.5038 the previous week 7

- 7. Guarseed futures : FEB Series GUARSEED 10 MT FUTURES PRICE TREND 2,470.00 2,450.00 (Rs/100 Kg) 2,430.00 2,410.00 2,390.00 2,370.00 2,350.00 13-Feb-10 14-Feb-10 15-Feb-10 16-Feb-10 17-Feb-10 18-Feb-10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 2,475.00 2,478.00 2,470.00 2,475.00 2,468.00 15-Feb-10 2,475.00 2,524.00 2,427.00 2,480.00 2,460.00 16-Feb-10 2,480.00 2,529.00 2,430.00 2,462.00 2,450.00 17-Feb-10 2,462.00 2,510.00 2,390.00 2,390.00 2,400.00 18-Feb-10 2,390.00 2,390.00 2,360.00 2,360.00 2,358.00 Guarseed futures negative Guarseed futures FEB series Closed at Rs.2360 down by Rs.115 from Rs.2475 the previous week.During the outgoing week, intra-day trade touched a high of Rs.2529 and a low of Rs.2360 .Spot Price Closed at Rs.2358 losing Rs.110 over Rs.2468 the previous week Market Buzz: NMCE Guarseed futures ended slightly lower over the week India's guar futures snapped a three-day losing streak to end higher on bargain-buying, supported by estimates of lower production, thin arrivals and on a likely rise in domestic demand Improvement in overseas enquiries also impacted the sentiments 8

- 8. Isabgulseed futures : APR Series ISABGULSEED FUTURES PRICE TREND 5,550.00 5,500.00 (Rs/100 Kg) 5,450.00 5,400.00 5,350.00 5,300.00 5,250.00 5,200.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 5,620.00 5,660.00 5,593.00 5,593.00 5,500.00 15-Feb-10 5,593.00 5,593.00 5,510.00 5,510.00 5,489.00 16-Feb-10 5,510.00 5,562.00 5,465.00 5,495.00 5,419.00 17-Feb-10 5,495.00 5,604.80 5,385.20 5,390.00 5,350.00 18-Feb-10 5,390.00 5,497.00 5,282.20 5,285.00 5,238.00 19-Feb-10 5,285.00 5,301.00 5,251.00 5,251.00 5,225.00 20-Feb-10 5,251.00 5,295.00 5,200.00 5,206.00 5,181.00 Isabgulseed futures turn southwards Isabgulseed futures APR series Closed at Rs.5206 down by Rs.387 from Rs.5593 the previous week.During the outgoing week, intra-day trade touched a high of Rs.5604.8 and a low of Rs.5200 .Spot Price Closed at Rs.5181 losing Rs.319 over Rs.5500 the previous week Market Buzz: NMCE Isabgul futures declined over the week Near series traded around Rs.5,241 today The carry forward stock last year was about 3.5 lac bags As against this the carry forward stock this year is estimated to be only around 50,000 bags The current crop production is expected to rise by 15% The new crop is expected to arrive after 2 months The new stock in Rajasthan and MP is expected to be good so the prices may not rise 9

- 9. Menthol crystal futures : FEB Series MENTHOL CRYSTAL FUTURES PRICE TREND 715.00 705.00 (Rs/1 Kg) 695.00 685.00 675.00 665.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 672.00 672.50 670.00 670.00 703.00 15-Feb-10 670.00 675.00 670.00 675.00 711.00 16-Feb-10 674.00 679.00 670.00 679.00 713.00 17-Feb-10 679.00 679.00 665.00 671.00 717.00 18-Feb-10 671.00 676.00 669.00 676.00 716.00 19-Feb-10 676.00 680.00 676.00 680.00 719.00 20-Feb-10 680.00 683.00 678.00 683.00 722.00 Menthol crystal futures positive Menthol crystal futures FEB series Closed at Rs.683 up by Rs.13 from Rs.670 the previous week.During the outgoing week, intra-day trade touched a high of Rs.683 and a low of Rs.665 .Spot Price Closed at Rs.722 gaining Rs.19 over Rs.703 the previous week 10

- 10. Pepper futures : MAR Series PEPPER FUTURES PRICE TREND 13,387.00 13,337.00 13,287.00 13,237.00 (Rs/100 Kg) 13,187.00 13,137.00 13,087.00 13,037.00 12,987.00 12,937.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 12,950.00 13,140.00 12,950.00 13,099.00 12,942.00 15-Feb-10 13,065.00 13,225.00 13,060.00 13,160.00 12,958.00 16-Feb-10 13,150.00 13,335.00 13,150.00 13,257.00 13,186.00 17-Feb-10 13,300.00 13,370.00 13,160.00 13,228.00 13,046.00 18-Feb-10 13,203.00 13,235.00 13,090.00 13,127.00 12,988.00 19-Feb-10 13,110.00 13,300.00 13,100.00 13,240.00 12,992.00 20-Feb-10 13,300.00 13,360.00 13,275.00 13,289.00 13,234.00 Pepper futures northwards Pepper futures MAR series Closed at Rs.13289 up by Rs.190 from Rs.13099 the previous week.During the outgoing week, intra-day trade touched a high of Rs.13370 and a low of Rs.13060 .Spot Price Closed at Rs.13234 gaining Rs.292 over Rs.12942 the previous week Market Buzz: Pepper futures moved northwards over the week Near rose from Rs.12,650 on Monday to Rs.13,315 today Indian pepper futures ended higher on low-level buying, but pressure from fresh arrivals and weak exports restricted the gains Prices are unlikely to fall sharply in coming months due to low carry-over stocks 11

- 11. Rape/mustard seed futures : MAR Series RAPE/MUSTARD SEED FUTURES PRICE TREND 459.00 454.00 (Rs/20 Kg) 449.00 444.00 439.00 434.00 429.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 449.00 455.80 438.20 450.00 453.00 15-Feb-10 450.00 458.90 441.10 442.00 453.00 16-Feb-10 442.00 450.70 433.30 447.00 453.00 17-Feb-10 447.00 455.80 438.20 443.00 456.00 18-Feb-10 443.00 451.80 434.10 436.00 449.00 19-Feb-10 436.00 444.60 427.30 434.00 448.00 20-Feb-10 434.00 442.60 425.40 436.00 445.00 Rape/mustard seed futures in red Rape/mustard seed futures MAR series Closed at Rs.436 down by Rs.14 from Rs.450 the previous week.During the outgoing week, intra-day trade touched a high of Rs.458.9 and a low of Rs.425.4 .Spot Price Closed at Rs.445 losing Rs.8 over Rs.453 the previous week Market Buzz: NMCE Rapeseed futures prices have unanimously fallen this week Near series fell from Rs.455 to Rs.425 India's rapeseed output is likely to drop 8 percent to 5.7 million tonnes in 2009/10 This year the weather wasn't favourable. Soil moisture was low due to poor rains India produced 6.2 million tonnes of rapeseed in 2009, but this year, acreage was reduced as poor rains and inadequate soil moisture delayed plantations in the main producing state of Rajasthan, which accounts for half the output. 12

- 12. Raw jute futures : FEB Series RAW JUTE FUTURES PRICE TREND 2,838.60 2,788.60 (Rs/100 Kg) 2,738.60 2,688.60 2,638.60 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 2,700.00 2,720.00 2,700.00 2,720.00 2,673.60 15-Feb-10 2,720.00 2,744.00 2,690.00 2,690.00 2,643.60 16-Feb-10 2,690.00 2,696.00 2,680.00 2,696.00 2,652.70 17-Feb-10 2,696.00 2,711.00 2,676.00 2,711.00 2,672.30 18-Feb-10 2,711.00 2,730.00 2,700.00 2,730.00 2,686.80 19-Feb-10 2,730.00 2,775.00 2,730.00 2,775.00 2,725.90 20-Feb-10 2,775.00 2,804.00 2,760.00 2,804.00 2,761.80 Raw jute future climbs Raw jute futures FEB series Closed at Rs.2804 up by Rs.84 from Rs.2720 the previous week.During the outgoing week, intra-day trade touched a high of Rs.2804 and a low of Rs.2676 .Spot Price Closed at Rs.2761.8 gaining Rs.88.2 over Rs.2673.6 the previous week Market Buzz: Raw jute prices improved over the week Near series prices moved from Rs.2,690 to Rs.2,765 India has raised the minimum support price for raw jute to 1,375 rupees per 100 kg for the financial year that began April 1, from last year's 1,250 rupees, The 61-day strike in jute mills ended on February 14, with the owners and the labour union signing a tripartite agreement in the presence of the West Bengal Labour Minister on Friday. SOON after the end of the strike,the jute industry has urged jute commissioner (JC) Benode Kispotta to cancel and reallocate the undelivered production control orders (PCOs) for supply of B.Twill jute bags on departmental account for Rabi 2010-11. 13

- 13. Rubber futures : MAR Series RUBBER FUTURES PRICE TREND 14,400.00 14,300.00 14,200.00 14,100.00 (Rs/100 Kg) 14,000.00 13,900.00 13,800.00 13,700.00 13,600.00 13,500.00 13,400.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 13,735.00 13,799.00 13,735.00 13,769.00 13,453.00 15-Feb-10 13,730.00 13,925.00 13,725.00 13,909.00 13,467.00 16-Feb-10 13,951.00 14,306.00 13,900.00 14,294.00 13,706.00 17-Feb-10 14,390.00 14,479.00 14,000.00 14,025.00 14,094.00 18-Feb-10 14,090.00 14,210.00 14,003.00 14,089.00 13,998.00 19-Feb-10 14,195.00 14,259.00 14,145.00 14,198.00 14,014.00 20-Feb-10 14,150.00 14,370.00 14,111.00 14,362.00 14,053.00 Rubber future rises Rubber futures MAR series Closed at Rs.14362 up by Rs.593 from Rs.13769 the previous week.During the outgoing week, intra-day trade touched a high of Rs.14479 and a low of Rs.13725 .Spot Price Closed at Rs.14053 gaining Rs.600 over Rs.13453 the previous week Market Buzz: NMCE Rubber futures prices soared higher this week Near series price moved from Rs.13500 to Rs.14,350 Statistics available from the Association of Natural Rubber Producing Countries reveal that there have been severe fluctuations in Indian rubber production in recent years. After producing 8.53 lakh tonnes of natural rubber in 2006, there were several fluctuations with production in 2009 projected to dip to 8.17 lakh tonnes. The projection for 2010 is production could rise to 2006 levels, at 8.53 lakh tonnes. India has a tough task ahead to bridge the gap between demand and supply of rubber in the coming years. 14

- 14. Sack futures : MAR Series SACK FUTURES PRICE TREND 3,167.50 3,147.50 3,127.50 (Rs/100 Bag) 3,107.50 3,087.50 3,067.50 3,047.50 3,027.50 3,007.50 2,987.50 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 20-Feb- 10 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 3,080.00 3,131.30 3,008.70 3,082.00 2,992.50 15-Feb-10 3,082.00 3,143.50 3,020.50 3,119.00 3,015.00 16-Feb-10 3,119.00 3,181.30 3,056.60 3,180.00 3,125.50 17-Feb-10 3,180.00 3,243.50 3,116.50 3,152.00 3,092.30 18-Feb-10 3,152.00 3,214.90 3,089.10 3,129.00 3,092.30 19-Feb-10 3,129.00 3,191.50 3,066.50 3,144.00 3,125.50 20-Feb-10 3,144.00 3,165.00 3,084.00 3,162.00 3,125.50 Sack futures in green Sack futures MAR series Closed at Rs.3162 up by Rs.80 from Rs.3082 the previous week.During the outgoing week, intra-day trade touched a high of Rs.3243.5 and a low of Rs.3020.5 .Spot Price Closed at Rs.3125.5 gaining Rs.133 over Rs.2992.5 the previous week Market Buzz: NMCE sack futures were more or less uncertain this week Near series last traded around Rs.3,114 The situation was such that the jute industry was not in a position to produce and supply jute bags during the strike period which continued for over two months from December 14 and the Union government required the foodgrain packaging materials urgently prior to procurement of rabi 2009-10 and kharif 2010-11 foodgrain. Now that jute mills have resumed their production, the industry has urged the GoI to cancel the dilution order issued on February 9 and also the unexecuted portion of the first dilution order issued on December 24 last year. 15

- 15. Soyoil futures : FEB Series SOYOIL 10 MT FUTURES PRICE TREND 465.00 463.00 461.00 (Rs/10 Kg) 459.00 457.00 455.00 453.00 451.00 13-Feb- 14-Feb- 15-Feb- 16-Feb- 17-Feb- 18-Feb- 19-Feb- 10 10 10 10 10 10 10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 463.00 473.75 455.25 461.60 461.00 15-Feb-10 461.00 470.80 452.40 457.80 457.00 16-Feb-10 457.00 466.90 448.70 457.85 457.00 17-Feb-10 457.00 466.95 448.75 458.20 458.00 18-Feb-10 458.00 467.30 449.10 456.00 456.50 19-Feb-10 449.00 449.15 447.00 449.00 454.00 Soyoil future dips Soyoil futures FEB series Closed at Rs.449 down by Rs.12.6 from Rs.461.6 the previous week.During the outgoing week, intra-day trade touched a high of Rs.470.8 and a low of Rs.447 .Spot Price Closed at Rs.454 losing Rs.7 over Rs.461 the previous week Market Buzz: NMCE Soy oil futures prices gained on certain days and fell on others Near series last traded around Rs.447.00 India's January oilmeal exports slumped 32 percent from a year earlier, falling for the third straight month, due to weak demand from Vietnam, South Korea, Indonesia, Japan and Thailand, the Solvent Extractors' Association of India said 16

- 16. Turmeric futures : FEB Series TURMERIC FUTURES PRICE TREND 10,300.00 10,250.00 10,200.00 (Rs/100 Kg) 10,150.00 10,100.00 10,050.00 10,000.00 9,950.00 9,900.00 13-Feb-10 14-Feb-10 15-Feb-10 16-Feb-10 17-Feb-10 18-Feb-10 CLOSE SPOT DATE OPEN HIGH LOW CLOSE SPOT 13-Feb-10 10,100.00 10,146.00 10,090.00 10,146.00 10,175.00 15-Feb-10 10,146.00 10,255.00 10,060.00 10,060.00 10,063.00 16-Feb-10 10,060.00 10,260.00 10,060.00 10,242.00 10,250.00 17-Feb-10 10,242.00 10,380.00 10,112.00 10,248.00 10,250.00 18-Feb-10 10,248.00 10,248.00 10,043.00 10,043.00 10,000.00 Turmeric future falls Turmeric futures FEB series Closed at Rs.10043 down by Rs.103 from Rs.10146 the previous week.During the outgoing week, intra-day trade touched a high of Rs.10380 and a low of Rs.10043 .Spot Price Closed at Rs.10000 losing Rs.175 over Rs.10175 the previous week Market Buzz: NMCE Turmeric prices did not show any particular trend this week India's turmeric futures ended higher on Friday on low-level buying prompted by dwindling stocks, though rising arrivals and weak exports limited the upside Pressure from rising arrivals, weak exports and hopes of higher output may weigh on prices. 17

- 17. SATURDAY SUMMARY Total Volume Traded 39638 Lots Total Value Recorded 781.81 Crores. * PEPPER FUTURES upwards * CASTOR SEED 10 MT FUTURES drops * COFFEE REP BULK FUTURES weakens * RUBBER FUTURES turn northwards * SACK FUTURES picks up * GUARSEED 10 MT FUTURES slips * COPRA FUTURES shows dual trends * ISABGULSEED FUTURES slips * RAPE/MUSTARD SEED FUTURES turn northwards DISCLAIMER __________________________________________________________________________________________ The information in this report has been provided by National Multi-Commodity Exchange of India Ltd for general reference purposes only.Although Care has been taken to ensure the accuracy of the information /data in the report, there is no warranty or representation expressed or implied by National Multi-Commodity Exchange of India Ltd as to the accuracy or completeness of the materials herein. The Exchange shall not be liable for any claims or losses of any nature, arising directly or indirectly, from the use of application of the data or material accessed from this report For more details, contact: Neha Bhandari. +91 79 4008 6038 Or write to: research@nmce.com ; contact@nmce.com 18