Connected cars and insurance claims - a new paradigm

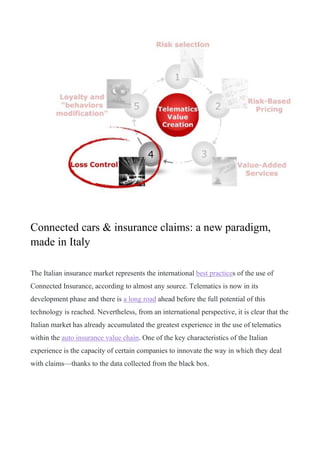

- 1. Connected cars & insurance claims: a new paradigm, made in Italy The Italian insurance market represents the international best practices of the use of Connected Insurance, according to almost any source. Telematics is now in its development phase and there is a long road ahead before the full potential of this technology is reached. Nevertheless, from an international perspective, it is clear that the Italian market has already accumulated the greatest experience in the use of telematics within the auto insurance value chain. One of the key characteristics of the Italian experience is the capacity of certain companies to innovate the way in which they deal with claims—thanks to the data collected from the black box.

- 2. The benefits of telematics data for handling claims are significant and can be divided into three main categories: a proactive approach, objective information and loss prevention and mitigation. The benefits of telematics data: assume a proactive rule First, telematics offers insurance companies the unique opportunity to assume a proactive role that starts immediately after the incident. Traditionally, the company would wait to hear from the insured person that a crash has occurred. Based on my experience, one aspect that turns out to be key to setting up the telematics approach is that it provides real-time data about the incident to the people in charge of claims management. Usually, this information only reaches the insurance company’s assistance department. This data is crucial for two subsequent processes: 1. Provide a great customer experience after the crash. It’s enough to think of how much information can be gathered directly from telematics data without having to ask the client for it. The whole experience delivered to the customer when interacting with the company is becoming more and more important. In light of this, recent Net Promoter Score® studies show that the economic value of a “promoter client” is more than two times higher than a “detractor.” 2. Anticipate activation of claims management. For example, this information can guide the client toward the preferred auto repair centers right after the accident. This maximizes the capacity to achieve savings within the context of an optimized customer experience that is meant to solve the customer’s issues. The benefits of telematics data: understand the dynamics of the claim

- 3. Second, telematics makes it possible to gather a structured set of objective data that can improve the understanding of the dynamics of the claim. The data can also provide an estimate of the damage. This information improves the decision-making capacity of the claims management process. It also assists the claims manager in searching for detailed information (such as additional inspections), which further reduces the time required. The information extracted from telematics data is the main factor that improves the efficiency and effectiveness of the liquidation process. Last but not least, this information is highly valuable from a legal point of view. These two characteristics combined have a great impact time-wise, allowing a significant reduction of the time spent in managing the different phases of the claims process—time that has proven to be directly related to the amount the company pays. Separating the knowledge supplied by the telematics (regarding the dynamics of the claims event in the case of minor damage) and combining it with the final claim cost by car brand and model will allow the company to make a liquidation proposal just a few hours after the crash. On the one hand, there is a clear benefit in terms of costs; on the other hand, it represents a significant improvement of the driver’s user experience. The benefits of telematics data: use value added services as risk mitigator Third, loss prevention and mitigation was the first area explored when telematics pilot projects began in Italy. This area focused on risk mitigation in case of theft, as their use as a satellite for stolen vehicle recovery is intrinsic to the telematics solutions. Precisely because of this, the current methods of Big Data analysis have enhanced this capacity by allowing the automatic identification (based on data received from the telematics device) of a driving style that differs from that of the car’s owner. This mitigating capacity no longer concerns only the professionally installed solutions. It has now partially extended to new self-installing solutions: The act of uninstalling the

- 4. device activates an alert. Similarly, there is the value-added services option that mitigates the risks linked to the driver and his car. For example, weather condition alerts or vehicle maintenance notifications could help influence client behavior and lead to a lower risk rate for the driver. In order to properly implement this type of protection, the company has to define its own risk model by identifying the behaviors it wishes to encourage, and then determine the most efficient and engaging way to implement it. Matteo is InsurTech Enthusiast, Insurance Thought Leader, Principal in Bain's Finacial Service and Digital Practice. [Click to Follow]