How to-register-a-partnership-business

•Download as DOCX, PDF•

0 likes•260 views

To register a partnership business in the Philippines, you must: 1. Prepare documents like name verification, articles of partnership, and affidavits and register with the Securities and Exchange Commission. 2. Obtain a certificate of registration from the SEC either online or in-person. Additional requirements may apply depending on the business. 3. Get a barangay clearance from the local government office and register the business and employees with agencies like the Social Security System, Philippine Health Insurance Corporation, and Home Development Mutual Fund.

Report

Share

Report

Share

Recommended

Tax can be confusing. At the basic, there is Percentage Tax or Value Added Tax; VAT registered and a Non-VAT registered tax payer. In the Philippines, managing tax matters can be really complicated. Several individuals and companies even hire Consultants/Accounting Firms to manage compliance reporting.Tax compliance reporting, tax consultant philippines, accounting bpo

Tax compliance reporting, tax consultant philippines, accounting bpoJCL - Business Processing Outsource, Inc.

Recommended

Tax can be confusing. At the basic, there is Percentage Tax or Value Added Tax; VAT registered and a Non-VAT registered tax payer. In the Philippines, managing tax matters can be really complicated. Several individuals and companies even hire Consultants/Accounting Firms to manage compliance reporting.Tax compliance reporting, tax consultant philippines, accounting bpo

Tax compliance reporting, tax consultant philippines, accounting bpoJCL - Business Processing Outsource, Inc.

More Related Content

What's hot

What's hot (20)

Lecture-4-Taxation-for-Individuals-Part-1-by-RAR-March-2-2022.ppt

Lecture-4-Taxation-for-Individuals-Part-1-by-RAR-March-2-2022.ppt

Introduction to franchising presentation 2018.pptxv1

Introduction to franchising presentation 2018.pptxv1

Similar to How to-register-a-partnership-business

Similar to How to-register-a-partnership-business (20)

How to Register a Company in Singapore in 10 Simple Steps

How to Register a Company in Singapore in 10 Simple Steps

PROMOTION, INCORPORATION AND ADMINISTRATION OF A COMPANY

PROMOTION, INCORPORATION AND ADMINISTRATION OF A COMPANY

Startup Your Startup: Tips and Tricks for Founders at the Starting Line

Startup Your Startup: Tips and Tricks for Founders at the Starting Line

Recently uploaded

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit is a combination of two medicines, ounwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE AbudhabiAbortion pills in Kuwait Cytotec pills in Kuwait

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

VIP Call Girls Napur Anamika Call Now: 8617697112 Napur Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Napur Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Napur understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Recently uploaded (20)

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Value Proposition canvas- Customer needs and pains

Value Proposition canvas- Customer needs and pains

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Service In Old Town Dubai ((0551707352)) Old Town Dubai Call Girl ...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon's Invoice Discounting: Your Path to Prosperity

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

Call Girls in Delhi, Escort Service Available 24x7 in Delhi 959961-/-3876

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

unwanted pregnancy Kit [+918133066128] Abortion Pills IN Dubai UAE Abudhabi

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Chandigarh Escorts Service 📞8868886958📞 Just📲 Call Nihal Chandigarh Call Girl...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls In Majnu Ka Tilla 959961~3876 Shot 2000 Night 8000

Call Girls In Majnu Ka Tilla 959961~3876 Shot 2000 Night 8000

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

How to-register-a-partnership-business

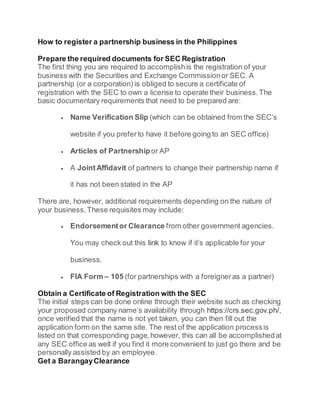

- 1. How to register a partnership business in the Philippines Prepare the required documents for SEC Registration The first thing you are required to accomplishis the registration of your business with the Securities and Exchange Commissionor SEC. A partnership (or a corporation) is obliged to secure a certificate of registration with the SEC to own a license to operate their business.The basic documentary requirements that need to be prepared are: Name Verification Slip (which can be obtained from the SEC’s website if you preferto have it before going to an SEC office) Articles of Partnershipor AP A JointAffidavit of partners to change their partnership name if it has not been stated in the AP There are, however, additional requirements depending on the nature of your business.These requisites may include: Endorsement or Clearance from other government agencies. You may check out this link to know if it’s applicable for your business. FIA Form – 105 (for partnerships with a foreigneras a partner) Obtain a Certificate of Registration with the SEC The initial steps can be done online through their website such as checking your proposed company name’s availability through https://crs.sec.gov.ph/, once verified that the name is not yet taken, you can then fill out the application form on the same site. The rest of the application processis listed on that corresponding page,however, this can all be accomplishedat any SEC office as well if you find it more convenient to just go there and be personally assisted by an employee. Get a BarangayClearance

- 2. All businesses are required to have a Barangay Clearance according to our Local Government Code.This clearance is obtained at the local Barangay Office where your business is or will be located and the fee in securing one, though varies per location, is often minimal. A Barangay Clearance serves as an assurance that your business adheres to the standards of the local Barangay and that your business is a community-friendly company. Register your business & employeeswith the Social Security System (SSS) Registering your business and employees (even if they are temporary or provisional) is mandated and is considereda violation of the Social Security Law if not performed.Employers are obliged to submit the SSS coverage of a worker within 30 days of his or her employment.The SSS website (sss.gov.ph)presents comprehensive information on the responsibilities and obligations of an SSS employer.The following forms must be completelyfilled out and submitted to be a registered SSS employer: SS Forms R-1 and R-1A Photocopyof SEC Articles of Partnership Business location sketch or map Validated Miscellaneous Payment Return also known as SS Form R-6 or SS Form R-6 with Special Bank Receipt(proof of payment for the EmployerRegistration Plate) Register with other government-mandated agencies Once your business began its operations and you’ve hired a number of employees,registration with other government-mandated agencies must follow through. The new National Health Insurance Act (RA 7875/RA 9241)is requiring all employers in the Philippines to register their employees with Philippine Health Insurance Corporation

- 3. (Philhealth) and to remit their share of contribution to the said agency. Registering your employeesensure that they are going to be covered by this health insurance which can help greatly in reducing hospitalization costs and their other health care needs. Pag-IBIG FUND. As stated in RA 7742,SSS members who earn at least Php4,000 per month must be registered with the Home DevelopmentMutual Fund (HDMF) which is the agency that administers the Pag-IBIG Fund. This agency works towards providing its members with sufficienthousing (loans) through an effective saving scheme. NOTE:Registration with the Departmentof Labor and Employment(DOLE) is also a must for business operations with five or more employees. Obtain a Mayor’s/Business Permit This document can only be acquired after securing a Certificate of Registration from SEC, Barangay Clearance, and registration with the SSS since these documents would be required to get a business permit. The fees,requirements,and processes may vary in differentlocal offices.Fees for new applicants may depend on their starting capital while charges for renewals depend on the applicant’s prior year gross revenues or sales. Here are the basic requirements in obtaining a Mayor’s Permit: Business Permit Application Form Barangay Clearance Certificate of SEC Registration Public Liability Insurance (for Restaurants, Cinemas, Malls,etc.) Authorization Letter of the owner/s with ID

- 4. Contract of a lease (if renting a space)or land title/tax declaration (if you own the place of business) SSS Certificationor Clearance Community Tax Certificate or CEDULA Depending on the type of business,other documents may also be required. Business permits are renewed every year. Register with the Bureauof Internal Revenue (BIR) A Mayor’s Permit must be submitted before processing a Certificate of Registration with the BIR since Mayor’s permit is actually a requirement to obtain such a certificate. Registering with the Bureau of Internal Revenue will give you permissionto issue officialreceipts,registerbooks of accounts, and (for partnerships and corporations)to obtain a separate Tax IdentificationNumber.