Time is Important, not the Timing

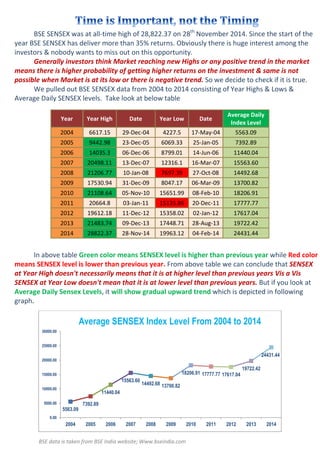

- 1. BSE SENSEX was at all-time high of 28,822.37 on 28th November 2014. Since the start of the year BSE SENSEX has deliver more than 35% returns. Obviously there is huge interest among the investors & nobody wants to miss out on this opportunity. Generally investors think Market reaching new Highs or any positive trend in the market means there is higher probability of getting higher returns on the investment & same is not possible when Market is at its low or there is negative trend. So we decide to check if it is true. We pulled out BSE SENSEX data from 2004 to 2014 consisting of Year Highs & Lows & Average Daily SENSEX levels. Take look at below table Year Year High Date Year Low Date Average Daily Index Level 2004 6617.15 29-Dec-04 4227.5 17-May-04 5563.09 2005 9442.98 23-Dec-05 6069.33 25-Jan-05 7392.89 2006 14035.3 06-Dec-06 8799.01 14-Jun-06 11440.04 2007 20498.11 13-Dec-07 12316.1 16-Mar-07 15563.60 2008 21206.77 10-Jan-08 7697.39 27-Oct-08 14492.68 2009 17530.94 31-Dec-09 8047.17 06-Mar-09 13700.82 2010 21108.64 05-Nov-10 15651.99 08-Feb-10 18206.91 2011 20664.8 03-Jan-11 15135.86 20-Dec-11 17777.77 2012 19612.18 11-Dec-12 15358.02 02-Jan-12 17617.04 2013 21483.74 09-Dec-13 17448.71 28-Aug-13 19722.42 2014 28822.37 28-Nov-14 19963.12 04-Feb-14 24431.44 In above table Green color means SENSEX level is higher than previous year while Red color means SENSEX level is lower than previous year. From above table we can conclude that SENSEX at Year High doesn't necessarily means that it is at higher level than previous years Vis a Vis SENSEX at Year Low doesn't mean that it is at lower level than previous years. But if you look at Average Daily Sensex Levels, it will show gradual upward trend which is depicted in following graph. BSE data is taken from BSE India website; Www.bseindia.com 5563.09 7392.89 11440.04 15563.60 14492.68 13700.82 18206.91 17777.77 17617.04 19722.42 24431.44 0.00 5000.00 10000.00 15000.00 20000.00 25000.00 30000.00 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Average SENSEX Index Level From 2004 to 2014

- 2. Volatility is permanent in the Equity Markets. When you are looking for higher returns in Equity, you simply cannot avoid volatility. But you can mitigate the risk of volatility & earn higher returns by investing via Systematic Investment Plan for long term in the Equity market. SIP is the way of investing in the mutual funds through small, periodic installments for specified tenure. By using SIP, investors are benefitting from long term advantage of Rupee-Cost averaging & convenience of saving regularly in smaller amounts. SIP has compounding effect on your investments in the long term. For investment purpose, we often wait to accumulate a large sum of money & invest it all at once. Though SIP allows you to start with smaller amount on regular basis which can help you to create wealth over long term or achieve your financial goals like buying house, child’s education or marriage, retirement planning etc. Every investor dreams of buying at low price & selling at higher price. But not many investors have expertise to know whether it is right time to buy or sell? Many investors try to judge the market movements & unfortunately end up losing their hard earned money. A more successful strategy is ‘Rupee Cost Averaging’ wherein you invest a fixed amount regularly regardless of market price. Thus you purchase more when the markets are low & purchase less when markets are high. Look at below example Month NAV SIP Investor Lump Sum Investor Amount Invested Units Bought Amount Invested Units Bought 1 10 1000 100.00 6000 600 2 11 1000 90.91 3 9 1000 111.11 4 8 1000 125.00 5 8 1000 125.00 6 11 1000 90.11 Total Units Accumulated 642.93 600 Value of Investment 7072.12 6600 SIP investments takes advantage of Rupee Cost Averaging Strategy & in the long run, the SIP investor gains as the investments are unaffected by Market volatility. Let’s look at 5yr, 7yr & 10yr SIP returns for equity mutual funds when SENSEX was at Year High or Year Low from 2012 to 2014.

- 3. We collected the data of all the equity mutual funds which has completed 5yrs or more on 01st December 2014. But it does not include Sector or Thematic Funds, Index Funds, ETFs & Close- Ended Plans but include ELSS funds. We choose SIP periods which would just complete their tenures at SENSEX High or Low. So if on 02-Jan SESNEX was at its lowest in 2012, then we chose 5yr SIP period from Jan-2007 to Jan 2012 & so on for 7yr, 10yr SIP. 5yr Monthly SIP Returns when SENSEX at Year High Year High SIP Period Total Funds Average 5Yr Return Funds with >10% but <15 % Return Funds with >15% Return 2012 19612.18 Dec-07 to Dec-12 136 12.14% 77 24 2013 21483.74 Dec-08 to Dec-13 149 11.75% 80 22 2014 28822.37 Nov-09 to Nov-14 161 21.41% 4 157 5yr Monthly SIP Returns when SENSEX at Year Low Year Low SIP Period Total Funds Average 5Yr Return Funds with >10% but <15% Return Funds with >15% Return Funds with -ve Return 2012 15358.02 Jan-07 to Jan-12 117 6.87% 24 1 6 2013 17448.71 Aug-08 to Aug-13 144 5.80% 15 0 6 2014 19963.12 Feb-09 to Feb-14 150 10.09% 64 13 0 7yr Monthly SIP Returns when SENSEX at Year High Year High SIP Period Total Funds Average 7Yr Return Funds with >10% but <15% Return Funds with >15% Return 2012 19612.18 Dec-05 to Dec-12 100 11.59% 50 13 2013 21483.74 Dec-06 to Dec-13 116 9.51% 46 3 2014 28822.37 Nov-07 to Nov-14 134 19.20% 14 120 7yr Monthly SIP Returns when SENSEX at Year Low Year Low SIP Period Total Funds Average 7Yr Return Funds with >10% but <15% Return Funds with >15% Return Funds with -ve Return 2012 15358.02 Jan-05 to Jan-12 73 9.81% 34 4 1 2013 17448.71 Aug-06 to Aug-13 111 5.12% 5 0 3 2014 19963.12 Feb-07 to Feb-14 118 9.00% 40 2 0 All the above returns are calculated on the basis of Compounded Annual Growth Rate i.e. CAGR. SIP data is taken from NJ India Website; Www.njwealth.in

- 4. 10yr Monthly SIP Returns when SENSEX at Year High Year High SIP Period Total Funds Average 10Yr Return Funds with >10% but <15% Return Funds with >15% Return 2012 19612.18 Dec-02 to Dec-12 49 17.41% 11 37 2013 21483.74 Dec-03 to Dec-13 54 12.66% 35 9 2014 28822.37 Nov-04 to Nov-14 70 16.75% 15 55 10yr Monthly SIP Returns when SENSEX at Year Low Year Low SIP Period Total Funds Average 10Yr Return Funds with >10% but <15 % Return Funds with >15% Return Funds with -ve Return 2012 15358.02 Jan-02 to Jan-12 38 19.27% 5 31 0 2013 17448.71 Aug-03 to Aug-13 53 10.88% 35 1 0 2014 19963.12 Feb-04 to Feb-14 56 11.92% 38 5 0 Markets at Year Low doesn’t mean Negative returns on your SIP investments as not more than 6 funds have given negative return for any SIP period. But it is also clearly evident, doesn’t matter whether SENSEX is at 15000 or 28000, 10yr SIP in equity mutual funds consistently deliver Double Digit Returns without any negative return. Even if you extend your 5yr & 7yr SIP when markets were low, that is to continue to invest till market reach new high, it has also deliver Double Digit returns except for one SIP period. Year Low Extended SIP Period Total Funds Average Returns Funds with >10% but <15% Return Funds with >15% Return Funds with -ve Return 2012 15358.02 Jan-07 to Dec-12 117 10.76% 61 8 0 2012 15358.02 Jan-05 to Dec-12 73 11.91% 44 10 0 2013 19963.12 Aug-08 to Dec-13 144 11.89% 78 23 0 2013 17448.71 Aug-06 to Dec-13 111 9.50% 46 2 0 2014 19963.12 Feb-09 to Nov-14 150 21.74% 3 147 0 2014 19963.12 Feb-07 to Nov-14 118 17.63% 24 94 0 We are not suggesting here that you can sell your investments at market high but if you are ready to remain invested when you didn’t get desirable returns, market will make up for it in the short term. So if you have invested in a good fund for long term don’t get disturbed by interim market volatility.

- 5. All above returns are CAGR returns. We are sure you still be wondering how come even 10% CAGR return over 10yr period would be considered as High Returns. Right question would be Simple interest is interest calculated only on the principal amount while Compounding Interest is interest added to the principal so that added interest also earns interest from then on. This addition of interest to the principal is called compounding. Although we used word ‘interest’, the process of compounding is applicable to all forms of returns, not just those are called interest. For example, If you have invested Rs. 10,000/- in Bank FD for 3yrs on 10%p.a. simple interest, you will receive Rs. 1,000/- as interest for 3yrs & get back your principal of 10000 at the end of the tenure that is Rs. 13,000/- in total. But if you would have received compounding interest of 10%p.a. on same Bank FD then your first year interest of Rs.1,000/- would have been added to the principal of Rs. 10,000/- at the end of 1st year & the 2nd year interest would be calculated on Rs. 11,000/- not on Rs 10,000/-& this process will continue till the end of tenure. Look at below table. Year Principal at the Start of the year Rate of interest Interest Earned Principal + Interest 1 10,000 10% 1,000 11,000 2 11,000 10% 1,100 12,100 3 12,100 10% 1,210 13,310 So Compounding returns means that the returns on the investments themselves become part of these investments & start generating returns. Our next question would be Compounded Annual Growth Rate or CAGR is the average of the total growth rate of an asset or price that is annualized to give an indication of the yearly growth between two points of time. CAGR always calculated for a period of time that is more than year. CAGR is calculated by following formula. CAGR = ( End Value / Beginning Value ) ^ ( 1 / No. of Years) -1 CAGR only gives an idea of the rate of growth as if the same was uniform over the period of time. But it is not the actual rate of growth. Look at the below table. Year Initial Investment Value at the Start of the year Value at the End of the year Rate of Growth for the year CAGR 1 10,000 10,000 11,500 15.00% 15.00% 2 11,500 10,350 -10.00% 1.73% 3 10,350 13,310 28.60% 10.00% Initial investment of 10000 grows to 13310 at the end of the 3rd year which means this investment has delivered 10% CAGR returns over the 3yrs. But it doesn’t mean that this investment has grown uniformly by 10% each year. It would have been easy to come to the conclusion that return at the end of the 2nd year is 3.5% or at the end of the 3rd year is 33.10%. But CAGR ignores absolute returns & gives you exact idea of year on year growth of the investment.

- 6. Let’s look at the below table which express CAGR returns in Absolute Returns. CAGR returns express as Absolute returns for Lump Sum Investment Years of Investment CAGR Returns 8% 10% 12% 15% 20% 25% 1 8.00% 10.00% 12.00% 15.00% 20.00% 25.00% 3 25.97% 33.10% 40.49% 52.09% 72.80% 95.31% 5 46.93% 61.05% 76.23% 201.14% 248.83% 305.18% 7 71.38% 94.87% 221.07% 266.00% 358.32% 476.84% 10 215.89% 259.37% 310.58% 404.56% 619.17% 931.32% 15 317.22% 417.72% 547.36% 813.71% 1540.70% 2842.17% 20 466.10% 672.75% 964.63% 1636.65% 3833.76% 8673.62% 25 684.85% 1083.47% 1700.01% 3291.90% 9539.62% 26469.78% 30 1006.27% 1744.94% 2995.99% 6621.18% 23737.63% 80779.36% 35 1478.53% 2810.24% 5279.96% 13317.55% 59066.82% 246519.03% After looking at the table you could understand why even 10% CAGR returns over 10yrs would be considered as high returns as it means your investment has delivered 259.37% in absolute terms. So if you have invested Rs. 10,000/- you would have received Rs. 25,937/- at the end of 10yrs. We will take another example. Real estate investment is always being considered as one which delivers very high returns. So if I say price of Home, which was bought 10yrs ago at the price of 25lakh, now gone up to 1 Crore, it won’t surprise you. Or rather you would say it has grown 4times in just 10yrs or delivered 400% returns. But if you look at the table, that home gives approx. 15% CAGR returns over 10yrs or its price grows by approx. 15% year on year. We would doubt if Real Estate returns would be given in CAGR form, would it still be as attractive investment as before. Since we are talking about SIP investments let’s look at below table which express CAGR returns in absolute terms for SIP investments. CAGR returns expressed as Absolute Returns for Monthly SIP investment Years of Investment CAGR Returns 8% 10% 12% 15% 20% 25% 1 4.44% 5.59% 6.74% 8.51% 11.52% 14.63% 3 13.35% 17.03% 20.85% 26.89% 37.78% 49.82% 5 23.28% 30.14% 37.48% 49.47% 72.42% 99.74% 7 34.36% 45.19% 57.12% 77.34% 218.49% 271.37% 10 53.47% 72.13% 93.62% 232.21% 318.64% 444.00% 15 93.53% 232.18% 280.32% 376.04% 630.16% 1086.55% 20 247.06% 319.04% 416.31% 631.65% 1317.28% 2857.96% 25 319.12% 445.96% 632.55% 1094.69% 2875.57% 7918.31% 30 416.75% 633.15% 980.53% 1947.17% 6489.11% 22770.75% 35 549.80% 911.49% 1546.49% 3538.25% 15019.88% 67283.01% After looking at this table, you would think it is better to invest lump sum money rather than SIP since it is delivering better returns. This difference is due to the fact that Lump Sum investments remain invested for the entire period, thus generate higher returns. For example if you have invested 12,000 as Lump Sum for 1 year, then returns would be calculated for entire year on single investment. But if you opted for SIP of Rs. 1,000/- for 12 months, then only return on 1st installment would be calculated for the entire year. For 2nd installment it would be calculated for 11 months, 3rd installment would be for 10 months & so on. But we are talking about equity investments where volatility is permanent. In such case SIP gives you advantage of Rupee-Cost averaging. & SIP gives you convenience of investing in small parts rather than waiting for accumulating large sum. So if you wish to have 1 Cr after 30yrs, @ 12% return you would have to invest Rs. 10,19,856.60/- (1 Cr / 980.53%) over 30yrs as SIP or just Rs. 2,832.94 per month (10,19,856.60 / 360).

- 7. If you think it you would be wise to wait & accumulate large sum then you should look at the following example. Do you think you have to earn High Income, so that you will have Higher Savings which will create Huge Wealth for you? Let’s take example of Mr. A, he is 35yr old, earns 1 lakh per annum. After meeting his expenses & EMI, he was able to save Rs. 30,000/- per month. If he decides to start the SIP with his savings till his retirement age of 60, what will be the value of his investment @ 15% CAGR returns? Age 35 Retirement Age 60 Investment Period in Years 25 Monthly Investment ₹ 30,000.00 Total Investment ₹ 9,000,000.00 Rate of Return 15% Value at Retirement ₹ 98,522,212.06 So Mr. A would create huge with his total investment of 90 Lakhs over 25 yrs. But like Mr. A, if you don’t earn High Income, & more importantly with no Higher Savings like him, do you think if you have any chance to create wealth for you? Look at Mr. B, who is 25yr old, just started his career & earns salary of Rs. 25,000/- per month. If he started monthly SIP of Rs. 10,000/- till his retirement, do you think if he will be able to create any wealth for himself? Look at the table below. Age 25 Retirement Age 60 Investment Period in Years 35 Monthly Investment ₹ 10,000.00 Total Investment ₹ 4,200,000.00 Rate of Return 15% Value at Retirement ₹ 148,606,449.16 Mr. B creates huge with his total investment of just 42 Lakhs over 35yrs. How it is possible? Secret lies in compounding. Mr. B, though invested comparatively small amount per month, but remain invested for longer period giving more TIME for his investments to grow. If one has to learn about investing then it should be this. In short, one needs to Start saving Early & for longer periods of TIME to achieve full power of compounding. The arithmetic of compounding means that investments start generating disproportionately higher amounts after some years. This makes long-term investing especially rewarding. So do not wait for accumulation of large amount start with savings today, however small they may be but it will turn into huge corpus after long term.

- 8. Always remember great scientist Einstein’s words, “Compound interest is the eighth wonder of the world. He, who understands it, earns it; he who doesn't, pays it!” tart Early