Rpbc gras approval 11.3.2010

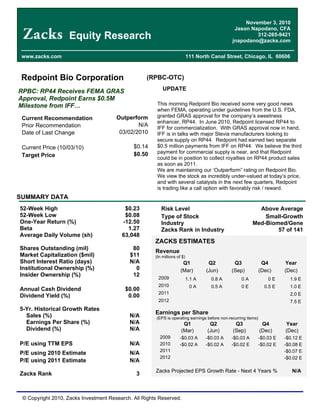

- 1. November 3, 2010 Jason Napodano, CFA Equity Research 312-265-9421 jnapodano@zacks.com www.zacks.com 111 North Canal Street, Chicago, IL 60606 Redpoint Bio Corporation (RPBC-OTC) RPBC: RP44 Receives FEMA GRAS UPDATE Approval, Redpoint Earns $0.5M Milestone from IFF This morning Redpoint Bio received some very good news when FEMA, operating under guidelines from the U.S. FDA, Current Recommendation Outperform granted GRAS approval for the company s sweetness enhancer, RP44. In June 2010, Redpoint licensed RP44 to Prior Recommendation N/A IFF for commercialization. With GRAS approval now in hand, Date of Last Change 03/02/2010 IFF is in talks with major Stevia manufacturers looking to secure supply on RP44. Redpoint had earned two separate Current Price (10/03/10) $0.14 $0.5 million payments from IFF on RP44. We believe the third $0.50 payment for commercial supply is near, and that Redpoint Target Price could be in position to collect royalties on RP44 product sales as soon as 2011. We are maintaining our Outperform rating on Redpoint Bio. We view the stock as incredibly under-valued at today s price, and with several catalysts in the next few quarters, Redpoint is trading like a call option with favorably risk / reward. SUMMARY DATA 52-Week High $0.23 Risk Level Above Average 52-Week Low $0.08 Type of Stock Small-Growth One-Year Return (%) -12.50 Industry Med-Biomed/Gene Beta 1.27 Zacks Rank in Industry 57 of 141 Average Daily Volume (sh) 63,048 ZACKS ESTIMATES Shares Outstanding (mil) 80 Revenue Market Capitalization ($mil) $11 (In millions of $) Short Interest Ratio (days) N/A Q1 Q2 Q3 Q4 Year Institutional Ownership (%) 0 (Mar) (Jun) (Sep) (Dec) (Dec) Insider Ownership (%) 12 2009 1.1 A 0.8 A 0A 0E 1.9 E 2010 0A 0.5 A 0E 0.5 E 1.0 E Annual Cash Dividend $0.00 2011 2.0 E Dividend Yield (%) 0.00 2012 7.5 E 5-Yr. Historical Growth Rates Earnings per Share Sales (%) N/A (EPS is operating earnings before non-recurring items) Earnings Per Share (%) N/A Q1 Q2 Q3 Q4 Year Dividend (%) N/A (Mar) (Jun) (Sep) (Dec) (Dec) 2009 -$0.03 A -$0.03 A -$0.03 A -$0.03 E -$0.12 E P/E using TTM EPS N/A 2010 -$0.02 A -$0.02 A -$0.02 E -$0.02 E -$0.08 E 2011 -$0.07 E P/E using 2010 Estimate N/A 2012 -$0.02 E P/E using 2011 Estimate N/A Zacks Projected EPS Growth Rate - Next 4 Years % N/A Zacks Rank 3 © Copyright 2010, Zacks Investment Research. All Rights Reserved.

- 2. WHAT S NEW? RP44 Receives FEMA GRAS Approval! On November 3, 2010, Redpoint Bio announced that it had received notification from the Flavor and Extract Manufacturers Association (FEMA) that its all-natural sweetness enhancer, RP44, had been determined to be Generally Recognized As Safe (GRAS) under guidelines set by the U.S. FDA. Receiving U.S. GRAS approval is a major milestone for Redpoint and RP44. Redpoint s development partner, International Flavor & Fragrances, Inc. (IFF) can now begin the next steps with respect to commercialization in the U.S. Additionally, many countries outside the U.S. recognize the U.S. GRAS designation, which should contribute towards regulatory acceptance around the world for RP44. Based on U.S. GRAS approval, Redpoint earned a $500,000 milestone payment from IFF. We believe with U.S. GRAS approval in hand, IFF will now actively pursue supply agreements with major stevia manufacturers, including PureCircle or Cargill / GLG LifeTech. These discussions will center on the economics of purifying RP44 (rebaudioside C) from raw Stevia leaf, steviol glycosides, or during the rebaudioside A ( Reb-A ) purification process. As a reminder, Reb-C is a side-stream product derived from material found in the Reb-A production process. Redpoint can still earn an additional $500,000 milestone if IFF enters into a supply agreement subject to certain commercial criteria. We believe consumer product companies will be highly interested in RP44 based on growing end-user demand for an all-natural option for sweetness enhancing. The use of Stevia as a natural sweetener has grown by 5x the growth in sugar over the past year. Stevia use is up 25% from 2009 in the U.S. alone. Outside the U.S., Stevia has become a major alternative to sugar or high-fructose corn syrup. Additionally, with the price of sugar doubling over the past month, along with heavy scrutiny from consumer advocacy groups on the overuse of sugar and high- fructose corn syrup leading to increased rates of obesity and diabetes in the U.S., we believe consumer product companies like Coke, Pepsi, and ConAgra are actively seeking ways to reduce sugar use in their products while still offering consumers an all-natural alternative without sacrificing taste or perception. INVESTMENT THESIS Background on Sweetness Enhancing & RR44 Over the past several years, use of an all natural sweetener made from the Stevia plant has begun to attract significant attention from flavor ingredients and consumer product companies in the U.S. Stevia is a genus of about 240 species of herbs and shrubs in the sunflower family (asteraceae), native to subtropical and tropical regions from western North America to South America. The Stevia plant has been used as sweeteners around the world for hundreds of years, from Native Americans centuries ago, to the Japanese in the early 1900s, to even Russia and China during the Cold War. The majority of Stevia crop around the world today is now found in China. However, as demand is increasing, production has recently spread into new areas around the equator such as Paraguay, Kenya, Indonesia, and India. Leaf extracts called steviol glycosides contain a mixture of over two dozen related compounds, including several forms of rebaudiosides, steviosides, and dulcosides. The two major compounds found in steviol glycosides, stevioside and rebaudioside A (Reb-A), have a sweetness ranging from 250x to 450x that of sucrose (table sugar). Not all of these compounds have practical use however. Scientists have discovered that rebaudioside A has the least bitterness of all the compounds in the stevia plant, and thus it has the most applicable use for foods and beverages as a low-calorie sweetener. Medical research has also shown stevia has a negligible effect on blood glucose, thus making it an attractive natural alternative to people on carbohydrate-controlled diets such as type 1 and type 2 diabetics. These extracts may also contain possible benefits in treating obesity and high blood pressure. In December 2008, the U.S. FDA approved Reb-A at purifications >95% for commercial use under the generally recognized as safe (GRAS) designation. Since their approval, stevia-derived sweeteners have gained significant market share in the alternative / natural sweetener market. In fact, both Coke and Pepsi have expanded their use of their respective Reb-A products for use in food and beverages. The products perceived safety and all-natural marketing campaign has greatly improved uptake. Zacks Investment Research Page 2 www.zacks.com

- 3. Sweetener Sugar Artificial Stevia (Reb-A) 100% Natural x Low-Calorie x Safe / Non-Toxic x To produce Reb-A commercially, harvested stevia plants are dried and subjected to a water extraction process. The extraction process uses freshwater brewing, similar to making tea, to unlock the plant s natural components, including rebaudioside, stevioside, and dulcoside. Reb-A is the primary target for commercial use, although other extracts including stevioside, Reb-D, and Reb-F are also GRAS approved. The balance of co-product, including Reb-C, previously believed to have low commercial utility, is refined out and either recycled or used in the production of other products. Soft drinks including sodas, juices, teas, sports drinks, and alcoholic beverages are a $100+ billion market in the U.S. Add in confectionary products such as canned fruit, ketchup, dairy, cereals, chocolate, and snack bars, the total market opportunity eclipses $200 billion. Sugar and high-fructose corn syrup (HFCS) are an estimated $50 billion market worldwide. By comparison, artificial and natural low-calorie sweeteners are a small fraction of the entire worldwide sweetener market. Artificial and natural low-calorie sweeteners are only a $5.5 billion market. But use is on the rise, especially following the approval of natural products like Stevia and highly successful marketing campaigns for Splenda to the older artificial sweeteners such as Equal, NutraSweet, and Sweet N Low. Over 200 million Americans used alternative low-calorie sweeteners in the U.S. in 2009. Stevia-based sweeteners are far more common outside the U.S., mainly in Asia and South America, but gaining popularity quickly inside the U.S. following the FDA s decision in December 2008. Obviously the opportunity to replace sugar and HFCS is tremendous. Consumers clearly want a safe low-calorie alternative. J&J s Splenda (sucralose), only approved in 2006, is marketed as made from sugar. Splenda is actually an artificial product, but the advertising campaign has been so successful that the compound now dominates the market. However, the low-hanging fruit for Stevia companies is going after the artificial sweetener market. Market surveys indicate that 45% of Americans have a negative perception of artificial sweeteners such as aspartame and saccharine. Thus, Stevia manufacturers including PureCircle, Cargill / GLG LifeTech predict that the alternative sweetener market will increase in size to over $8.0 billion in 2015. We estimate that global Stevia market is around $400 - 500 million, with Japan accounting for roughly half of that figure in 2009. However, by 2015 the global Stevia market should eclipse $1 billion worldwide as use in the U.S. increases and regulatory approval in Europe allows for commercialization of products later this year or in 2011. The artificial sweetener market is growing only slightly, we estimate around 3-4% annually. Stevia-derived sweeteners are growing significantly faster, we estimate around 25% annually. At this rate we would not be surprised to see Stevia-derived sweeteners capture 20% market share of the alternative sweetener market outside the U.S. and 15% in the U.S. by 2015. Alternative Global Share U.S. Share Sweetener Global Share U.S. Share Sucralose 24% 62% Sugars 80% 67% Aspartame 31% 14% HFCS 9% 16% Saccharin 20% 13% Alternative 9% 13% Other 21% 10% Other 2% 4% Stevia (Reb-A) 4% ~1% Rebaudioside C (Reb-C) is a component of the Stevia leaf along with Reb-A, stevioside and dulcoside. Reb-C makes up approximately 3 6% of the extract from wild Stevia, and around 8% of GLG s proprietary cultivated leaf used by Cargill. Until recently, Reb-C has been stored at Cargill and PureCircle manufacturing plants or recycled as a fertilizer for the production of new Stevia leaf. Unlike Reb-A, Reb-C has a very low intrinsic level of sweetness and therefore is not useful as a sweetener alone. However, we believe that is about to change. Recently Reb-C has been shown to enhance the sweetness (amplify the existing sweet taste) of caloric sweeteners such as sugar and HFCS. In January 2010, Redpoint disclosed that its all natural sweetness enhancer, first identified as RP44 in June 2009, is in fact, Reb-C. In November 2010, Reb-C earned the GRAS designation from the U.S. FDA. RP44 works by binding together with a caloric or artificial sweetener to form a synergistic complex that binds to the sweet receptors found on the lingual epithelium. This amplifies the ability of humans to taste sweetness. Quite simply, food and beverage manufacturers can achieve a greater level of sweetness in their products by adding small levels of RP44. This would allow them to use less sugar or HFCS to achieve the same sweetness level with the same clean taste profile. For Coke and Pepsi, two companies spending an estimated $7 billion each year on sugar, the opportunity to reduce the amount of sugar they buy is of significant interest. Zacks Investment Research Page 3 www.zacks.com

- 4. Furthermore, and perhaps the most important attribute, there is no change to the label for adding small sweetness enhancing levels of Reb-C. Reb-C is a natural product that fall under the Natural Flavors section of the current label for products such as Coke and Pepsi. Artificial Sweeteners such as aspartame and saccharin must be listed a separate ingredients. Same with Reb-A, although Reb-A is listed as a Natural Sweetener. Because Reb-C falls under the Natural Flavors section, it can be added without changing the perception of the product in the eyes of consumers. As noted above, companies like Coca-Cola and PepsiCo will spend an estimated $7 billion on sugar in 2010. The opportunity to reduce the sugar or HFCS in products by 25 50% is would certainly be attractive to management at these global corporations. The value proposition for using RP44 is quite simple: Less Sugar, Less Calories Same Great Taste! The Perfect Opportunity Products like Coke and Pepsi have been the target of anti-obesity organizations and marketing campaigns over the past several years. The products are getting demonized as the root cause of the U.S. obesity epidemic. Given the data, it is difficult to disagree. One 12oz can of soda contains between 35g to 40g of sugar. That is an estimated 150 calories from sugar alone. But it is not just soft drinks. Sugar is added to an enormous number of consumer products, including baby food, cereals, dairy, fruits, vegetables, beef, poultry, fish, and soup to nuts. Daily sugar consumption in the U.S. is up nearly seven-fold in the U.S. over the past 30 years. In 1970 the average American drank approximately 12 gallons of soda each year. In 2005 that number soared to over 50 gallons. Not surprisingly, obesity rates in the U.S. are also substantially higher. This has lead to a dramatic rise in obesity- related diseases, including type 2 diabetes. In response to this growing epidemic of obesity, The American Heart Association (AHA) recently began urging consumers to cut back on the amount of sugar they consume. The advice of the American Heart Association is mostly falling on deaf ears. As a result, the government is starting to get involved. A tax on soda is one option considered to help pay for health care reform. The Joint Committee on Taxation calculated that a 3-cent tax on each 12-ounce sugared soda would raise $51.6 billion over a decade. President Obama has not been shy about floating the idea of a sugar tax. In fact, 40 states already have a sugar tax in place. The addition of a federal sugar tax would increase the tax rate above what states are currently enforcing. For example, the idea of taxing an additional penny per ounce of beverage that contains sugar/HFCS over a certain concentration has been floated. This concentration would most likely be set above the sugar concentration for 100% natural juices such as apple juice and orange juice at around 8% sucrose by-volume so as to not curb use for these products, but will include carbonated and sports beverages with sucrose concentrations above 10% such as Coke, Pepsi, and Gatorade. Under this taxation scenario, the price of a 12oz Coke would increase by $0.12, or a 12-pack would increase by $1.44. According to a review conducted by Yale University s Rudd Center for Food Policy and Obesity, the price elasticity of soft drinks is between -0.8 and -1.0. Thus, a 10% increase in price would result in an 8 10% decrease in demand. Clearly Coca-Cola and PepsiCo do not want to see sales of their core products decline by 10% or more, so the motivation at management of these companies to reduce the sugar concentration of their carbonated beverages to below this taxation threshold would be significant. But as to not alienate consumers, management would have to reduce this sugar level without changing the taste of the product or adding in artificial sweeteners. Remember New Coke? The ideal situation would be to add less sugar and then enhance the sweetness of the reduce beverage with a combination of Reb-A (natural sweetener) and Reb-C (natural enhancer). Zacks Investment Research Page 4 www.zacks.com

- 5. GRAS Approved On November 3, 2010, Redpoint Bio announced that it had received notification from the Flavor and Extract Manufacturers Association (FEMA) that its all-natural sweetness enhancer, RP44, had been determined to be Generally Recognized As Safe (GRAS) under guidelines set by the U.S. FDA. Receiving U.S. GRAS approval is a major milestone for Redpoint and RP44. Redpoint s development partner, International Flavor & Fragrances, Inc. (IFF) can now begin the next steps with respect to commercialization in the U.S. Additionally, many countries outside the U.S. recognize the U.S. GRAS designation, which should contribute towards regulatory acceptance around the world for RP44. To earn GRAS approval, Redpoint and IFF relied heavily on the previous FDA approvals of Reb-A, Reb-D, and Red-F. Deal With IFF On June 30, 2010, Redpoint Bio announced that it has entered into a license and commercialization agreement with IFF covering the commercialization of RP44, Redpoint s all-natural sweetness enhancer. Under terms of the agreement, IFF will have exclusive rights, for five years, to develop, manufacture and commercialize RP44 in virtually all food and beverage product categories. In return, Redpoint received an upfront payment of $0.5 million. Redpoint earned another $0.5 million in November 2010 when FEMA, operating under guidelines set by the FDA, provided GRAS approval for RP44. The potential exists for Redpoint to earn an additional $0.5 million once a supply agreement between IFF and Stevia manufactures are put in place. Redpoint will receive royalties based on the amount of RP44 purchased by IFF for use in products. We believe this royalty rate equates to about a mid- single digit royalty on RP44 commercial sales. Zacks Investment Research Page 5 www.zacks.com

- 6. IFF will assume responsibility for the costs associated with prosecuting and maintaining Redpoint s intellectual property (IP) covering the sweetness enhancer. After the 5-year exclusivity period, all rights return to Redpoint Bio, potentially allowing for a more lucrative, exclusive or non-exclusive, deal to be signed in 2015 should RP44 be a success. We believe that IFF is an ideal partner for Redpoint Bio with RP44. IFF is a global leader in the food and beverage industry with deep sector knowledge and a global customer base. IFF will provide outstanding regulatory and product development capabilities. We are particularly excited about the deal with IFF. The company is an ideal partner for Redpoint, and a global leader in the food and beverage industry with deep sector knowledge and a global customer base. IFF will provide outstanding regulatory and product development capabilities in our view. We note that IFF s CEO, Doug Tough, highlighted the deal with Redpoint on his company s second quarter call, calling the deal an opportunity, to offer customers more natural solutions to reduce sugar products. Clearly IFF is behind the concept of RP44 and motivated to see it to succeed. Manufacturing Currently, manufacturers are producing about 1 pound of Reb-A from around 40 pounds of raw Stevia leaf. We expect yield on Reb-A production to improve dramatically over the next few years thanks to improved material sourcing and genetically-modified crops. Based on our analysis, if Reb-A manufacturers can manufacture Reb-C on a level of around 1 pound of purified Reb-C from 160 pounds of raw Stevia leaf, the economics are favorable compared to Reb-A and sugar. Reb-A currently sells for roughly $215,000 per tonne. Data from PureCircle and GLG LifeTech shows the gross margin for Reb-A product is around 35%. Therefore, manufacturing costs of 1 tonne of Reb-A is around $140,000, about 70% of which ($95,000) is the raw leaf sourcing. We estimate that Reb-C can be purified from the Reb-A post-extract product for an additional $45,000 per tonne, with a yield at around 25% of the pre-Reb-A figures. Having a second product from the raw Stevia leaf is a highly desirable venture for PureCircle and Cargill / GLG LifeTech, and we believe that now that IFF is involved, a product supply plan will be outlined over the next several months. At this point, how PureCircle and Cargill would go about allocating the manufacturing and raw leaf sourcing accounting costs remains to be seen, but it is clear that this would help drive down costs of both Reb-A and Reb-C over time. Our base-case assumption is that the selling price of Reb-C will be around $90,000, yielding a 50% gross margin to the manufacturer. Flavor Discovery Technology Recognizing the attractiveness of natural compounds for food applications, Redpoint has developed a novel and proprietary technology platform to find natural substances that may be effective as taste enhancers. In fact, this strategy led to the discovery of the sweetness enhancement properties of RP44. The basic strategy involves sourcing both natural compounds and natural product compound libraries, and then screening these compounds using an in-house proprietary, computer controlled, operant animal model system termed the Microtiter Operant Gustometer, or MOG. In this system, rodents are trained to identify novel sweeteners through discrimination taste tests. The MOG methodology is based on classical animal models of operant conditioning that have been used in the academic community for 50 years. Redpoint s spin on this classical method has been to develop novel, computerized protocols for training the rodents in taste discrimination tests, coupled with a new apparatus allowing testing of taste samples in 96 well microtitre plates of the kind used for high throughput screening in pharmaceutical discovery. Management believes its platform has several key advantages. Firstly, it offers the ability to find taste-active compounds using very small initial quantities of test materials (typically less than 1 mg.), thus allowing cost-effective screening of purified natural products. Second is the ability to find taste-active compounds in partially purified natural product samples (like from Stevia leaf). And finally, if offers the ability to rapidly perform dose-ranging studies to directly determine in vivo potency. Thus, compounds determined as actives using this approach are then subsequently scaled up and evaluated for taste properties in human taste tests and, potentially for regulatory approval. Redpoint believe this technology platform strategy may provide additional opportunities for the discovery of new natural high-intensity sweeteners or salt enhancers. Zacks Investment Research Page 6 www.zacks.com

- 7. In fact, in October 2010, Redpoint Bio announced success with a salt taste enhancing program. The concept of enhancing salty taste is similar to RP44 and sweetness enhancing. This program is aimed at discovering potential compounds that enhance the ability to taste salt in foods, which would allow for less salt to be used to obtain the same salty taste. It's an ideal product for salty-snack such as chips and pretzels that have come under heavy consumer fire recently due to the increasing sodium consumption in our diets. It has also drawn the attention of potential partners, and we would expect management to look to leverage this technology into licensing and collaborative activities in 2011. Diabetes & Obesity Over the past several years, researchers been characterizing taste receptor cells found on the surface of the tongue, along the soft palate, and in the epithelium of the pharynx and epiglottis. Concurrent with the sequencing the human genome, most of the molecular machinery responsible for taste sensation has been uncovered. As a result, there is now a substantial understanding at the cellular and molecular levels of the components involved in the taste signaling pathway. Specific pathways determine the quality of the taste through ion channel signaling or G-protein coupled receptor (GPCR) activation. Scientific breakthroughs relating to these molecular receptors and key signal transduction pathways responsible for taste have allowed Redpoint to develop a proprietary platform, based on modern drug discovery technologies, to identify and develop novel, use-specific taste modifiers. Activated GPCRs, acting through a coupling G-protein called gustducin, initiate a sequence of sequential signaling events that eventually triggers a nerve impulse that is sensed in the brain. The signal transduction of the GPCR-linked taste modalities is critically dependent upon the function of an ion channel, known as TRPm5. Research has shown that TRPm5 is specific to taste cells, and without it we cannot taste sweet, savory, or bitter flavors. Preclinical work with transgenic ( knock-out ) mice that lack TRPm5 channels are unable to taste sweet, savory, or bitter flavors, but are still capable of tasting sour and salty flavors. Thus, Redpoint Bio s primary target for intervention in taste signaling became through the TRPm5 ion channel. Management believes by controlling the activity of TRPm5, it can mitigate or even abolish unwanted bitter tastes, or enhance desirable sweet and savory flavors. TRPm5 modulators discovered at Redpoint Bio have been shown to elicit the secretion of hormones known to play important roles in metabolism in relevant model systems. One area where management at Redpoint has made significant discovery progress is in the area of treating diabetes and obesity. The therapeutic objective is to develop orally acting incretin and insulin secretogogues for therapeutic use. According to the World Health Organization (WHO), there are an estimated 200 million people (3% of the population) worldwide with diabetes, approximately 25 million (nearly 8% of the population) of which are in the U.S. Plus, in the U.S., there are an estimated 57 million Americans nearly 18% of the country s population that are considered pre-diabetic or at risk for developing full onset adult diabetes. The Center for Disease Control and Prevention (CDC) estimates that 1 out of 3 Americans born after 2000 will develop diabetes in their lifetime. It is an enormous medical problem that costs an estimated $175 billion each year in the U.S. alone. Obesity is the major cause of adult onset diabetes, with nearly 60% of all diabetics considered obese. Data from the ADA show that nearly two-thirds of diabetic patients are inadequately controlling their blood glucose level (failing to reduce HbA1c < 7%). High blood glucose levels have been associated with retinopathy, nephropathy, neuropathy, and serious cardiovascular complications. This is clearly an enormous market and one where new novel approaches to treating the disease could have a significant impact rather quickly. The graph to the left show the precipitous rise in prevalence of diabetes in the U.S. The graph is eerily similar to the rise in both sugar consumption and the trend in overall obesity. Source: American Diabetes Association (ADA) Zacks Investment Research Page 7 www.zacks.com

- 8. As noted above, work at Redpoint has been focused on the discovery of modulators of the TRPm5 channel. This is a key element in nutrient signaling in both gut chemosensory cells and pancreatic beta-cells. Redpoint s therapeutic objective is the development of an orally acting incretin and insulin secretogogue for the treatment of type 2 diabetes. The ongoing discovery program has involve the synthesis of approximately 1000 novel small molecules, of which Redpoint has identified a lead series of orally acting hormone secretogogues that have demonstrated positive results in a number of in vitro and in vivo experiments. Research has shown that GPCR-linked taste signaling play a central role in metabolism of sugar (sucrose) to glucose, fructose, and galactose. These are in turn are absorbed into the blood stream by glucose transporters through the expression of enterocytes. Blocking one such enterocytes, SGLT1, is the target of significant drug development programs in type 2 diabetes at Bristol-Myers, AstraZeneca, J&J, and Eli Lilly. Stimulation of the enterocytes, such as SGLT1, is activated by the intracellular signaling elements found on the T1R2 and T1R3 receptors that release the hormones GLP-1 (glucagon-like peptide-1) and GIP (gastric inhibitory polypeptide). GLP-1 activation (agonist) is the mechanism of action for Amylin and Eli Lilly s $700 million type 2 diabetes drug, Byetta (exenatide). To make sure blood sugar does not drop too low, GLP-1 is inactivated by the protein dipeptidyl peptidase-4 (DPP-4). DPP-4 inhibitors, such as Merck s $1.9 billion Januvia, and the recently approved Onglyza at Bristol-Myers and Galvus at Novartis, work by blocking this inactivation of GLP-1, which in turn allows stimulation of insulin release and inhibits glucagon. Redpoint Bio believes that its TRPm5 modulators, acting as incretin and glucose-dependent secretogogues, potentially offer an exciting new therapeutic option for the treatment of type 2 diabetes. Given the obvious validation of these targets by blockbuster drugs such as Byetta and Januvia, it is an exciting opportunity for Redpoint. Management is currently in discussions with potential collaborators for the continued development of its incretin secretogogue program. Zacks Investment Research Page 8 www.zacks.com

- 9. RECOMMENDATION Redpoint & IFF Team-Up to Develop RP44 We believe that IFF is an ideal partner for Redpoint Bio with RP44. IFF is a global leader in the food and beverage industry with deep sector knowledge and a global customer base. IFF will provide outstanding product development capabilities. We note that IFF achieved U.S. GRAS approval for RP44 roughly one year ahead of our forecasts. We are optimistic on the future for RP44: Stevia manufacturers are interested in Reb-C because it allows them to produce a second product from the side-stream production of Reb-A. Flavor and ingredient companies are interested in offering the consumer product companies an all natural solution for reducing sugar costs and expanding their product lines. Consumer product companies are interested in lower costs, potentially avoiding government imposed sugar taxes on their core products, and expanding their product lines without alienating customers. Consumers are interested in lowering their sugar intake through an all natural solution without sacrificing safety or taste. Three More Shots on Goal for Redpoint We believe that Redpoint Bio has three more potential deals it can sign in 2010 or 2011 to create shareholder value. The first is a potential opportunity for Redpoint Bio to partner yet another taste enhancing program, this time with salt enhancers. The concept of enhancing salty taste is similar to RP44 and sweetness enhancing. Redpoint is discovering potential compounds that enhance the ability to taste salt in foods, which would allow for less salt to be used to obtain the same salty taste. It's an ideal product for salty-snack such as chips and pretzels that have come under heavy consumer fire recently due to the increasing sodium consumption in our diets. The second opportunity for Redpoint is to leverage its Microtiter Operant Gustometer (MOG) novel and proprietary technology platform used to discover the sweetness enhancing effects of Stevia and RP44 and advance the current salt enhancing program. The basic strategy involves sourcing both natural compounds and natural product compound libraries, and then screening these compounds using an in-house proprietary, computer-controlled operant model system. The Stevia leaf has been used as an all-natural sweetener around the world for hundreds of years. Reb-C was dismissed by consumer product companies as a relatively useless compound within the leaf until Redpoint's discovery of its sweetness enhancing effects. Redpoint potentially has discovered a meaningful product in RP44 right in the midst of the Stevia revolution using its MOG technology. Imagine the possibilities to find additional compounds by applying MOG on libraries of compounds not being used by consumer product companies. Management has the potential to leverage its discovery of RP44 and its new salt enhancer program into signing new discovery collaborations in 2010 or 2011. The third opportunity is another for Redpoint Bio stems from the company's work in TRPm5 modulators and the discovery of incretin and glucose-dependent secretogogues. This work could potentially offer a new exciting therapeutic option for the treatment of type 2 diabetes. Given the obvious validation of this pathway by blockbuster drugs such as Byetta and Januvia, Redpoint has received significant interest from pharmaceutical partners looking to collaborate through an early-stage discovery program. Redpoint is currently in discussions with these potential collaborators for its incretin secretogogue program, and we are anticipating a deal in 2010 or 2011. Redpoint is trading like a call option with three potential ways to make money. The first is the commercialization of RP44 at IFF. The second and third are to secure collaborative research agreements on MOG or TRPm5. The current market capitalization of only $12 million is overly pessimistic. Downside is limited at this point, and we think if management can deliver, the upside is tremendous if RP44, MOG, or TRPm5 pan out. We recommend investors establish a position in Redpoint at today's price. Zacks Investment Research Page 9 www.zacks.com

- 10. PROJECTED FINANCIALS Redpoint Bio Corp. Income Statement 2009 A Q1 A Q2 A Q3 E Q4 E 2010 E 2011 E 2012 E 2013 E Product Sales / Royalties $0 $0 $0 $0 $0 $0 $1.0 $5.0 $10.0 YOY Growth - - - - - - - - - Collaborative Payments / JVs $1.9 $0 $0.5 $0 $0.5 $1.0 $1.0 $2.5 $2.5 YOY Growth -53.3% - - - - - - - - Total Revenues $1.9 $0 $0.5 $0 $0.5 $1.0 $2.0 $7.5 $12.5 YOY Growth -53.3% - - - - - - - - CoGS $0 $0 $0 $0 $0 $0 $0 $0 $0 Product Gross Margin - - - - - - - - - Research & Development $5.6 $0.8 $0.8 $0.8 $0.8 $3.2 $3.5 $4.0 $4.5 % R&D - - - - - - - - - Sales, General & Admin $5.0 $0.9 $1.1 $1.1 $1.0 $4.1 $4.5 $5.0 $5.5 % SG&A - - - - - - - - - Operating Income ($8.7) ($1.8) ($1.4) ($1.9) ($1.3) ($6.3) ($6.0) ($1.5) $2.5 Operating Margin 0% - - - - 0% 0% 0% 0% Interest & Other Income ($0.1) ($0.0) ($0.0) ($0.0) ($0.0) ($0.1) ($0.1) ($0.1) ($0.1) Pre-Tax Income ($8.8) ($1.8) ($1.4) ($1.9) ($1.3) ($6.5) ($6.1) ($1.6) $2.4 Taxes $0 $0 $0 $0 $0 $0 $0 $0 $0 Tax Rate 0% 0% 0% 0% 0% 0% 0% 0% 0% Net Income ($8.8) ($1.8) ($1.4) ($1.9) ($1.3) ($6.5) ($6.1) ($1.6) $2.4 Net Margin 0% - - - - - - - - Reported EPS ($0.11) ($0.02) ($0.02) ($0.02) ($0.02) ($0.08) ($0.07) ($0.02) $0.03 YOY Growth - - - - - -27.0% -7.9% -74.4% -246.5% Stock Options / Warrants $0.7 $0.2 $0.2 $0.2 $0.1 $0.7 $0.7 $0.8 $0.8 EPS Impact ($0.01) ($0.00) ($0.00) ($0.00) ($0.00) ($0.01) ($0.01) ($0.01) ($0.01) Weighted Ave. Shares Out 79.6 79.8 79.8 79.9 80.0 79.9 82.0 84.0 86.0 Source: Zacks Investment Research, Inc. Jason Napodano, CFA © Copyright 2010, Zacks Investment Research. All Rights Reserved.

- 11. HISTORICAL ZACKS RECOMMENDATIONS DISCLOSURES The analysts contributing to this report do not hold any shares of RPBC. Zacks Investment Research may have, or seeks to have, a business relationship with the companies listed in this report. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next one to two quarters. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next one to two quarters. Underperform- Zacks expects the company will underperform the broader U.S. Equity market over the next one to two quarters. The current distribution of Zacks Ratings is as follows on the 1007 companies covered: Outperform- 13.2%, Neutral- 79.9%, Underperform 6.4%. Data is as of midnight on the business day immediately prior to this publication. © Copyright 2010, Zacks Investment Research. All Rights Reserved.