Venture Capital Fundraising Q2 '06

•

0 gostou•416 visualizações

Denunciar

Compartilhar

Denunciar

Compartilhar

Baixar para ler offline

Recomendados

Recomendados

Sasfin Securities; Balancing the risks & global economic outlook; Nov 2013

Sasfin Securities; Balancing the risks & global economic outlook; Nov 2013Senate Group Financial Advisors

Mais conteúdo relacionado

Mais procurados

Sasfin Securities; Balancing the risks & global economic outlook; Nov 2013

Sasfin Securities; Balancing the risks & global economic outlook; Nov 2013Senate Group Financial Advisors

Mais procurados (20)

Sasfin Securities; Balancing the risks & global economic outlook; Nov 2013

Sasfin Securities; Balancing the risks & global economic outlook; Nov 2013

Destaque

Destaque (12)

Private Equity Performance Moved Into Positive Territory in Third Quarter 2003

Private Equity Performance Moved Into Positive Territory in Third Quarter 2003

Semelhante a Venture Capital Fundraising Q2 '06

Semelhante a Venture Capital Fundraising Q2 '06 (20)

Venture Capital Investment Q4 04 – MoneyTree Survey

Venture Capital Investment Q4 04 – MoneyTree Survey

Venture Capital Investment Q3 05 - MoneyTree Survey Results

Venture Capital Investment Q3 05 - MoneyTree Survey Results

Short-Term Private Equity Performance Begins to Improve in Q2 2003 With Lit...

Short-Term Private Equity Performance Begins to Improve in Q2 2003 With Lit...

Venture Capital Fundraising Levels Fall Below $1 Billion In First Quarter O...

Venture Capital Fundraising Levels Fall Below $1 Billion In First Quarter O...

Cgap brief-miv-performance-and-prospects-highlights-from-the-cgap-2009-miv-be...

Cgap brief-miv-performance-and-prospects-highlights-from-the-cgap-2009-miv-be...

MIV Performance and Prospects: Highlights from the CGAP 2009

MIV Performance and Prospects: Highlights from the CGAP 2009

Mais de mensa25

Mais de mensa25 (20)

Palin Report / Branchflower Report OFFICIAL FINAL Full Text with Gov.'s Press...

Palin Report / Branchflower Report OFFICIAL FINAL Full Text with Gov.'s Press...

Sarah Palin Secret Emails What Does Sarah Palin Have To Hide

Sarah Palin Secret Emails What Does Sarah Palin Have To Hide

Último

VIP Call Girls Napur Anamika Call Now: 8617697112 Napur Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Napur Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Napur understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Último (20)

Cheap Rate Call Girls In Noida Sector 62 Metro 959961乂3876

Cheap Rate Call Girls In Noida Sector 62 Metro 959961乂3876

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Business Model Canvas (BMC)- A new venture concept

Business Model Canvas (BMC)- A new venture concept

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Eluru Call Girls Service ☎ ️93326-06886 ❤️🔥 Enjoy 24/7 Escort Service

Call Girls Ludhiana Just Call 98765-12871 Top Class Call Girl Service Available

Call Girls Ludhiana Just Call 98765-12871 Top Class Call Girl Service Available

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Lundin Gold - Q1 2024 Conference Call Presentation (Revised)

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Call Girls From Raj Nagar Extension Ghaziabad❤️8448577510 ⊹Best Escorts Servi...

Call Girls From Raj Nagar Extension Ghaziabad❤️8448577510 ⊹Best Escorts Servi...

Nelamangala Call Girls: 🍓 7737669865 🍓 High Profile Model Escorts | Bangalore...

Nelamangala Call Girls: 🍓 7737669865 🍓 High Profile Model Escorts | Bangalore...

Venture Capital Fundraising Q2 '06

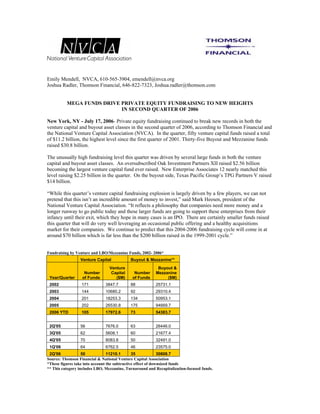

- 1. Emily Mendell, NVCA, 610-565-3904, emendell@nvca.org Joshua Radler, Thomson Financial, 646-822-7323, Joshua.radler@thomson.com MEGA FUNDS DRIVE PRIVATE EQUITY FUNDRAISING TO NEW HEIGHTS IN SECOND QUARTER OF 2006 New York, NY - July 17, 2006- Private equity fundraising continued to break new records in both the venture capital and buyout asset classes in the second quarter of 2006, according to Thomson Financial and the National Venture Capital Association (NVCA). In the quarter, fifty venture capital funds raised a total of $11.2 billion, the highest level since the first quarter of 2001. Thirty-five Buyout and Mezzanine funds raised $30.8 billion. The unusually high fundraising level this quarter was driven by several large funds in both the venture capital and buyout asset classes. An oversubscribed Oak Investment Partners XII raised $2.56 billion becoming the largest venture capital fund ever raised. New Enterprise Associates 12 nearly matched this level raising $2.25 billion in the quarter. On the buyout side, Texas Pacific Group’s TPG Partners V raised $14 billion. “While this quarter’s venture capital fundraising explosion is largely driven by a few players, we can not pretend that this isn’t an incredible amount of money to invest,” said Mark Heesen, president of the National Venture Capital Association. “It reflects a philosophy that companies need more money and a longer runway to go public today and these larger funds are going to support these enterprises from their infancy until their exit, which they hope in many cases is an IPO. There are certainly smaller funds raised this quarter that will do very well leveraging an occasional public offering and a healthy acquisitions market for their companies. We continue to predict that this 2004-2006 fundraising cycle will come in at around $70 billion which is far less than the $200 billion raised in the 1999-2001 cycle.” Fundraising by Venture and LBO/Mezzanine Funds, 2002- 2006* Venture Capital Buyout & Mezzanine** Venture Buyout & Number Number Capital Mezzanine Year/Quarter of Funds ($M) of Funds ($M) 2002 171 3847.7 88 25731.1 2003 144 10680.2 92 29310.4 2004 201 18253.3 134 50953.1 2005 202 26530.8 175 94669.7 2006 YTD 105 17972.6 73 54383.7 2Q'05 56 7676.0 63 26446.0 3Q'05 62 5608.1 60 21677.4 4Q'05 70 8083.8 50 32491.0 1Q'06 64 6762.5 46 23575.0 2Q'06 50 11210.1 35 30808.7 Source: Thomson Financial & National Venture Capital Association *These figures take into account the subtractive effect of downsized funds ** This category includes LBO, Mezzanine, Turnaround and Recapitalization-focused funds.

- 2. Fundraising by early-stage venture capital funds took the lead with twenty-eight funds raising $5.3 billion in this quarter. In second place, fifteen balanced funds raised $4.9 billion. New Enterprise Associates and Oak Investment Partners fell into the early and balanced categories respectively. Follow-on venture capital funds continued to be the dominant fundraisers with only eight new funds being raised in this quarter. VC Funds: New vs Follow-On No. of No. of Follow- New on Total 2002 56 115 171 2003 49 95 144 2004 55 146 201 2005 49 153 202 2006 YTD 18 87 105 2Q'05 12 44 56 3Q'05 14 48 62 4Q'05 20 50 70 1Q'06 11 53 64 2Q'06 8 42 50 Source: Thomson Financial & National Venture Capital Association Buyout and mezzanine funds continued to bring in commitments at the traditional 3-to-1 rate over venture capital funds. This is the second biggest quarter for US-based buyout and mezzanine funds- the first biggest being in 4Q 2005. “While the number of buyout and mezzanine funds has steadily fallen over the past year, the dollar size continues to grow,” said Joshua Radler, assistant project manager at Thomson Financial. “It appears that the mega fund is here to stay and this liquidity will have a significant impact on the dynamics of corporate America and the US economy in the coming year.” About Thomson Financial Thomson Financial, with 2005 revenues of US$1.9 billion, is a provider of information and technology solutions to the worldwide financial community. Through the widest range of products and services in the industry, Thomson Financial helps clients in more than 70 countries make better decisions, be more productive and achieve superior results. Thomson Financial is part of The Thomson Corporation (www.thomson.com), a global leader in providing integrated information solutions to more than 20 million business and professional customers in the fields of law, tax, accounting, financial services, higher education, reference information, corporate e-learning and assessment, scientific research and healthcare. With revenues of US$8.50 billion, The Thomson Corporation lists its common shares on the New York and Toronto stock exchanges (NYSE: TOC; TSX: TOC). The National Venture Capital Association (NVCA) represents approximately 480 venture capital and private equity firms. NVCA's mission is to foster greater understanding of the importance of venture capital to the U.S. economy, and support entrepreneurial activity and innovation. According to a 2004 Global Insight study, venture-backed companies accounted for 10.1 million jobs and $1.8 trillion in revenue in the United States in 2003. The NVCA represents the public policy interests of the venture capital community, strives to maintain high professional standards, provides reliable industry data, sponsors professional development, and facilitates interaction among its members. For more information about the NVCA, please visit www.nvca.org.