Tricumen / Barclays Investment Bank_extending the cuts_151215

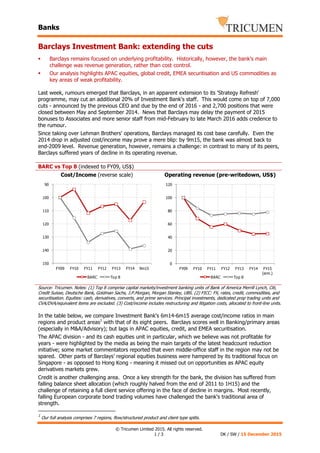

- 1. Banks © Tricumen Limited 2015. All rights reserved. 1 / 3 DK / SW / 15 December 2015 Barclays Investment Bank: extending the cuts Barclays remains focused on underlying profitability. Historically, however, the bank's main challenge was revenue generation, rather than cost control. Our analysis highlights APAC equities, global credit, EMEA securitisation and US commodities as key areas of weak profitability. Last week, rumours emerged that Barclays, in an apparent extension to its 'Strategy Refresh' programme, may cut an additional 20% of Investment Bank's staff. This would come on top of 7,000 cuts - announced by the previous CEO and due by the end of 2016 - and 2,700 positions that were closed between May and September 2014. News that Barclays may delay the payment of 2015 bonuses to Associates and more senior staff from mid-February to late March 2016 adds credence to the rumour. Since taking over Lehman Brothers' operations, Barclays managed its cost base carefully. Even the 2014 drop in adjusted cost/income may prove a mere blip: by 9m15, the bank was almost back to end-2009 level. Revenue generation, however, remains a challenge: in contrast to many of its peers, Barclays suffered years of decline in its operating revenue. BARC vs Top 8 (indexed to FY09, US$) Cost/Income (reverse scale) Operating revenue (pre-writedown, US$) Source: Tricumen. Notes: (1) Top 8 comprise capital markets/investment banking units of Bank of America Merrill Lynch, Citi, Credit Suisse, Deutsche Bank, Goldman Sachs, J.P.Morgan, Morgan Stanley, UBS. (2) FICC: FX, rates, credit, commodities, and securitisation. Equities: cash, derivatives, converts, and prime services. Principal investments, dedicated prop trading units and CVA/DVA/equivalent items are excluded. (3) Cost/income includes restructuring and litigation costs, allocated to front-line units. In the table below, we compare Investment Bank's 6m14-6m15 average cost/income ratios in main regions and product areas1 with that of its eight peers. Barclays scores well in Banking/primary areas (especially in M&A/Advisory); but lags in APAC equities, credit, and EMEA securitisation. The APAC division - and its cash equities unit in particular, which we believe was not profitable for years - were highlighted by the media as being the main targets of the latest headcount reduction initiative; some market commentators reported that even middle-office staff in the region may not be spared. Other parts of Barclays’ regional equities business were hampered by its traditional focus on Singapore - as opposed to Hong Kong - meaning it missed out on opportunities as APAC equity derivatives markets grew. Credit is another challenging area. Once a key strength for the bank, the division has suffered from falling balance sheet allocation (which roughly halved from the end of 2011 to 1H15) and the challenge of retaining a full client service offering in the face of decline in margins. Most recently, falling European corporate bond trading volumes have challenged the bank's traditional area of strength. 1 Our full analysis comprises 7 regions, flow/structured product and client type splits. 90 100 110 120 130 140 150 FY09 FY10 FY11 FY12 FY13 FY14 9m15 BARC Top 8 0 20 40 60 80 100 120 FY09 FY10 FY11 FY12 FY13 FY14 FY15 (ann.) BARC Top 8

- 2. Banks © Tricumen Limited 2015. All rights reserved. 2 / 3 DK / SW / 15 December 2015 Other areas have been hit by cyclical challenges. The European CMBS market has yet to truly emerge from the shadows making European securitisation a challenging business for the bank. Further, in commodities, the US the bank’s withdrawal from the energy market has left a rump focused on facilitating client needs; this is in contrast to other regions, where Barclays retains pockets of true expertise. Cost/income: BARC over/under Top 8 (average for 6m14, FY14 and 6m15, US$) Source: Tricumen. Note: Dark green areas represent BARC's top quartile outperformance vs Top 8 average; Light green: 2nd quartile; Light orange: 3rd quartile; Red: bottom quartile, where BARC's cost/income is significantly below Top 8 peers. Banking FICC Equities EMEA EMEA EMEA AMER AMER AMER APAC APAC APAC DCM Bonds FX EQ Cash EMEA EMEA EMEA AMER AMER AMER APAC APAC APAC DCM Loans Rates & Munis EQ Derv & Converts EMEA EMEA EMEA AMER AMER AMER APAC APAC APAC ECM Credit Prime Services EMEA EMEA EMEA AMER AMER AMER APAC APAC APAC M&A / Advisory Commodities EMEA EMEA AMER AMER APAC APAC Securitisation EMEA AMER APAC BARC over/under Top 8 BARC over/under Top 8 BARC over/under Top 8

- 3. Banks © Tricumen Limited 2015. All rights reserved. 3 / 3 DK / SW / 15 December 2015 About Tricumen Tricumen was founded in 2008. It quickly became a strong provider of diversified market intelligence across the capital markets and has since expanded into transaction and corporate banking coverage. Tricumen’s data has been used by many of the world’s leading investment banks as well as strategy consulting firms, investment managers and ‘blue chip’ corporations. Situated near Cambridge in the UK, Tricumen is almost exclusively staffed with senior individuals with an extensive track record of either working for or analysing banks; and boasts what we believe is the largest capital markets-focused research network of its peer group. Caveats No part of this document may be reproduced or transmitted in any form by any means without written permission of Tricumen Limited. Such consent is often given, provided that the information released is sourced to Tricumen and that it does not prejudice Tricumen Limited’s business or compromise the company’s ability to analyse the financial markets. Full acknowledgement of Tricumen Limited must be given. Tricumen Limited has used all reasonable care in writing, editing and presenting the information found in this report. All reasonable effort has been made to ensure the information supplied is accurate and not misleading. For the purposes of cross- market comparison, all numerical data is normalised in accordance to Tricumen Limited’s proprietary product classification. Fully-researched dataset may contain margin of error of 10%; for modelled datasets, this margin may be wider. The information and commentary provided in this report has been compiled for informational purposes only. We recommend that independent advice and enquiries should be sought before acting upon it. Readers should not rely on this information for legal, accounting, investment, or similar purposes. No part of this report constitutes investment advice, any form of recommendation, or a solicitation to buy or sell any instrument or to engage in any trading or investment activity or strategy. Tricumen Limited does not provide investment advice or personal recommendation nor will it be deemed to have done so. Tricumen Limited makes no representation, guarantee or warranty as to the suitability, accuracy or completeness of the report or the information therein. Tricumen Limited assumes no responsibility for information contained in this report and disclaims all liability arising from negligence or otherwise in respect of such information. Tricumen Limited is not liable for any damages arising in contract, tort or otherwise from the use of or inability to use this report or any material contained in it, or from any action or decision taken as a result of using the report. © Tricumen Limited 2015. All rights reserved.